April 20, 2021 – Earlier today, NJPP released the Blueprint to Secure a Just Recovery, a bold and comprehensive policy platform to guide New Jersey’s pandemic recovery within an anti-racist framework. State and national leaders commend the policy recommendations in the Blueprint and its goals of reducing the racial wealth gap, eliminating poverty, and realizing equity in every corner of the state.

“Over the years, NJPP has distinguished itself as one of the most influential think tanks in New Jersey, driving meaningful policy change to advance economic, social, and racial justice through rigorous independent research,” said Governor Phil Murphy. “The organization’s new report – “Blueprint to Secure a Just Recovery” – serves as an important contribution to the policy discourse at a time when we not only need to get through the pandemic, but spark equitable growth over the long-term to build a stronger, fairer, and more resilient economy for every New Jersey family.”

“The New Jersey Policy Perspective’s Blueprint to Secure a Just Recovery lays out an ambitious plan that not only addresses some of the current crises we’re facing now, but creates guidance for building a more resilient state prepared to face challenges yet to come,” said Rep. Bonnie Watson Coleman (NJ-12). “The COVID-19 pandemic has ripped the cover off of many vulnerabilities that went unchecked and often unnoticed by policymakers. This blueprint would ensure we don’t return to the state we were before the pandemic and that we meet the challenges in front of us to create a more just and fairer New Jersey in which every resident can thrive.”

“Congratulations to Brandon McKoy and the New Jersey Policy Perspective team on the release of their Blueprint,” said Senator Vin Gopal (D-Monmouth). “I am pleased to see several initiatives that we have worked together, such as the repeal of the yacht tax, and other key policy platforms included in this Blueprint. These policy points will continue conversations in some cases, and begin conversations in other cases, on how we make New Jersey fair for every resident.”

“NJPP has designed a modernized roadmap for policy changes that create a stronger inclusive New Jersey, especially for people of color,” said Assemblywoman Shavonda Sumter (D-Passaic), Chair of the New Jersey Legislative Black Caucus. “This Blueprint establishes a well-defined resolution that addresses centuries of discriminatory policies across a variety of issue areas including labor, housing, health, education, and more. The New Jersey Legislative Black Caucus has served as a collaborative partner throughout the years with NJPP to highlight the legislative initiatives necessary to disrupt the norm. These initiatives included the increase in the minimum wage, paid sick leave, expansion of affordable healthcare, and pay equity.

“The historic Coronavirus pandemic has revealed that there is still much work to be done,” Sumter added. “Reports such as the Blueprint unveils the history of systemic and structural policies that have disproportionately impacted black people in the state. To restore New Jersey’s economy, there must be a realignment of policies that help Blacks, Hispanics, and low-wage earners grow financially. Additionally, earnest efforts must be made to understand the structural limitations established by prior generations so that we may break the barriers for future generations. Therefore, support for legislation such as the Reparations Taskforce bill is crucial. As the prime sponsor of the Reparations Taskforce legislation, the passage in both the house and senate with signature by the Governor is critical to document the historical role our state played in the enslavement of black people. It will also help to validate the economic impediments for generations outlined in this report.”

“New Jersey is in a position to be a leader of progress in reducing the disparate impact on communities of color, immigrants, and the poor. New Jersey is shoring up our future to improve the lives of all and not just some,” Sumter added. “We have the foundational pillars within the Blueprint, now it is time to get to work as collaborative partners. The New Jersey Legislative Black Caucus looks forward to working with this effort.”

“NJPP’s Blueprint to Secure a Just Recovery reflects a more equitable state for all New Jersey residents,” said Assemblywoman Verlina Reynolds-Jackson (D-Mercer). “The Blueprint clears the path for a fairer state by focusing on key areas such as economic security, education, and voting rights. NJPP has been a crucial partner during my time as a legislator and I look forward to continuing working with them to create a new normal that leads to a fairer Garden State.”

“NJPP constantly reminds us that math is real, and as a legislator with a scientific approach to policymaking, I appreciate the data and statistics that NJPP brings to the conversation,” said Assemblyman Andrew Zwicker. “I look forward to in-depth discussions about the recommendations in the report as we work to make a New Jersey that works better for all those who call our Garden State community home. Our discussions must advance the importance of strengthening New Jersey’s economy and enhancing our resident’s daily lives in a manner that does not minimize or silence social inequality.”

“In order for New Jersey to truly thrive, we must ensure that recovery from the pandemic is about much more than climbing back to an inequitable and unacceptable status quo,” said Maisha Simmons, New Jersey Team Director at the Robert Wood Johnson Foundation. “The policy reforms identified in NJPP’s Blueprint are critical to achieving the promise of a healthier, more equitable New Jersey for everyone who calls our state home.”

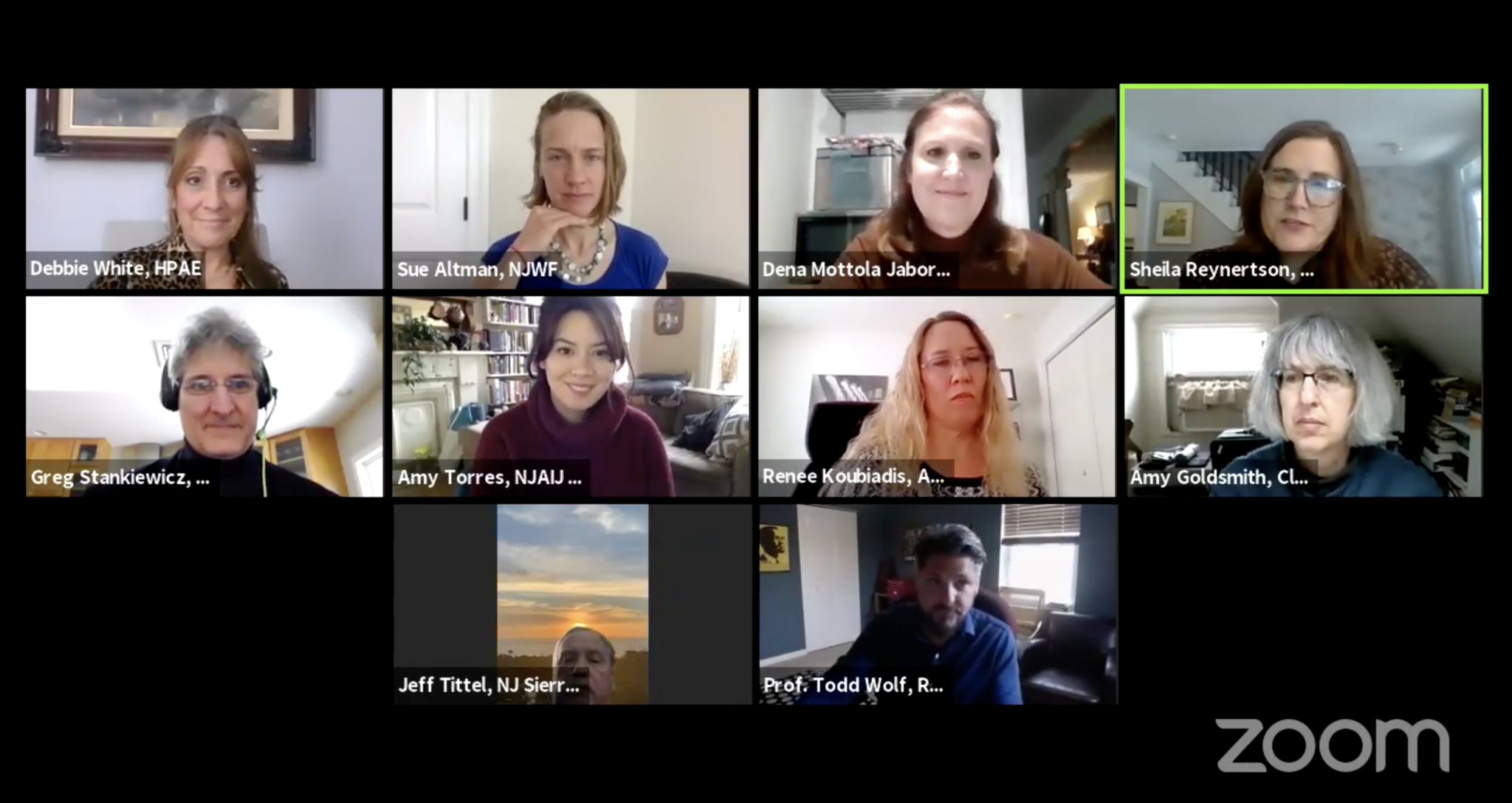

“New Jersey Citizen Action understands the main reasons why social and economic inequities persist in New Jersey and this nation: corporate influence over government tax and budget decisions, and systemic racism,” said Dena Mottola Jaborska, Associate Director, New Jersey Citizen Action. “This Blueprint is built around this same analysis and includes many of the fundamental solutions families need to escape poverty and build economic security. There is no getting around this problem with surface-level proposals — systemic issues baked into state and federal laws and regulations can only be addressed by systemic changes. The vast majority of New Jersey families are poor or struggling middle income and urgently need the solutions this blueprint contains.”

“This Blueprint provides concrete policy solutions for New Jersey to lead the nation toward a more prosperous and equitable future,” said Nick Johnson, Senior Vice President for State Fiscal Policy, Center on Budget and Policy Priorities. “It’s a bold vision for New Jersey, forged with partners across the state and with a particular emphasis to advancing economic and racial justice for communities of color and those with low incomes. Every Garden State policymaker should read this Blueprint closely – and then help turn its forward-thinking ideas into action.”

“Having grown up in New Jersey, I am especially thrilled to see New Jersey Policy Perspective’s Blueprint to Secure a Just Recovery putting forth recommendations to prioritize economic and racial justice in the state’s pandemic recovery efforts,” said Otis Rolley, Senior Vice President of Equity and Economic Opportunity at The Rockefeller Foundation. “This is a real chance to put equity first and address longstanding disparities.”

“This is an ambitious agenda that rightly recognizes that New Jersey’s economy is not working well if it is not working for everyone,” said Naomi Walker, Director of the Economic Analysis and Research Network (EARN). “The policies outlined target racial and gender inequities, ensure working people have good, safe, and stable jobs with family-supporting benefits and wages, and make strong public investments financed by a tax system in which the wealthy pay their fair share. This agenda would allow New Jersey to build an economy where everyone can thrive and prioritizes justice for all.”

“New Jersey faces critical choices that will determine whether we emerge from the COVID-19 pandemic as a stronger, more equitable state or one that continues to perpetuate devastating racial disparities and economic inequality,” said Sara Cullinane, Director of Make the Road NewJersey. “NJPP’s Blueprint is a powerful, comprehensive and visionary tool to ensure everyone — in particular, working-class and poor communities of color that have disproportionately suffered — has the opportunity to thrive.”

“While New Jersey has taken significant steps in recent years to end punitive policies that disproportionately harm low-income communities and communities of color, much remains to be done. As NJPP’s Blueprint for a Fair and Just Recovery shows, the pandemic exposed starkly how deep the cracks of inequity in our system go, and the recovery presents an unprecedented opportunity to more forcefully confront these issues,” said Amol Sinha, Executive Director of ACLU-NJ. We cannot allow complacency to take hold in addressing what has become clearer in the emergency of the pandemic. The public health emergency may end, but the emergency of injustice and inequity that COVID clearly showed will still rage on. NJPP reminds us that New Jersey can and must be a leader in addressing issues like racial injustice, threats to democracy, access to reproductive care, full inclusion of immigrants, and so many other inequities as the emergencies they are.”

“The path out of the pandemic and building a better society will be long. NJPP’s Blueprint report paves the way forward for holistically thinking about the solutions that will put our state on firmer footing,” said Doug O’Malley, director of Environment New Jersey. “While the storm of COVID will eventually pass, the struggles we face to build a more sustainable, healthier, and greener New Jersey will remain. Climate change has not abated, our public health crisis from lead pollution has not disappeared and the air pollution from our dirtiest trucks and buses still pollutes our air. This blueprint should be a rallying call for the public — and for decision-makers — to think big as we build our recovery from the pandemic.”

“This Blueprint is a clear path forward to a truly sustainable and just economic future for New Jersey,” said Debra Coyle McFadden, Executive Director, NJ Work Environment Council. “We can create a system that includes affordable healthcare, stronger worker protections, climate resilience, and investment in our public schools. We can do this and more if we think big and make investments in our values.”

“The COVID-19 pandemic brought to the fore the inequalities that harm the lives of so many New Jerseyans,” said Kevin Brown, SEIU 32BJ Vice President and New Jersey Director. “The Blueprint for a Just Recovery provides our state with a foundation to move into recovery with the means to better protect workers. By enhancing the equal enforcement of our state’s $15 minimum wage, just cause protections, wage theft laws, and ALL workplace protections, we will be building a fair economy that works for us all.”

“As New Jersey moves toward COVID-19 pandemic recovery, many immigrants, people of Color, and low-income families are still suffering. New Jersey Policy Perspective’s Blueprint affirms what our communities have known all along — we can no longer tolerate margins of error in our public policy. The State must look back at the practices that brought us to this point in order to move toward a just future,” said Amy Torres, Executive Director at the New Jersey Alliance for Immigrant Justice. “NJPP’s Blueprint does exactly that, by proposing a just recovery that asks more from those who suffered the least and invests it back into the communities that make New Jersey strong.”

“Building a stronger, fairer, and thriving New Jersey is going to take bold forward-thinking policies, which this comprehensive Blueprint maps out,” said Staci Berger, President and CEO of the Housing and Community Development Network of New Jersey. “The recommendations include a path towards creating a place every New Jerseyan can afford to call home in a healthy community of choice. There are steps New Jersey leaders can take right now to achieve this goal, including preventing another raid on the Affordable Housing Trust Fund and protecting homeowners and renters impacted by the pandemic. We applaud NJPP for creating this commonsense path for post-pandemic recovery.”

“NJPP’s Blueprint uplifts what we know to be true: that ending the drug war, replacing punishment with public health and community care, and embedding racial justice and equity for immigrants in every facet of policymaking are essential if New Jersey hopes to live up to our progressive reputation,” said Jenna Mellor, Executive Director of the New Jersey Harm Reduction Coalition. “NJPP’s thoughtful research and analysis, done in deep collaboration with community partners, put it at the moral center of policy leadership in New Jersey.”

New Jersey Policy Perspective (NJPP) is a nonpartisan think tank that drives policy change to advance economic, social, and racial justice through evidence-based, independent research, analysis, and strategic communications.

# # #