Independent public opinion polls conducted before and after Gov. Murphy’s election show consistent support for raising taxes on New Jersey’s wealthiest households and corporations. These polls reinforce the notion that targeted tax increases are a popular way to help generate a stronger economy. In pursuing much-needed tax reform, policymakers should feel emboldened by the public attitudes reflected in these polls – New Jersey voters value a balanced tax code that provides adequate funding for the state’s most important assets.

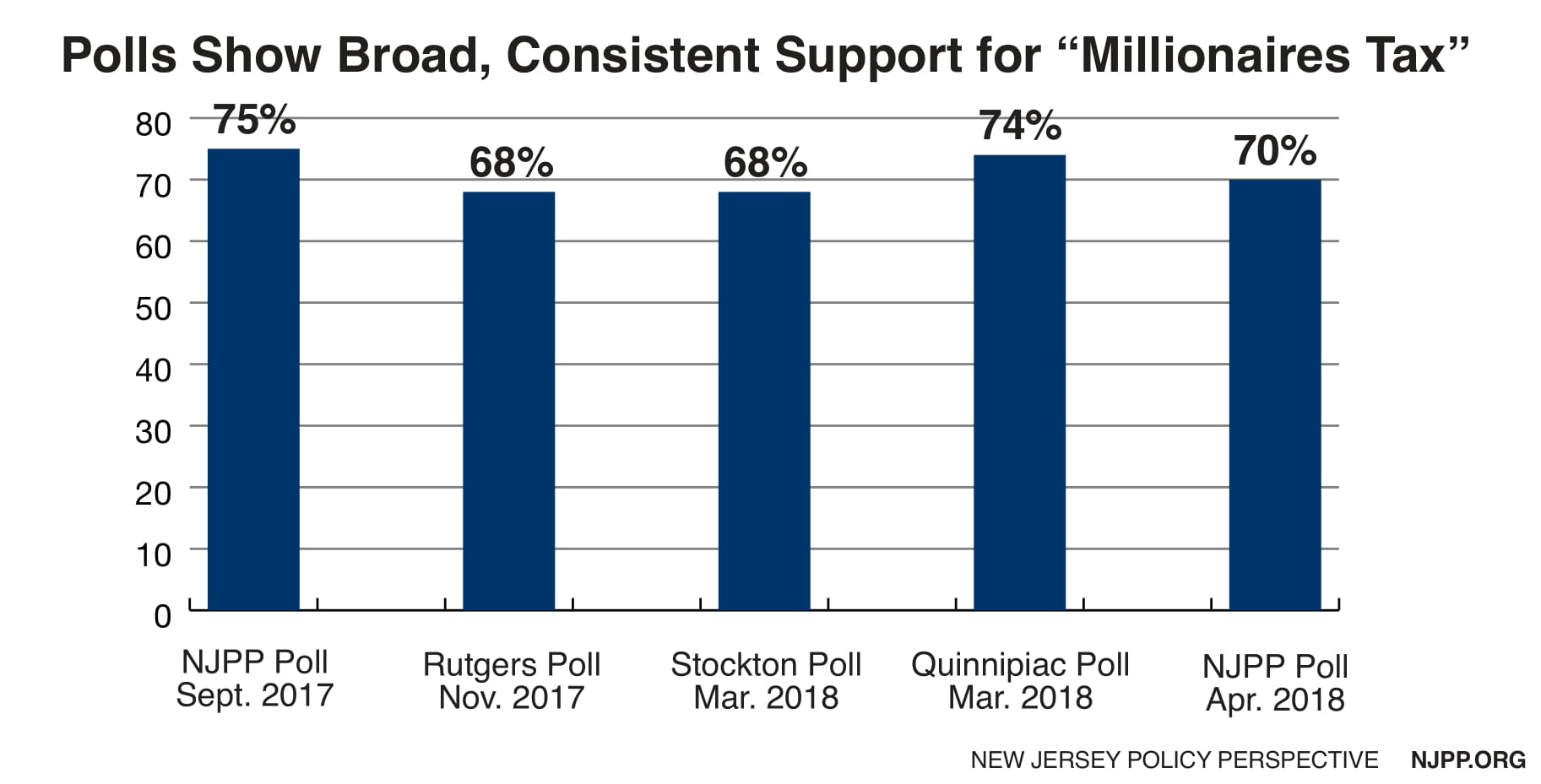

A poll commissioned by New Jersey Policy Perspective (NJPP) last fall showed that voters are willing to support tax increases – even on themselves – in order to invest in critical assets. These findings were complemented by Rutgers’ Eagleton Center for Public Interest Polling, which similarly found widespread support for new taxes just after the 2017 gubernatorial election. The first NJPP poll was conducted at the end of September 2017 with a sample of 750 likely New Jersey voters. The Rutgers-Eagleton poll was conducted in mid-November 2017 with a sample of 1,203 adults.

Support for new sources of revenue has remained consistent since then, according to two polls from spring 2018: one by the Stockton Polling Institute and another NJPP-commissioned poll conducted by Anzalone Liszt Grove Research. The Stockton poll was conducted in late March 2018 with a sample of 728 adults. The second NJPP poll of 600 likely New Jersey voters was conducted at the end of April 2018.

Income Taxes

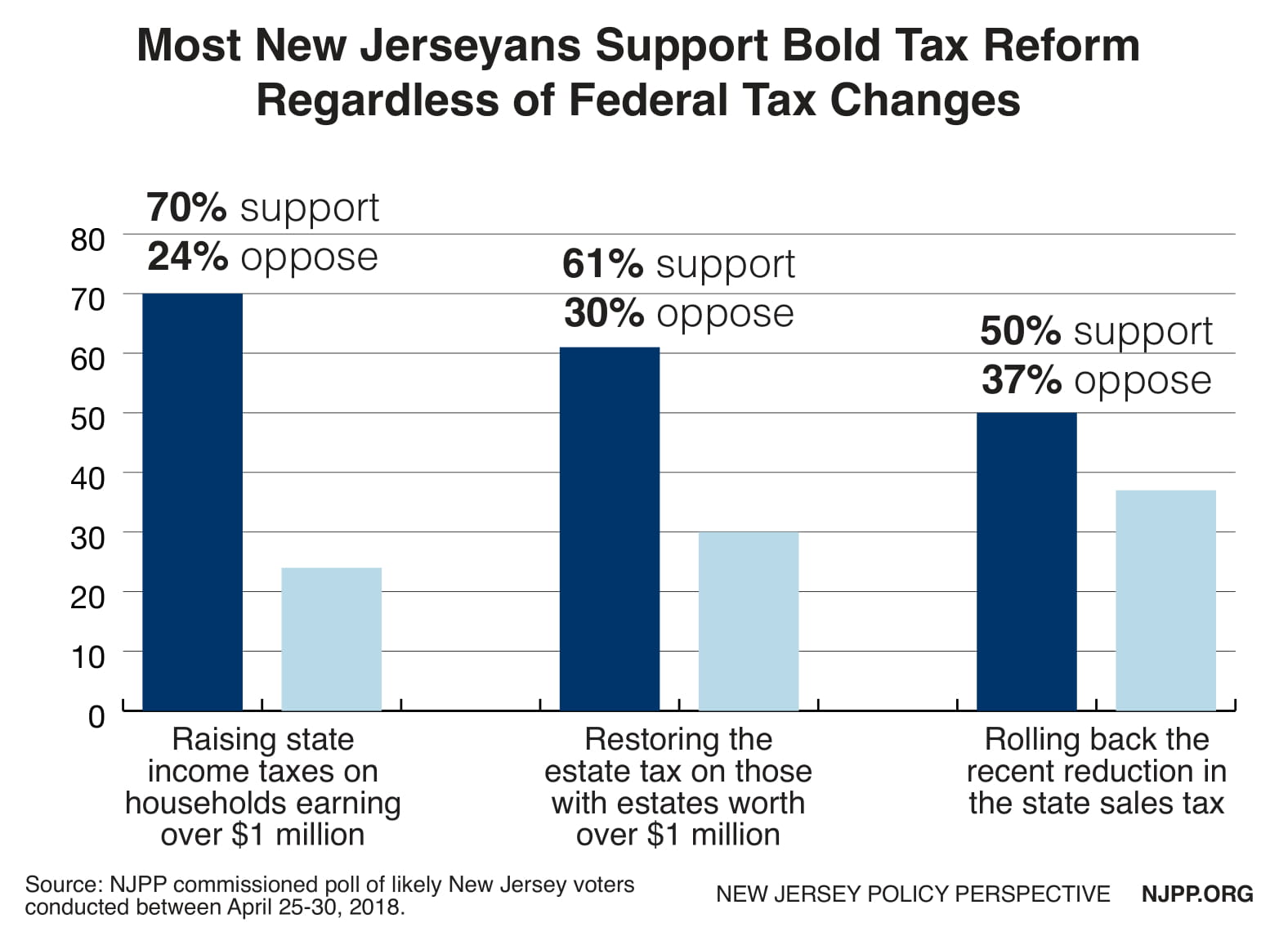

All recent polling points to strong support for a fairer income tax structure. The Rutgers-Eagleton poll found that 68 percent of New Jersey adults support raising taxes on households making more than $1 million a year. Both NJPP polls showed at least 70 percent support. These findings are consistent with similar polls conducted by Stockton University and Quinnipiac University.

NJPP explored other income tax proposals, including increasing state taxes on the wealthiest five percent of all households, and found an average support of 71 percent of likely voters – including 76 percent of independents and 57 percent of Republicans. The most recent NJPP poll also found that about half (49 percent) of voters were more likely to support their state representative if they opted to raise income taxes on households earning $1 million a year or more.

Estate Tax

Restoring the estate tax, which until last year was paid by only the wealthiest five percent of New Jersey heirs, is also popular with New Jersey voters. Both NJPP polls found that over 60 percent of likely voters support bringing back the estate tax back with a $1 million threshold, with slightly higher support for taxing estates worth over $2 million. The Rutgers-Eagleton poll, however, found just 28 percent in support this policy.

A possible explanation for this discrepancy could be that the Eagleton poll only asked about “reinstating the estate tax” without providing any context. As the 2017 NJPP poll shows, there is widespread voter misunderstanding about who pays the estate tax.The NJPP polls offered more context about who would actually be affected by this tax on inheritance which could explain such strong support for the proposal.

Rutgers-Eagleton respondents also said property taxes were the “least fair” of the taxes (75 percent). That result tracks with the first NJPP poll, which found most likely voters think the income tax is a fairer way to pay for state and local services than the property tax. That poll also showed a strong majority (69 percent) think the wealthiest five percent of households are paying too little in state taxes.

Sales Tax

All polling points to moderate support for rolling back the recent reduction in the state sales tax, especially if the proposal is tied to specific funding needs. In NJPP’s 2017 poll, likely voters were asked how much the reduction helped them or their families. Sixty percent of likely voters responded, “Not at all.” Both NJPP polls show at least 50 percent in favor of returning the sales tax to 7 percent, but the Stockton poll found stronger support (61 percent) when the extra revenue raised was dedicated to funding schools and higher education.

The Rutgers-Eagleton poll explored the possibility of expanding the sales tax to include more types of purchases like clothing and groceries, which predictably polled very poorly with 86 percent opposed. Such a proposal may be deeply unpopular because it would disproportionately harm low- and middle-income families. However, it would be interesting to see that same question asked with different examples of currently exempt services commonly utilized by the wealthy, like interior decorating, private chartered flights, and tax accountants. Chances are support for sales tax expansion on such high-end services would be much stronger.

Corporate Taxes

NJPP’s first poll found that voters are more likely to think corporations are paying too little in state taxes than paying their fair share by a wide margin (66 percent to 14 percent, respectively.) One way to fix this would be to enact a policy that closes tax loopholes used by multi-state corporations. Known as “combined reporting,” this policy proposal proved to be quite popular even without much context or explanation. The Rutgers-Eagleton poll found that there is majority support (57 percent) for this policy and the 2018 NJPP poll found even stronger support (69 percent). That same poll also found that 58 percent of likely voters support creating a three percent tax surcharge on businesses with more than one million dollars in net dollars.

Targeted Investments

Though the framing of how tax revenue should be used differed slightly, polling results consistently demonstrated that investing in New Jersey’s assets is a popular concept. The Rutgers-Eagleton poll asked how willing one would be to see a small increase in their state taxes to pay for free community college for all, free universal pre-kindergarten, full funding of all school districts, infrastructure investments and public employee pension funding. All five options received majority support when presented this way.

The NJPP polls approached targeted investments in two ways. The 2017 poll asked likely voters how important an extra billion dollars of annual revenue would be for each item presented. Within this context, all of the items received majority support with improving roads and bridges, cutting property taxes for middle- and lower-income New Jerseyans, and cutting taxes for these New Jerseyans receiving the most support (94 percent, 92 percent, and 91 percent support). Improving public transit service, increasing funding for schools, and reducing the cost of public college tuition also received majority support (85 percent, 82 percent, and 82 percent).

The 2018 NJPP poll asked likely voters to prioritize funding options if the state had an extra one billion dollars of revenue each year. The three most popular choices for targeted funding were schools, roads and bridges and property tax relief for the middle class.

Endnotes

September 2017 poll commissioned by New Jersey Policy Perspective and conducted by Anzalone Liszt Grove Research: https://www.njpp.org/budget/poll-most-new-jerseyans-want-bold-solutions-on-taxes-public-investments

November 2017 poll conducted by Eagleton Center for Public Interest Polling of the Eagleton Institute of Politics: http://eagletonpoll.rutgers.edu/state-of-the-garden-state-taxes-2018/

March 2018 poll conducted by Stockton Polling Institute of the William J. Hughes Center for Public Policy: https://stockton.edu/hughes-center/polling/documents/2018-0404-stockton-poll-marijuana-and-state-issues.pdf

March 2018 poll conducted by Quinnipiac University Poll: https://poll.qu.edu/new-jersey/release-detail?ReleaseID=2440

April 2018 poll commissioned by New Jersey Policy Perspective and conducted by Anzalone Liszt Grove Research: https://www.njpp.org/budget/new-poll-most-new-jerseyans-want-bold-tax-reform-regardless-of-federal-tax-changes