New Jersey’s recovery from the Great Recession continues to be rocky one, according to a the latest analysis of tax revenue data by Pew Charitable Trusts. While tax revenues in the majority of states have returned to pre-recession levels, New Jersey’s remain well below collections made just before the recession.

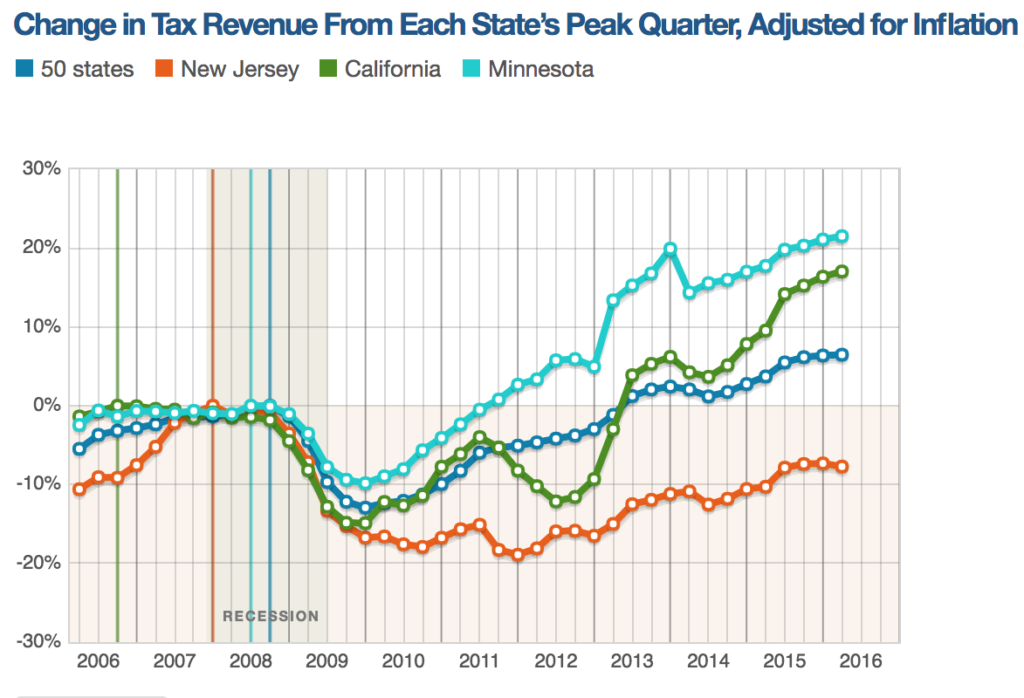

Nationally, states took in 6.5 percent more tax revenue in the first quarter of 2016 than they did in the third quarter of 2008. That is the equivalent of 6.5 cents more in purchasing power for every dollar collected at their 2008 peak. Sounds good, right?

But the national trend hides how varied the recovery has been among states with their own set of economic conditions, population changes and tax policy choices since the recession. New Jersey has consistently lagged behind national tax revenue rates and, in the first quarter of 2016, pulled in tax revenues 7.7 percent less than it did when its tax revenue last peaked in late 2007.

Some states that have fully recovered their tax revenue raised taxes after the recession including California and Minnesota. These states have rebounded by 17 percent and 21.5 percent, respectfully. Some states that chose to cut taxes continue to struggle toward previous tax collection peaks since the recession – including New Jersey.

The Garden State’s tax revenue collections recovery have taken a “two steps forward, one step back” approach since its last major dip in 2001. Meantime, significant tax cuts that were passed in October as part of the gas tax increase deal will go into full effect next year – taking as much as $675 million in revenue out of next year’s budget, according to Office of Legislative Services estimates. Although national analysts predict that total state tax revenues will likely grow at a slow rate in 2017, it remains to be seen if New Jersey’s revenue will do the same.