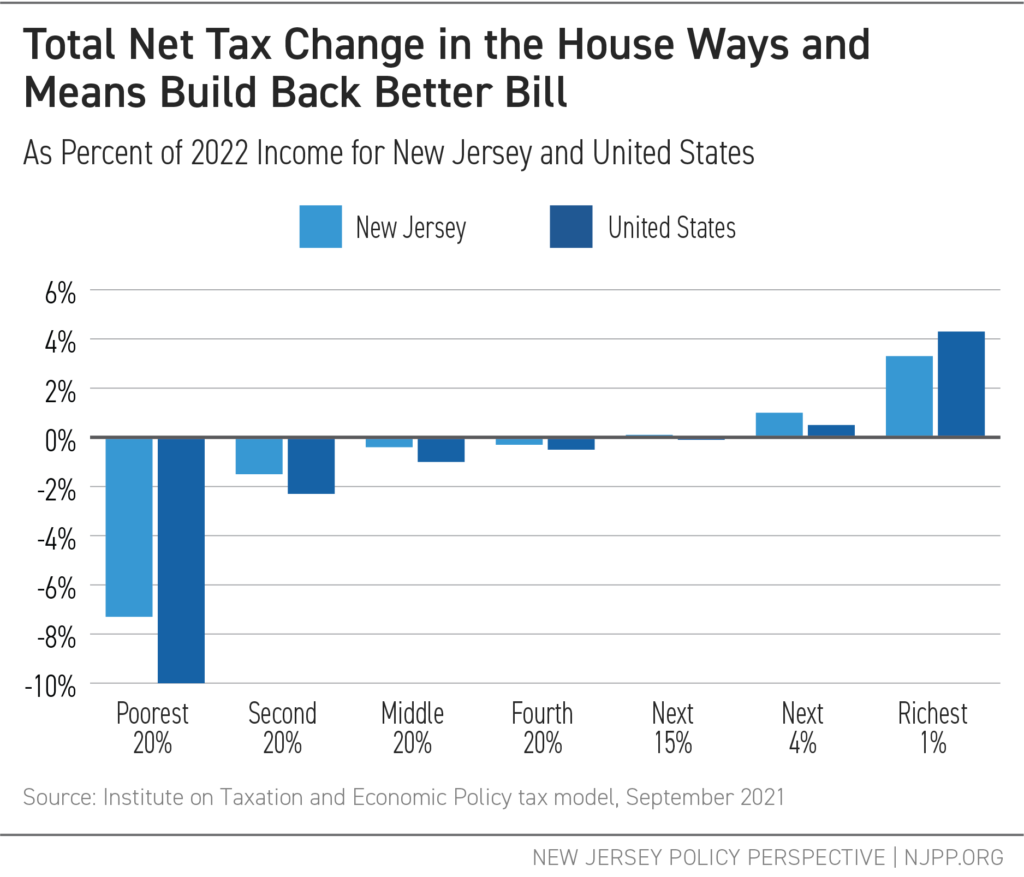

The tax proposals in the Build Back Better legislation recently approved by the House Ways and Means Committee would make the U.S. tax code more progressive, but only if the $10,000 cap on state and local tax (SALT) deductions is kept in place, according to two new reports by the Institute on Taxation and Economic Policy (ITEP). As currently written, the $3.5 trillion package would raise taxes on the nation’s richest households and biggest corporations while providing a tax cut for the average taxpayer in all income groups except the top 5 percent.

These tax reforms would pay for nearly all of the groundbreaking investments in the bill, like child care infrastructure, targeted rental assistance, new Medicare benefits, carbon emission limits, and permanently enhanced tax credits for workers and their families (more on that below).

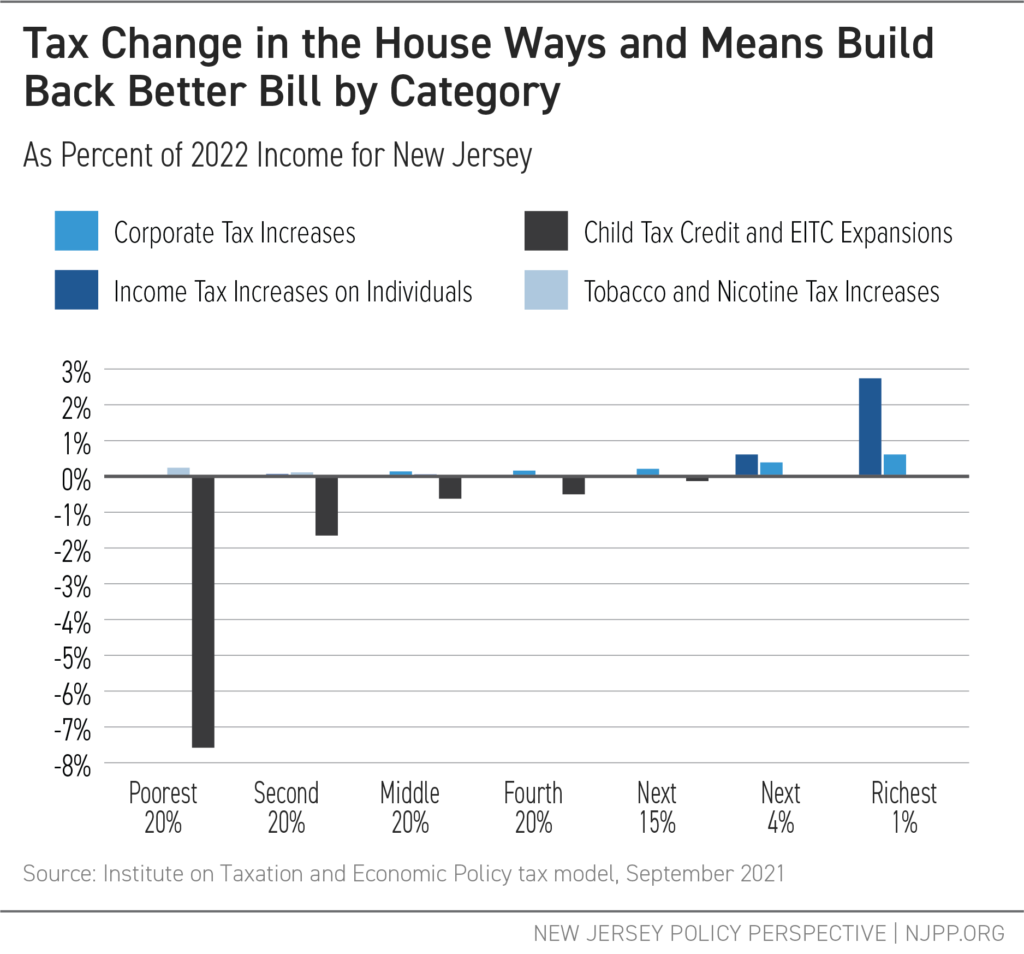

Here’s what the tax changes of the Build Back Better bill would mean for New Jersey. First, income taxes would go up, but only for 2.7 percent of New Jersey tax filers. According to the ITEP analysis, 86 percent of the tax increases would be paid for by the richest 1 percent of earners, who have a projected average annual income of $2.73 million in 2022. The bill would also raise taxes on corporations. Again, this reform would primarily fall on the wealthiest people as they are the most likely to own stocks and other business assets. Third, the bill would raise federal taxes on tobacco and nicotine, which would affect individuals in all income groups. Together, these tax increases account for 94 percent of the revenue that would be raised in the bill’s first 10 years.

The biggest tax cuts in the legislation are through expansions to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC), which would mostly benefit the bottom 60 percent of earners. These changes would result in a lower effective federal tax rate for households in all but the wealthiest income brackets.

The bottom 20 percent of earners in New Jersey would receive a tax cut equal to 7.3 percent of their income if they qualify for the CTC or EITC expansion. On the other end of the income spectrum, the richest 1 percent in New Jersey would receive a tax increase equal to 3.3 percent of their income. That’s a progressive shift away from the tax policies currently in place, especially after the enactment of the 2017 Trump-GOP tax law, which disproportionately benefits the richest tax filers.

The graph below shows how each of the major tax policies of the proposed legislation would affect each income group as a share of income. Unlike the regressive tax changes made during the Trump administration, these policies target those who have flourished while improving the tax code for those who were disproportionately harmed by the public health crisis and its economic fallout.

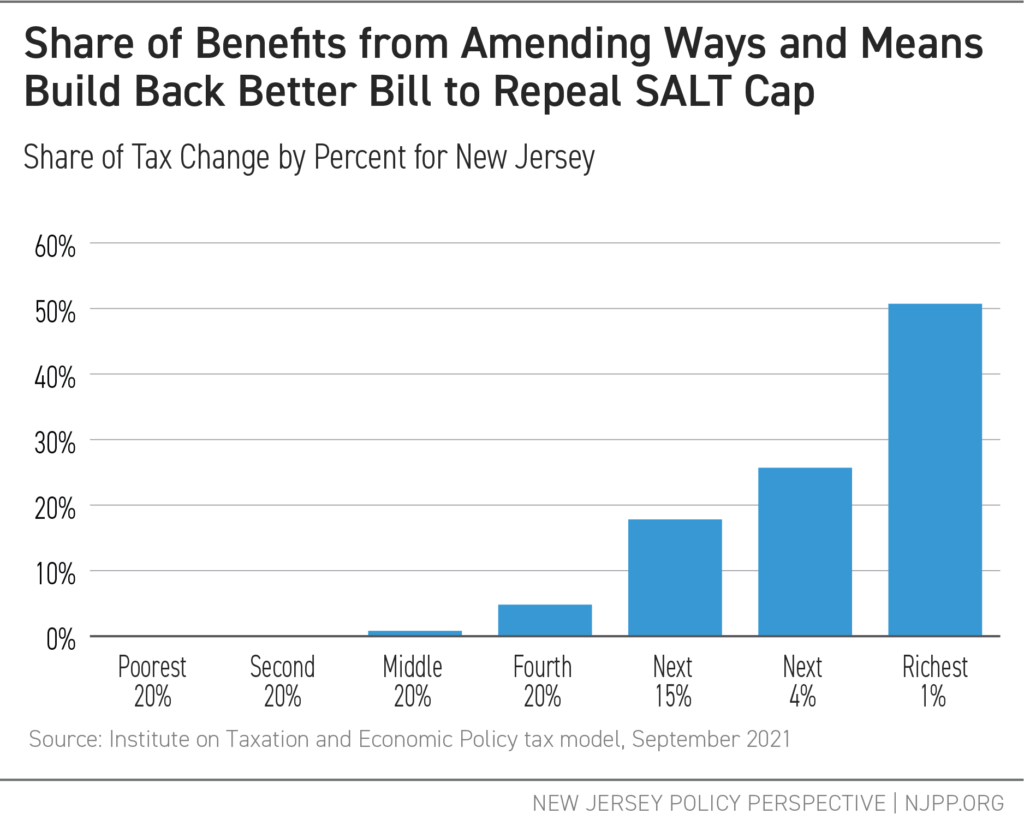

But, should amendments include a full repeal of the $10,000 cap on deductions for state and local taxes (SALT), the bill’s progressive income tax reform would be completely wiped out, putting key investments at risk, according to a follow-up analysis by ITEP released last week.

New Jersey’s congressional representatives have repeatedly claimed that their “middle-class” constituents are hurt by the SALT cap. In reality, a full repeal would disproportionately benefit the richest households; almost none of the benefits would go to the state’s bottom 80 percent of earners. Those who make between $89,500 and $159,700 a year, like an East Rutherford police officer (average salary $152,461) or Edison teacher (average salary $96,455), would receive just 5 percent of the benefit with an annual average tax break that amounts to a dollar a day. In contrast, the richest 1 percent would enjoy over 50 percent of the benefit with an average tax break equal to $231 dollars a day, or $84,000 a year.

Further, claims that the bill raises revenue directly from the rich would no longer be accurate if the SALT cap is repealed. In fact, 81 percent of the proposed tax increases for the richest 1 percent would be wiped out. Unless other significant changes are made to the legislation (looking at you, stepped-up basis), an amended version that includes a full SALT cap repeal lets the rich off the hook and puts a huge dent in new tax revenue for the bill’s unprecedented investments in programs like universal pre-K and free community college. As written now, the income tax changes would raise $84.4 billion. But a repeal of the SALT cap would reduce new revenue by $114 billion, resulting in lost revenue overall.