Advocates, policy experts, and small business owners from For The Many NJ condemned the numerous corporate tax cuts and giveaways in the state budget proposal voted out of committee Wednesday night. The budget was advanced by the Senate and Assembly Budget Committees late in the evening, with zero public comment and text not available for the public to review before the $54.3 billion budget was voted on.

The budget deal includes a $1 billion corporate tax cut, an overhaul of the corporate tax code that makes it easier for companies to hide their profits overseas, and major expansions of tax credits for Hollywood studios and commercial developers that were snuck into the budget in the waning hours of negotiations.

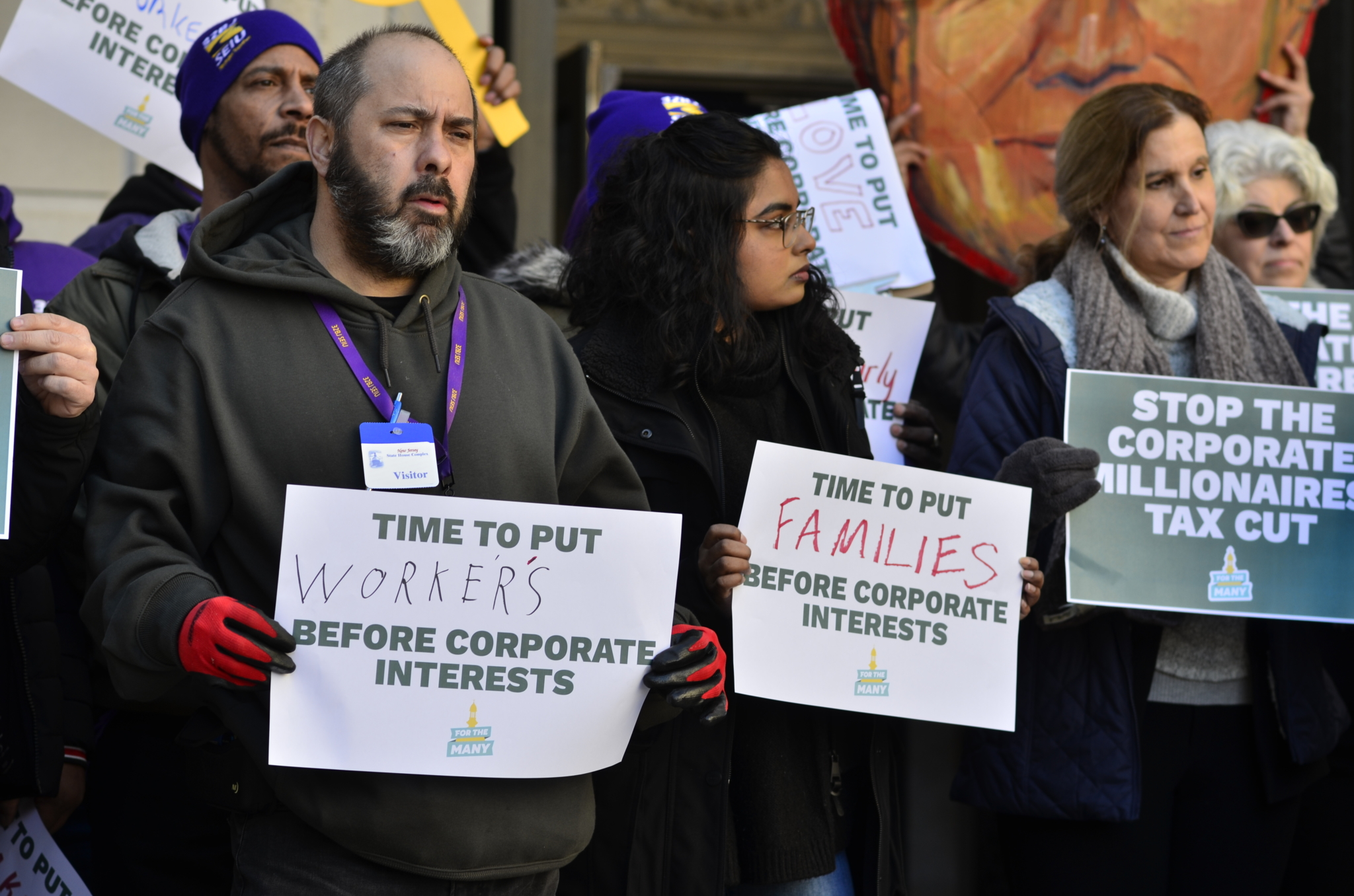

Over the last few months, members of the For the Many NJ have urged lawmakers that everyday New Jerseyans, not big corporations, should be the focus of the budget: testifying at public hearings, meeting with NJ Transit riders, unveiling a scroll representing the ultra wealth of big corporations, and rallying in front of the offices of corporate lobbyists.

In a year with record-breaking tax collections, lawmakers failed to invest these funds in programs that families and small businesses rely one — like NJ Transit, affordable housing, the social safety net, and more — and instead diverted billions of dollars to corporate entities, their shareholders, and high-paid executives.

Antoinette Miles, Interim State Director, New Jersey Working Families Party:

“For months, advocates have urged lawmakers not to dole out billions of dollars in costly corporate tax handouts to companies like Amazon and Walmart. Trickle-down policies don’t work. They limit our ability to make investments that make New Jersey’s economy work for everyone and do nothing to ensure our state can maintain its fiscal footing.”

Nicole Rodriguez, President, New Jersey Policy Perspective (NJPP):

“It’s hard to evaluate this budget when it’s riddled with errors and needs to be corrected. What we do know is that an overall lack of transparency rewarded big corporations and special interests at the expense of everyday New Jerseyans. With record revenues and a chance to make generational investments in the state, lawmakers prioritized a $1 billion corporate tax cut and hundreds of millions of dollars to Hollywood studios and real estate developers. Make no mistake, there are great investments in the budget worth celebrating, but they pale in size and scope to the tax cuts and credits given to the wealthy and well-connected. When corporations and wealthy households are allowed to skirt the tax system and do not pay what they owe, that leaves less funding for our schools, mass transit, and other public goods we all rely on.”

Elizabeth Roque, member of Make the Road – New Jersey:

“The Legislature has given a billion dollar handout to the wealthiest multinational corporations like Amazon, while working families across New Jersey continue to suffer. The failure to extend the Corporate Business Tax Surcharge is a mistake that will have long-lasting, devastating consequences on families like mine who are struggling to make ends meet. A billion dollars would fix NJ Transit, provide a full Child Tax Credit to all kids in New Jersey, and help build more affordable housing. But instead, the Legislature today has chosen to line the pockets of the wealthiest corporations.”

Liz Glynn, Director of Organizing, New Jersey Citizen Action:

“Allowing the Corporate Business Tax Surcharge to expire benefits a handful of wealthy corporations at the expense of the vast majority of New Jerseyans. This could eventually lead to significant cuts in programs involving healthcare, education, the environment, transportation, and many other initiatives that help ensure working families in our state can thrive and prosper. It also puts future state leaders in the impossible dilemma of pitting our state’s financial health against the economic security of countless New Jersey families.”

J. Kelly Conklin, Founding Board Member, New Jersey Main Street Alliance:

“While there are certainly things to like in the budget legislation moving toward the Governor’s desk, the political calculus that includes massive revenue giveaways to a very small number of highly profitable corporations in the form of cutting the corporate tax rate doesn’t add up. Using calculus to disguise bad math never works in the long run. But while big, profitable corporations laugh all the way to their offshore bank accounts it will be small businesses that pick up the revenue shortfalls with tax increases and diminished public investment that impacts them, their customers and their employees.”

Marcia Marley, President, BlueWaveNJ:

“New Jersey’s economy is growing in part because of responsible stewardship from our Governor and the Legislature. That said, we are in danger of repeating our mistakes by creating a budget plan that will not weather the coming fiscal cliff. Instead the Legislature and Governor are making large tax relief plans which may not be sustainable and fail to target those who need it most.”

Amy Goldsmith, New Jersey State Director, Clean Water Action:

“Despite a looming fiscal cliff with federal funds depleting and a troubling economic clouds smoldering, the announced agreed upon budget is a reverse Robin Hood. Taking from the poor to give to the rich is unconscionable. Yet, that’s what’s on the table with fare hikes and service cuts being considered for NJ Transit, underfunding of the Earned Income Tax Credit, and $400 million raids on NJ Transit and the Clean Energy Fund that target the low income while millionaire businesses and McMansion homeowners get billions of dollars in new tax breaks and those with low incomes gets less.”

Dennis Trainor, CWA District 1 Vice President:

“After decades of administration after administration of both political parties failing to make the required full pension payment, we’re thrilled that – for the third time in a row – this budget makes the full pension payment. This will help bring retirement security for hundreds of thousands of current and former state workers. And that’s incredible. What’s not so thrilling is Trenton failing to extend the Corporate Business Tax Surcharge – in effect, incredulously rewarding corporate greed and robbing our state of more than $1 billion of revenue annually at a time when New Jersey continues to struggle funding crucial services like education, transportation and healthcare.”

Cliff Simms, Peter Simms, Dorothea von Moltke, Owners of Labyrinth Books and Great Jones Books:

“As the owners of two New Jersey family businesses, we are tired of hearing how small businesses are the engine of employment and economic growth while watching how large corporations are the beneficiaries of unwarranted tax breaks, which add proportionally little or nothing to the economy of New Jersey. Sunsetting the 2.5% surcharge on corporations that make over one million in net profits will eventually put more of a financial burden on small and medium sized businesses, which are still digging out of from the difficulties of the pandemic and have had to cope with, in its wake, rapidly rising wages as well as heightened inflationary costs. It seems obscene to give a handout to large corporations at a time when businesses on Main Street remain depressed and struggling while trying to do the right thing for employees.”

Rev. Sara Lilja, Director, Lutherans Engaging in Advocacy Ministry NJ (LEAMNJ):

“Does the state budget reflect our values? Tax breaks for wealthy corporations during this time of economic uncertainty is short-sided and immoral. The state budget must prioritize the needs of all; not just wealthy corporations! The economic engine of our state is our people. Hard working neighbors and friends continue to struggle to make ends meet each month, while contributing every day to the state’s economy. We have a moral obligation to plan for the future of families, and help all New Jersyans to thrive. Our state budget must reflect these values!”

Julie Borst, Executive Director, Save Our Schools NJ:

“New Jersey schools have been underfunded for over a decade. While the Murphy administration has made great strides in getting us to full funding, we do not see how it will be possible to maintain without the largest corporations paying their fair share of taxes. These same corporations have benefitted from significant federal tax cuts and they have benefitted from New Jersey’s well-educated population. They should contribute to support the system that produces those people. Without this funding, homeowners can expect to have to make up the difference.”

Philip Hensley, Democracy Policy Analyst, League of Women Voters of New Jersey:

“In the middle of the night, the legislature passed a budget giving away billions to big corporations. And the process was as flawed as the budget itself: no public testimony was allowed, legislators voted without seeing the final text, and because of rushed drafting the budget’s numbers don’t even add up. While this budget does invest in some laudable programs, for example by increasing the Child Tax Credit, this budget misses the opportunity to fund New Jersey’s future. This continues a worrying trend in Trenton of passing damaging legislation in the dark. From laws gutting campaign finance limits, to secretive last-minute amendments, to a budget that nobody saw and an assault on OPRA, New Jersey residents are noticing an anti-transparency streak in Trenton. With this budget, an opaque process has once again produced short-sighted and inadequate legislation.”

# # #

For The Many NJ is a statewide coalition of more than 30 organizations working to expand funding for essential services and improve budget practices to meet current and future needs, especially for communities that have been historically marginalized.