To read a PDF version of the full report, click here.

The Earned Income Tax Credit (EITC) is one of the most effective anti-poverty programs for working-age households in the U.S.[1] It raises incomes for workers with low-wages and advances income and racial equity. In fact, the EITC has helped millions of workers better make ends meet and afford basic needs for themselves and their families, particularly among Black and Latino households.[2]

In 2000, New Jersey created its own version of the EITC, building upon the federal credit and providing a bigger boost to the state’s working families. Originally, the state credit provided a benefit at 10 percent of the federal credit. Over the years, the value of the state credit has increased – and occasionally decreased – to the point where it now provides a benefit at 40 percent of the federal credit.

Nearly two decades after adopting an EITC in New Jersey, the impact of the program is clear. In 2018 alone, the state EITC infused $400 million into local economies and provided a much-needed boost to over 500,000 workers and families struggling to meet basic needs.[3] While both Republican and Democratic lawmakers recognize the program’s value and have supported several expansions to the credit, the EITC’s reach is still limited. Specifically, workers, who are not raising children at home, have a disproportionately lower income cap and lower maximum credit than qualifying families with children. Further, single workers who are not raising children at home lose the benefit completely after earning more than $15,570, and childless workers under the age of 25 and over 64 are completely ineligible for the credit.

Recognizing such disparities in the federal EITC, several lawmakers have proposed changes to the program. However, New Jersey does not need to wait for federal changes to be enacted. The state, like several others, can take steps to expand eligibility beyond federal rules. The following report examines these proposals and evaluates the potential impact of strengthening New Jersey’s EITC.

This report makes three recommendations to improve parity and accessibility of the state EITC:

- Reduce the minimum age requirement for workers without qualifying children from 25 to 18.

- Increase the refundability of the New Jersey EITC for workers without qualifying children from 40 percent to 100 percent of the federal credit.

- Increase the income threshold for workers without qualifying children from $15,570 to $25,000.

If all three recommendations are implemented, over 400,000 workers would benefit, infusing $156 million into local New Jersey economies.

Introduction

The Earned Income Tax Credit (EITC), a refundable tax credit for low- and moderate-income working individuals and families, has long been one of the most successful tools for reducing poverty, promoting economic security, and improving the quality of life of working families. In 2017 alone, the federal EITC lifted approximately 5.7 million people out of poverty, including about 3 million children. And the credit further reduced the severity of poverty for an additional 19.5 million people, including about 7.3 million children.[4]

Recognizing the effectiveness of the EITC, federal lawmakers have repeatedly expanded the credit since its enactment as a temporary provision in 1975, including adjustments to both the amount of the credit and eligibility rules.[5] The federal EITC is now among the nation’s largest anti-poverty programs, with 25 million taxpayers receiving approximately $63 billion in 2018.[6]

In 2000, New Jersey enacted a state EITC to supplement the federal EITC. While the EITC has since boosted the economic security of workers and families in the Garden State, several groups of New Jersey workers receive little or no benefit from this program. The EITC for workers who are not raising children at home, in particular, is currently not available for people under the age of 25. Further, relative to the credit for households with children, the childless EITC has a disproportionately small income cap and low maximum credit amount. In short, the current state (and federal) EITC falls short for childless workers in New Jersey as compared to other groups.

With common-sense changes to the state EITC, New Jersey could better support hard-working taxpayers who are just entering the workforce. Further, expanding the credit for childless workers would improve parity between families with children and families who do not have qualifying children at home. The following report provides an overview of New Jersey’s EITC program, as well as an examination of other jurisdictions’ efforts to expand EITC eligibility. This report also provides an analysis of the impact of targeted expansions of EITC eligibility in the state as well as recommendations for improving the New Jersey’s EITC program.

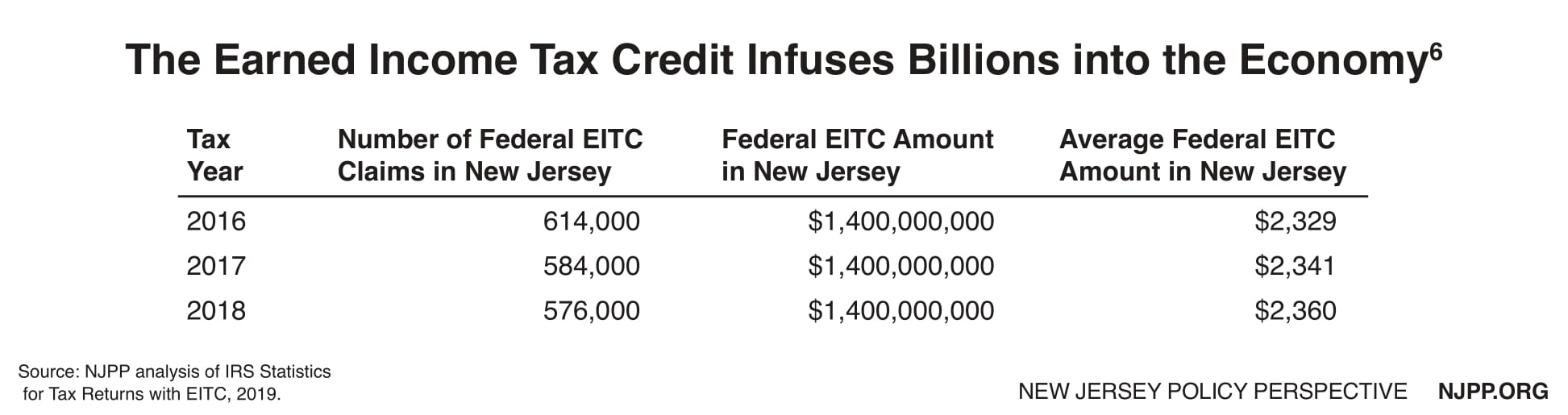

Federal EITC Rules Exclude Childless Workers

Enacted as a part of the Tax Reduction Act of 1975 to reduce participation in federal assistance programs, encourage employment, and promote economic recovery from the recession, the EITC reduces the tax liability of low- and moderate-income workers. Each year, the federal EITC improves the economic security of Garden State residents and strengthens state and local economies. In 2018, for example, the EITC benefitted over 576,000 New Jersey workers and infused $1.4 billion into New Jersey’s economies.[7]

In order to qualify for the credit, households must have earned income and file a tax return with the IRS. The amount of the credit is a function of the worker’s income; the percentage of income increases with the amount of income until reaching a maximum credit threshold, at which point the value of the credit remains flat until it reaches a phase-out point.[8] After the phase-out point, the amount of the credit incrementally declines with additional income. If the amount of the credit that an individual or family qualifies for is greater than their tax liability, they can receive the balance as a refund.

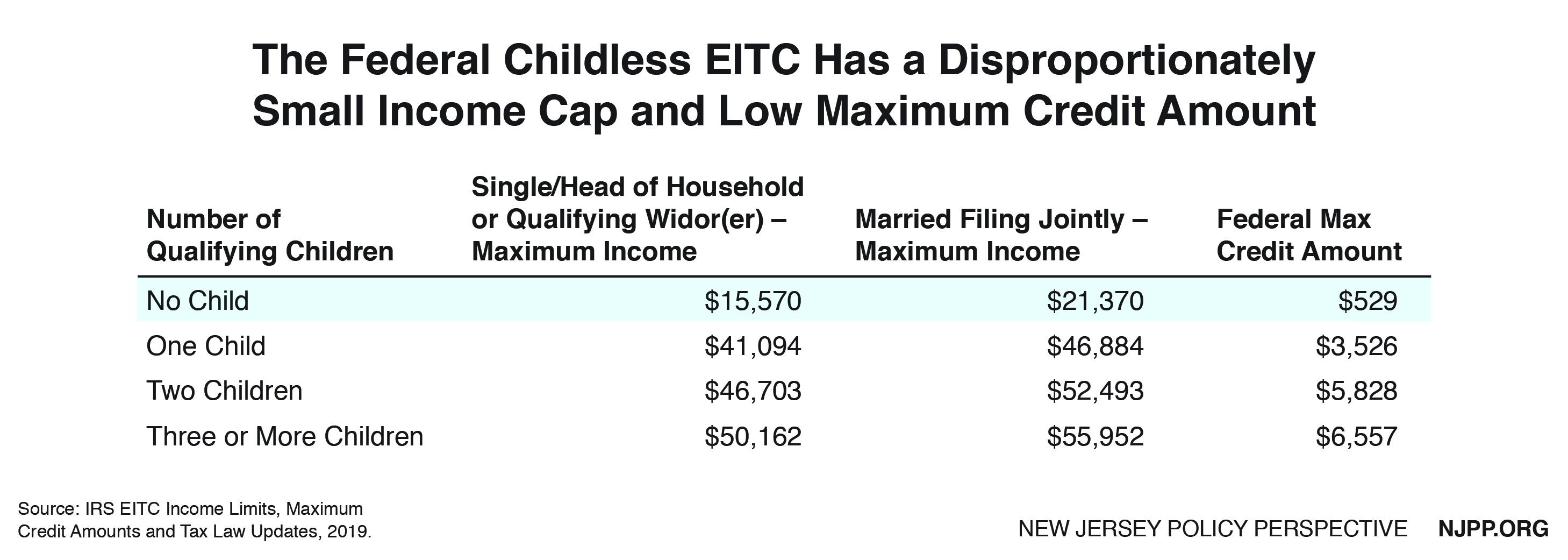

Eligibility for the federal EITC is contingent on several factors, including age, citizenship, residency, number of qualifying children, marital status, tax filing status, and income.[9] The adjusted gross-income cap for eligibility for the federal EITC increases based on family size. In tax year 2019, for families with one qualifying child, the income cap is $41,094 ($46,884 if married filing jointly).[10] The cap rises to $46,703 ($52,493 for married filing jointly) for families with two qualifying children, and to $50,162 ($55,952 for married filing jointly) for families with three or more qualifying children. For workers without qualifying children, the income cap is substantially lower than for families with children: $15,570 ($21,370 for married filing jointly).

While the maximum credit for families with children ranges from $3,526 (for families with one child) to $6,557 (for families with three or more children), the maximum credit for childless workers is only $529. As a result, the amount of the tax credit received by the eligible childless workers is often less than their tax liability and fails to provide sufficient support to low-income workers.[11]

In addition to a very low adjusted gross income cap and low maximum credit for workers without qualifying children, age and residency restrictions further limit the EITC eligibility. In order to qualify for the EITC, childless workers must be older than 25 years old and younger than 65.[13] Accordingly, while the majority of households that qualify are childless, over 90 percent of the federal EITC is distributed to families with children.[14] While this program was designed with the assumption that workers under 25 are dependent on parents, the reality is that many young New Jersey workers are struggling financially to meet their basic needs.[15]

Federal Proposals Recognize Shortfalls in EITC

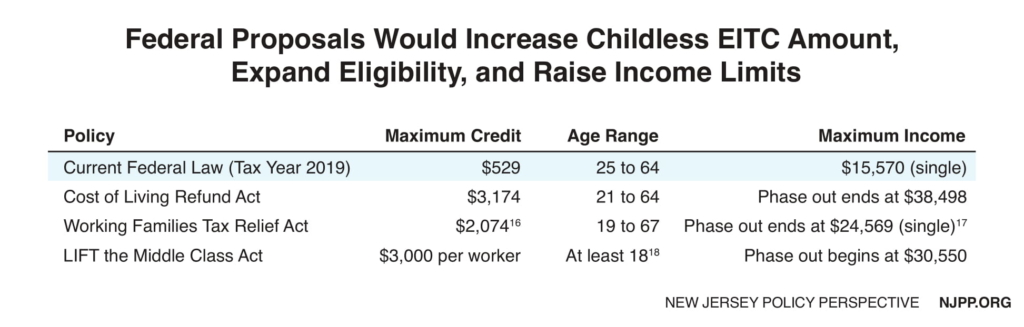

During the past year, federal lawmakers have announced several proposals to mitigate poverty by strengthening tax credits for low- and moderate-income people. While the details of these proposals vary substantially, several of these proposals would improve parity between the EITC for families with children and families who do not have qualifying children at home.

The table below provides an overview of the impact of three of these proposals—the Cost of Living Refund Act of 2019, the Working Families Tax Relief Act, and the LIFT the Middle Class Act—on tax credits for childless workers. While the Cost of Living Refund Act and Working Families Tax Relief Act would expand the EITC, the LIFT the Middle Class Act would create a new credit that supplements the EITC.[16]

Cost-of-Living Refund Act

Introduced in both the House and Senate in February 2019, the Cost of Living Refund Act of 2019 (H.R. 1431, S. 527) would decrease the age eligibility for workers without qualifying children from 25 to 21, extend eligibility to qualified students, and expand qualified dependents to include seniors and other relatives.[20] The proposal would also increase the amount of the EITC by raising the credit percentage and phaseout amount, which would nearly double the maximum credit for households with children as well as increase the maximum credit for workers without children nearly six-fold from $529 to approximately $3,054.[21] This Act would also increase the maximum income cap for workers without qualifying children from $15,570 to $38,498, and for households with one child from $40,320 to $61,393. According to a microsimulation produced by Institute on Taxation and Economic Policy (ITEP), this proposal would lead to an $1,950 average decrease in tax liability for the poorest 20 percent of New Jersey residents (with incomes of less than $24,300) and a $1,330 average decrease for the second poorest 20 percent (those earning $24,300 to $43,500).

Working Families Tax Relief Act

Introduced by Senators Sherrod Brown, Michael Bennet, Richard Durbin, and Ron Wyden in April 2019, the Working Families Tax Relief Act would expand the EITC by changing both the eligibility rules and the amounts of the credits. In addition, it would make the Child Tax Credit (CTC) fully refundable and create a Young Child Tax Credit (YCTC) for children under age 6. The bill would expand the age limits for eligibility for the EITC for childless workers from 25 to 64 to 19 to 67. Further, this proposal would increase the maximum EITC for families with children by up to 25 percent (the exact amount depends on family size) and quadruple the benefit for workers without children.[22] The bill would also increase the phase-in and phase-out rates and raise the maximum income limits for eligibility for the credit. According to a microsimulation produced by ITEP, this proposal would lead to an $1,510 average decrease in tax liability for the poorest 20 percent of New Jersey residents (with incomes of less than $24,300) and a $560 average decrease for the second poorest 20 percent (those earning $24,300 to $43,500).[23]

LIFT the Middle Class Act

Introduced by Senator Kamala Harris, the LIFT the Middle Class Act would create a new credit that would operate alongside the EITC. The new credit is designed to match a taxpayer’s earnings, providing up to $3,000 per worker ($6,000 for a married couple). In addition, this credit would consider income from Pell grants, a need-based form of financial aid for college students. Because the credit does not take family size into account and drops the minimum age requirement for all workers to 18, all childless workers would see considerable increases in tax credits under this proposal.

States Leading the Way on EITC Expansion: Addressing Gaps in Federal EITC

Since 1986, New Jersey and 28 other states as well as the District of Columbia, Puerto Rico, and some municipalities have created an EITC to supplement the federal credit. State EITCs largely mirror federal criteria and are calculated as a percentage of the federal credit. For example, in a state where the EITC is calculated at 40 percent of the federal credit, an EITC beneficiary who is eligible for a $100 federal credit would also be eligible for a $40 state EITC, for a combined total of $140. Additionally, all but 6 state EITCs are refundable, meaning that a tax filer can receive a refund for the amount by which the credit exceeds their federal income tax liability. The percentage of the federal EITC varies considerably among states.[24] Further, several state EITCs deviate from other aspects of the federal EITC, including maximum credit amounts and eligibility criteria.

Many jurisdictions have recently taken steps to address the limitations of the EITC by making targeted changes to eligibility rules. In 2014, the District of Columbia, for example, was the first jurisdiction to extend the EITC to workers without qualifying children. Further, Washington D.C. increased the match for workers without children from 40 percent to 100 percent. In addition, D.C. increased the income limit of its EITC beyond the federal cap.[25] As a result, the D.C. EITC provided a boost for 26.8 percent more workers, most of which has been attributed to 12,940 new applicants without children—9,507 of which were ineligible for the federal EITC.[26]

In 2017, Minnesota expanded eligibility for its state EITC by reducing the minimum age for childless workers without qualifying children from 25 to 21. Other states have also extended the credit to specific groups that would not otherwise benefit from this program, including New York, which provides the EITC to non-custodial parents, and Massachusetts, where survivors of domestic violence who are separated from a spouse are eligible to receive the credit.[27]

Most recently, Maryland and California expanded eligibility beyond the federal EITC’s rules, as well. In 2018, Maryland eliminated the minimum age requirement for its state EITC, which was previously set at 25.[28] This eligibility change is expected to extend the credit to an estimated 40,000 more workers.[29] Also in 2018, California expanded the program to childless workers between the ages of 18 and 24 and over the age of 64. The legislation that led to these changes also included measures to expand the state’s EITC to immigrant workers with ITINs; however, this proposal was rejected during budget negotiations.[30] In addition, in 2017, California increased its income cap, allowing people working full-time at the minimum wage to be eligible for the credit.

New Jersey’s EITC Has Improved, But Prior Expansions Continue to Leave Young and Childless Workers Behind

In 2000, New Jersey enacted a state EITC. In order to be eligible for the state EITC, applicants must meet the eligibility requirements of the federal EITC and file both a federal tax form and state income tax return. The amount of the state EITC that a taxpayer can claim, which is currently calculated as a percentage of the federal EITC, has undergone several changes during the last two decades. After remaining at 20 percent for several years, the state EITC percentage of the federal EITC increased to 22.5 percent in tax year 2008, and to 25 percent in 2009.

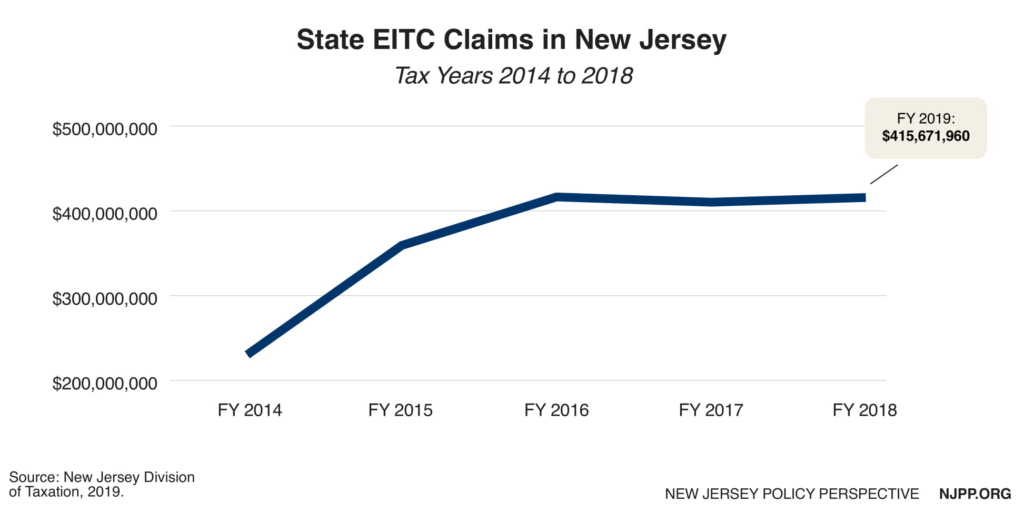

In 2011, the New Jersey EITC was reduced from 25 percent to 20 percent of the federal credit. Despite attempts to increase the EITC, the credit was not restored until Fiscal Year (FY) 2015,[31] when it was increased to 30 percent of the federal amount. In 2016, alongside a gas tax increase for New Jersey’s Transportation Trust Fund, the state EITC was increased to 35 percent of the federal credit. Most recently, legislation was enacted in 2018 that increased the state’s EITC from 35 percent to 40 percent over the course of three years (37 percent in tax year 2018, 39 percent in tax year 2019, and 40 percent in tax year 2020 and thereafter) and that added a new Child and Dependent Care Credit.[32]

Current Impact

Each year, New Jersey’s EITC infuses hundreds of thousands of dollars into local economies by putting cash in the hands of workers struggling to meet basic needs. This helps lift thousands of families out of poverty and eases the challenges faced by families still in poverty. Under the state EITC’s current structure, the program has helped over 510,000 workers and their families and added $415.7 million to the state’s economy in 2018 alone. Passaic, Hudson, and Essex counties had the highest number and amount of approved EITC claims in 2018.

Many New Jersey Workers Are Left Still Behind

As noted above, the EITC has been one of the most successful anti-poverty programs in the U.S., helping lift millions of people and their families out of poverty while injecting billions of dollars into local economies.[33] Due to the fact that people of color often face barriers to reliable employment with sufficient wages, they also make up a significant share of residents who qualify for the EITC. As such, the EITC is a critical tool to combating income inequality and racial inequities, which benefits all New Jerseyans. Considering the positive impacts, it is important to expand the benefits of this credit to all of New Jersey’s low-wage workers – especially childless workers.

While the EITC has benefited Garden State residents, and the incremental increases in the amount of the credit have strengthened its impact, several groups continue to be excluded from this program. Due to the current eligibility requirements, low- and moderate-income childless workers are left behind. Like the federal EITC, workers under 25, who do not claim a child as a dependent, only benefit if they have exceedingly low-income, and those that do claim a child receive a disproportionately smaller benefit. Further, workers under 25 and over 64, who do not claim children as dependents, are ineligible for any EITC credit. By removing arbitrary age restrictions for childless workers, New Jersey could expand access to the EITC to provide a more stable foundation for young people entering the workforce.

New Jersey Can Expand and Strengthen Its EITC to Provide an Important Boost for Workers and Economies

There are several mechanisms for increasing the impact of New Jersey’s EITC. The following recommendations can be used in combination with one another to improve the impact and scope of the state EITC. Unless otherwise noted, the estimates included in this section were produced by ITEP using their Microsimulation Tax Model, which is based on tax year 2015 tax returns and other data.[34]

Recommendation #1: Lower the minimum age for the childless New Jersey EITC from 25 to 18

Under the current state rules that provide workers with 40 percent of the federal EITC amount, reducing the minimum age threshold for workers, who are not raising children at home, from 25 to 18 would benefit approximately 137,199 additional young New Jersey workers and add an estimated $17 million to state and local economies. For this newly eligible population, the average credit, which could be used for basic necessities, like clothing or transportation for work, would be $121.

While expanding eligibility for the state EITC would provide an important boost for young workers beginning their careers, the amount of the credit would remain modest under current EITC rules. By both lowering the minimum age and increasing the state EITC amount for young childless workers from 40 percent to 100 percent of the amount they would receive if they were eligible for the federal credit (see Recommendation #2), the credit could have a more meaningful impact on young people. At 100 percent of the federal rate, funds added to state and local economies would increase to an estimated $42 million, and the average credit for young childless workers would be $304.

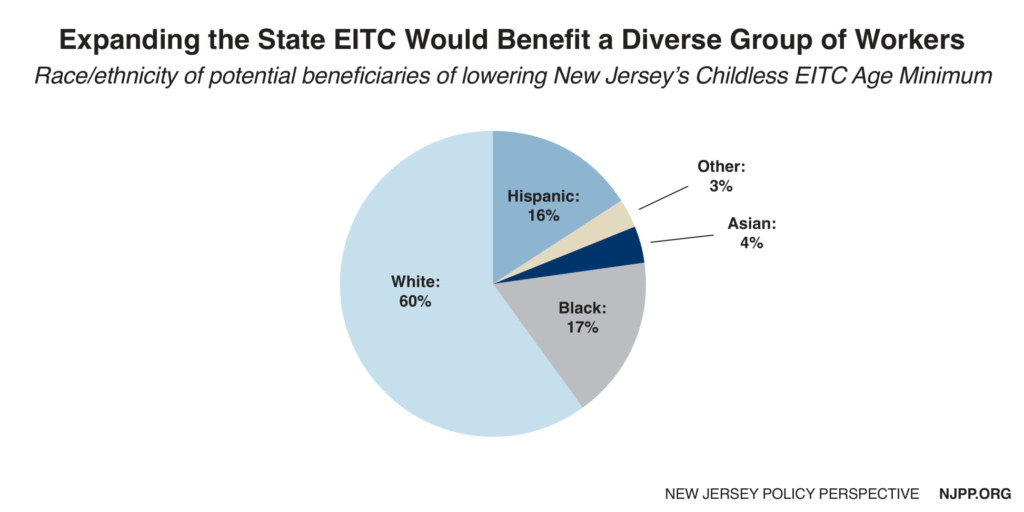

Similar amounts of young men and women would benefit from this eligibility expansion, with men (51.6 percent), representing a slightly larger proportion of the new beneficiaries than women (48.5 percent). Additionally, compared to the New Jersey population, newly eligible Non-Hispanic White, Non-Hispanic Black and African American, and multiracial workers would make up a slightly larger amount of the newly eligible population, while Asians and Hispanics would make up a smaller amount of the potential beneficiaries.

Lowering the minimum age for the childless EITC would infuse money into under-resourced areas with high poverty rates and high populations of young people. Over one-third of the newly eligible population of beneficiaries reside in four counties – Camden (9.7 percent of the potential beneficiaries), Essex (9.5 percent), Middlesex (9.0 percent), and Ocean (8.4 percent). Relative to each county’s total population, Warren (1.66 percent), Gloucester (1.63 percent), and Mercer (1.59 percent) counties had the highest percentage of potential beneficiaries.

Recommendation #2: Increase the New Jersey EITC for childless workers from 40% of 100%

Even those childless workers struggling to meet basic needs who are currently eligible for the EITC under existing rules are only entitled to a small credit. Increasing the percentage of the federal credit for childless workers who are currently eligible for the state EITC from 40 percent to 100 percent (under existing rules) would benefit an estimated 142,310 workers between the ages of 25 and 64 and add $24 million to state and local economies. At 100 percent of the federal credit, childless workers, who are currently eligible for the EITC, would see an average increase of $166 in their EITC.

Recommendation #3: Increase the income threshold for workers without qualifying children from $15,570 to $25,000

Under current EITC eligibility rules, workers without qualifying children lose the benefit after earning more than $15,570. Raising the income threshold to $25,000 for childless workers would allow more hardworking New Jersey residents with low-wages to benefit from this program. Extending the maximum income cap to $25,000 by increasing the phase-out starting point, for example, while expanding eligibility rules to include young workers ages 18 to 24 (as in Recommendation #1) and increasing EITC amount to 100 percent for all childless workers of the federal credit (as in Recommendation #2) would benefit an estimated 408,207 childless workers and add $156 million to New Jersey’s economies.)

New Jersey Residents Need a Stronger EITC

Expanding the EITC can help increase the program’s parity and support many workers struggling to meet basic needs; however, the credit excludes many New Jerseyans. The EITC’s attachment to earned income, for example, leaves out taxpayers who are unable to participate in the formal economy, including some people with disabilities and those who serve as unpaid caregivers. A more robust set of mechanisms to promote equity that extends beyond the paradigm of paid labor is needed. Moreover, the EITC’s restrictions on immigration status excludes noncitizens and mixed-status families from benefiting from the credit.

While targeted expansions of the EITC to reach these groups would certainly provide an important boost for other low-income workers and families, New Jersey will need more than a stronger EITC to address the systemic causes of poverty. The Garden State can and should do more to ensure that all residents are equipped with the resources needed to live with financial security and dignity.

Appendix

Appendix A: Demographic Breakdown – Methodology

The demographic estimates included in this report were produced by using the 2017 American Community Survey (ACS) to evaluate the impact of lowering the minimum EITC eligibility age for workers without qualifying children from 25 to 18. In order to estimate the size and sociodemographic characteristics of the population that would benefit from this targeted expansion, ACS microdata were used as a proxy for eligibility criteria for the New Jersey EITC.

The methodology for the demographic estimates updated and built upon the target group analysis approach employed in the Closing the Gap: Expanding the Earned Income Tax Credit to Younger, Childless Workers in New Jersey,[35] which employed ACS 2016 data. In addition, distinct choices around variables used to estimate dependency status to more closely reflect EITC eligibility parameters. While household type was used to exclude all family households in Closing the Gap, for example, the present report used more narrow exclusion parameters to isolate only individuals who are likely to be claimed as a dependent by another taxpayer. Further details on the variable selection process are provided below.

Data Source

The American Community Survey is an ongoing, monthly survey that is used to produce population and housing estimates each year. This analysis employed ACS 2017 microdata, which were extracted and downloaded from Integrated Public Use Microdata Series (IPUMS USA) online data extraction tool.[36] The IPUMS sample included both household- and person- level records. IPUMS USA samples are unweighted, and the sample size for the ACS 2017 dataset for New Jersey residents is 88,114. In order to obtain representative statistics, person-level sample weights (variable “perwt”) were applied. The ACS response rate for housing units in New Jersey in 2017 was 88.4%.[37]

While the ACS provides rich information about New Jersey’s population, there are also several limitations to this dataset. As the ACS is a survey that consists of self-reported data rather than tax filing information, it is subject to error. In addition, because this study employed the ACS 2017 dataset, the results suggest the impact of extending the credit if it had been in effect in 2017 and therefore do not account for economic and demographic changes that have since taken place. Finally, while the ACS contains information on several personal and household characteristics, not all EITC eligibility criteria have corresponding variables in this dataset. A detailed explanation of the selection and limitations of each variable used in this analysis is provided in the following section.

Eligibility Parameters and Target Group Creation

In order to be eligible to receive the EITC, tax filers without qualifying children must meet several criteria related to residency, age, income, marital status, immigration status, and family relations. Variables related to each of these criteria were combined to create a target group representing an estimate of the population that would become eligible if the New Jersey EITC were expanded to include workers without qualifying children between the ages of 18 and 24. An overview of the measures of these characteristics employed in this study and any recoding of these variables is provided below.

Residence. The ACS2017 household variable “statefip” was used to limit the IPUMS data extraction to households in New Jersey (FIPS code 24).

Age. The ACS 2017 dataset included a continuous variable for age ranging from 1 to 95. As workers without qualifying children between the ages of 25 to 64 are currently eligible, and this study sought to estimate the impact on two potential expansion groups (childless workers 18 to 20 and 18 to 24), age was recoded into categorical variable (age5cat).

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| age | Age5cat | ||

| 0 to 17 | 1 Under 18” | 1,976,538 | 21.95 |

| 18 to 20 | 2 “18 – 20” | 337,134 | 3.74 |

| 21 to 24 | 3 “21 – 24” | 449,174 | 4.99 |

| 24 to 64 | 4 “25 – 64” | 4,827,300 | 53.60 |

| 65 to 95 | 5 “65 and Older” | 1,415,498 | 15.72 |

Immigration Status. While the EITC eligibility criteria allow filers who are either U.S. Citizens or resident aliens all year, the ACS 2017 only captures citizenship status and does indicate whether or not a respondent is a resident alien. For this analysis, all non-citizens are treated as ineligible, likely resulting in an underestimate of eligible immigrants.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| Citizen | cit2cat | ||

| 0 “N/A (Born in the US)” | 1 “Citizen” | 6,879,510 | 76.39 |

| 1 “Born abroad of American parents” | 1 “Citizen” | 77,181 | 0.86 |

| 2 “Naturalized Citizen” | 1 “Citizen” | 1,135,086 | 12.60 |

| 3 “Not a citizen” | 0 “Not a citizen” | 913,867 | 10.15 |

Marital Status. The ACS 2017 person-level data includes the marital status of respondents; however, it does not include tax filing status information. For this target group analysis, respondents that are never married/single, widowed, or divorced are assumed to be single for tax filing purposes. Respondents that are married with a spouse present are assumed to be married and filing jointly. Respondents that are either separated or are married with a spouse absent are treated as married and filing separately, and therefore ineligible for the EITC.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| Marst | Marst3cat | ||

| 1 “Married, spouse present” | 1 “Married, likely filing jointly” | 3,463,260 | 38.46 |

| 2 “Married, spouse absent” 3 “Separated” | 2 “Married, likely filing separately” | 309,945 | 3.44 |

| 4 “Divorced” 5 “Widowed” 6 “Never married/single” | 0 “Not married” | 5,232,439 | 58.10 |

Investment Income. The EITC eligibility criteria require that the investment income of filers be less than $3500. The ACS 2017 person variable incinvst (range: -2100 to 24700), which measures income from an estate or trust, interest, dividends, royalties, and rents received, was recoded to reflect this cap. Households with $3500 or less in investment income was marked as eligible, while households with $3501 or more in investment income were marked as ineligible. Respondents under 15 are coded as missing.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| incinvst | Incinvst_3500 | ||

| -2100 (min) to 3500 | 1 “Eligible – $3500 or less” | 448,296 | 4.98 |

| $3501 to 247000 (max) | 0 “Ineligible -$3501 or more” | 6,929,598 | 76.95 |

| 999999 | .i “N/A – under 15” | 1,627,750 | 18.07 |

Earned Income. As EITC filers are required to have earned income, respondents without earned income were excluded from this analysis using the 7-digit numeric variable “incearn”, which records respondents’ self-reported income earned from wages or a person’s own business or farm for the previous year.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| incearn | incearn2cat | ||

| -6300 (min) to 1 (max) | 0 “Ineligible – no personal earned income” | 4,103,220 | 45.56 |

| 1 to 1025000 (max) | 1 “Eligible – has personal earned income” | 4,902,424 | 54.44 |

Personal Income. For unmarried individuals, the variable inctot, which captures respondents’ pre-tax personal income or losses from all sources for the previous year was used to create a dichotomous variable for income eligibility. As the maximum adjusted gross income for single tax filers is $15,270, individuals earning more than this amount were considered ineligible in the target group analysis.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| inctot | inc0child | ||

| -6300 (min) to $15,270 | 1 “Eligible – $15,270 or less” | 2,609,153 | 28.97 |

| 15271/1272000 (max) | 0 – “Ineligible – $1571 or more” | 4,768,741 | 52.95 |

| 999999 | .i. “N/A – under 15 years” | 1,627,750 | 18.07 |

Total Family Income. For married individuals assumed to be filing jointly, the variable ftotinc, which captures the total pre-tax money income earned by one’s family (as defined by family unit) from all sources for the previous year, was used to create a dichotomous variable for income eligibility. As the maximum adjusted gross income for single tax filers is $15,270, individuals earning more than this amount were treated as ineligible in the target group analysis.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| ftotinc | faminc0child | ||

| -6300 (min) to 20950 | 1 “Eligible – $20,950 or less” | 1,003,393 | 11.14 |

| 20951 to 1684500 (max) | 0 – “Ineligible – $20,951 or more” | 7,811,460 | 86.74 |

| 999999 | .i. “N/A” | 190,791 | 2.12 |

Qualifying Child Status. In order to be eligible for the New Jersey EITC, tax filers must not be claimed as a dependent or qualifying child of another person. Tax filers may be claimed as another person’s qualifying child until the age of 19 if they are not a student, and until the age of 24 if they are a student. Accordingly, three variables were combined to create a composite measure of whether or not a respondent was likely to be a qualifying child or dependent of another person. Respondents were coded as possible qualifying children of other tax filers if they indicated that were either 1) under 19; and the child, sibling, or grandchild of the head of household, or under 2) under 25; a student, and the child, sibling, or grandchild of the head of household. Respondents that were identified and possible qualifying children were treated as ineligible for the EITC in this analysis.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| Relate | Qualchild | ||

| 3 “Child” 7 “Sibling“ 9 “Grandchild” AND age <=19, OR age <=25 AND in school | 1 “Ineligible – Could be a Qualifying Child/Sibling/Grandchild” | 2,286,485 | 25.39 |

| 1 “Head/Householder”; 2 “Spouse”; 4 “Child-in-law”; 5 “Parent”; 6 “Parent-in-Law”; 8 “Sibling-in-Law”; 10 “Other relatives”; 11 “Partner, friend, visitor”; 12 “Other non-relatives” OR if age >= 20 AND not in school |

0 “Eligible – Likely Not a Qualifying Child” | 6,624,630 | 73.56 |

| 13 “Institutional inmates” | 2 “Ineligible – Institutional Inmates” | 94,529 | 1.05 |

Number of Qualifying Children. The ACS 2017 household variable “number of related children in household under 18” The number of related children in the household was used as a proxy for qualifying children. Any respondents living with related children under 18 were excluded from the target group analysis. As the ACS does not capture which household member claims qualifying children, it is likely that the number of people without qualifying children is underestimated.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| us2017a_nrc | numrelchild | ||

| 0 | 0 | 4,389,570 | 48.74 |

| 1 | 1 “1 Child” | 1,607,720 | 17.85 |

| 2 | 2 “2 children” | 1,721,873 | 19.12 |

| 3 to 18 | 3 “3 or more children” | 1,103,408 | 12.25 |

| BB | .i “N/A (Group Quarters or Vacant)” | 183,073 | 2.03 |

Sociodemographic Measures and Descriptive Statistics

After establishing the parameters for the target group, the following variables were employed to examine the characteristics of the newly eligible population.

| Original Variable | New Variable | N (Weighted) | % (Weighted) |

| Sex | N/A | ||

| 1. Male | – | 4,398,062 | 48.84 |

| 2. Female | – | 4,607,582 | 51.16 |

| County | |||

| 0. Not Identifiable | – | 579,997 | 6.44 |

| 3. Bergen | – | 948,558 | 10.53 |

| 5. Burlington | – | 448,537 | 4.98 |

| 7. Camden | – | 511,228 | 5.68 |

| 13. Essex | – | 808,506 | 8.98 |

| 15. Gloucester | – | 292,408 | 3.25 |

| 17. Hudson | – | 691,893 | 7.68 |

| 19. Hunterdon | – | 124,745 | 1.39 |

| 21. Mercer | – | 374,077 | 4.15 |

| 23. Middlesex | – | 841,893 | 9.35 |

| 27. Morris | – | 499,306 | 5.54 |

| 29. Ocean | – | 597,268 | 6.63 |

| 31. Passaic | – | 511,844 | 5.68 |

| 35. Somerset | – | 335,557 | 3.73 |

| 37. Sussex | – | 141,896 | 1.58 |

| 39. Union | – | 564,008 | 6.26 |

| 41. Warren | – | 107,349 | 1.19 |

| Race/Ethnicity (composite of two variables, race and Hispanic origin (hispan) | |||

| Race = 1 “White”; hispan = 0 “Not Hispanic” | 1. Non-Hispanic White | 4,939,554 | 54.85 |

| Race = 2 “Black/African American/Negro” hispan = 0 “Not Hispanic” | 2. Non-Hispanic Black or African American | 1,146,813 | 12.73 |

| Race = 4 “Chinese”, 5 “Japanese”, or 6 “Other Asian OR Pacific Islander” hispan = 0 “Not Hispanic” | 3. Non-Hispanic Asian | 879,384 | 9.76 |

| Race = 3 “American Indian or Alaska Native” hispan = 0 “Not Hispanic” | 4. Non-Hispanic American Indian or Alaska Native | 9,339 | 0.10 |

| Hispan = 1 “Mexican”, 2 “Puerto Rican”, 3 “Cuban”, or 4 “Other” | 5. Hispanic/Latino, any race | 1,840,591 | 20.44 |

| Race = 7 “Other Race” hispan = 0 “Not Hispanic” | 6. NH Other Race | 37,124 | 0.41 |

| Race = 8 “Two or more races” or 9 “Three or more major races” hispan = 0 “Not Hispanic” | 7. NH Two or More Races | 152,839 | 1.70 |

Appendix B: Demographic Breakdown – Tables

Due to data availability limitations, the demographic estimates were generated using ACS 2017 data and the total impact and cost estimates were produced using ITEP’s Microsimulation tax model. Because the two analyses are based on different data sets with unique sampling frames and assumptions related to eligibility criteria, the total number of potential beneficiaries in demographic breakdown differs from the estimates generated by ITEP’s Microsimulation Tax Model. Further information on the methodology used to produce demographic estimates is available in Appendix A. Further information on ITEP’s methodology is available here: https://itep.org/itep-tax-model-simple/.

Potential Beneficiaries of Lowering Age Limit for Childless EITC to 18 in New Jersey

| County | Total Pop (Weighted) | Total Pop % (Weighted) | Total Number of Potential Beneficiaries (18 to 24, Childless) (Weighted) | Potential beneficiaries in county among total beneficiaries | Potential beneficiaries in county among total county population |

| Not Identifiable | 579,997 | 6.44 | 5,011 | 6.1% | 0.86% |

| Bergen | 948,558 | 10.53 | 4,578 | 5.6% | 0.48% |

| Burlington | 448,537 | 4.98 | 3,673 | 4.5% | 0.82% |

| Camden | 511,228 | 5.68 | 8,013 | 9.7% | 1.57% |

| Essex | 808,506 | 8.98 | 7,839 | 9.5% | 0.97% |

| Gloucester | 292,408 | 3.25 | 4,757 | 5.8% | 1.63% |

| Hudson | 691,893 | 7.68 | 5,550 | 6.7% | 0.80% |

| Hunterdon | 124,745 | 1.39 | 588 | 0.7% | 0.47% |

| Mercer | 374,077 | 4.15 | 5,930 | 7.2% | 1.59% |

| Middlesex | 841,893 | 9.35 | 7,384 | 9.0% | 0.88% |

| Monmouth | 626,574 | 6.96 | 5,041 | 6.1% | 0.80% |

| Morris | 499,306 | 5.54 | 3,002 | 3.7% | 0.60% |

| Ocean | 597,268 | 6.63 | 6,916 | 8.4% | 1.16% |

| Passaic | 511,844 | 5.68 | 4,004 | 4.9% | 0.78% |

| Somerset | 335,557 | 3.73 | 2,234 | 2.7% | 0.67% |

| Sussex | 141,896 | 1.58 | 849 | 1.0% | 0.60% |

| Union | 564,008 | 6.26 | 5,080 | 6.2% | 0.90% |

| Warren | 107,349 | 1.19 | 1,785 | 2.2% | 1.66% |

Source: NJPP Analysis of ACS 2017 Data

Note: Atlantic, Cape May, Cumberland and Salem counties are not included because they are not identified in the IPUMS USA sample. Because these counties are not identified in public use microdata, they are grouped together in the “Not Identifiable” category at the top of the table.

Potential Beneficiaries of Lowering Childless New Jersey EITC Age Limit to 18 by Race/Ethnicity

| Race/Ethnicity | Number of Potential Beneficiaries | Percentage of Potential Beneficiaries |

| NH White | 49,566 | 60% |

| NH Black or African American | 13,791 | 17% |

| NH Asian | 3,535 | 4% |

| NH American Indian/Alaska Native | 0 | 0% |

| Hispanic/Latino, any race | 12,661 | 15% |

| NH Other Race or Multiple Races | 2,681 | 3% |

Source: NJPP Analysis of ACS 2017 Data

Appendix C: New Jersey EITC Claims by County, Number and Amount

EITC Claims Approved In New Jersey Counties in Tax Year 2018

| County | Number of Claims | Amount of Claims |

| ATLANTIC COUNTY | 26,718 | $23,296,892 |

| BERGEN COUNTY | 37,145 | $26,033,256 |

| BURLINGTON COUNTY | 19,401 | $14,334,688 |

| CAMDEN COUNTY | 36,763 | $31,462,183 |

| CAPE MAY COUNTY | 5,882 | $4,468,061 |

| CUMBERLAND COUNTY | 12,814 | $11,437,603 |

| ESSEX COUNTY | 65,257 | $56,755,829 |

| GLOUCESTER COUNTY | 13,658 | $10,408,981 |

| HUDSON COUNTY | 54,324 | $46,272,607 |

| HUNTERDON COUNTY | 3,084 | $1,868,004 |

| MERCER COUNTY | 21,757 | $18,050,397 |

| MIDDLESEX COUNTY | 43,418 | $34,576,149 |

| MONMOUTH COUNTY | 23,029 | $16,303,291 |

| MORRIS COUNTY | 13,465 | $8,704,800 |

| OCEAN COUNTY | 27,998 | $23,611,984 |

| PASSAIC COUNTY | 46,138 | $41,697,797 |

| SALEM COUNTY | 4,072 | $3,417,477 |

| SOMERSET COUNTY | 10,079 | $7,099,285 |

| SUSSEX COUNTY | 5,107 | $3,207,105 |

| UNION COUNTY | 35,693 | $29,050,432 |

| WARREN COUNTY | 4,853 | $3,615,139 |

Source: NJPP Analysis of New Jersey Treasury Data

End Notes

[1] Tax Policy Center (2019). Key Elements of the U.S. Tax System. https://www.taxpolicycenter.org/briefing-book/what-earned-income-tax-credit

[2] Center of Budget and Policy Priorities (2019).). How the Federal Tax Code Can Better Advance Racial Equity. https://www.cbpp.org/research/federal-tax/how-the-federal-tax-code-can-better-advance-racial-equity

[3] NJPP analysis of data from the New Jersey Division of Taxation (2019).

[4] Center on Budget and Policy Priorities (2019). Policy Basics: The Earned Income Tax Credit. https://www.cbpp.org/research/federal-tax/policy-basics-the-earned-income-tax-credit

[5] Crandall-Hollick, Margot L. (2018). The Earned Income Tax Credit (EITC): A Brief Legislative History. Congressional Research Service. https://fas.org/sgp/crs/misc/R44825.pdf

[6] National Conference of State Legislatures (2019). Tax Credits for Working Families: Earned Income Tax Credit (EITC). Retrieved from http://www.ncsl.org/research/labor-and-employment/earned-income-tax-credits-for-working-families.aspx; Statistics for Tax Returns with EITC (2019) Retrieved from https://www.eitc.irs.gov/eitc-central/statistics-for-tax-returns-with-eitc/statistics-for-tax-returns-with-eitc

[7] IRS (2019). Statistics for Tax Returns with EITC. https://www.eitc.irs.gov/eitc-central/statistics-for-tax-returns-with-eitc/statistics-for-tax-returns-with-eitc

[8] Ibid 1.

[9] A complete list of the current federal EITC requirements can be found here: IRS (2019). Publication 596, Earned Income Credit. Retrieved from https://www.irs.gov/forms-pubs/about-publication-596

[10] IRS (2018). EITC Income Limits, Maximum Credit Amounts and Tax Law Updates. https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/eitc-income-limits-maximum-credit-amounts

[11] Marr, Chuck, C. Huan, C.Murray, and A. Sherman (2016). Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty Improvement Targeted at Lone Group Taxed into Poverty. https://www.cbpp.org/sites/default/files/atoms/files/4-11-16tax.pdf

[12] IRS (2019). 2019 EITC Income Limits, Maximum Credit Amounts and Tax Law Updates https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/eitc-income-limits-maximum-credit-amounts-next-year.

[13] IRS (2019). Publication 596, Earned Income Credit. Retrieved from https://www.irs.gov/forms-pubs/about-publication-596

[14] Meyer, Bruce (2010). The Effects of the Earned Income Tax Credit and Recent Reforms. Tax Policy and the Economy 2010 24:1, 153-180. https://www-journals-uchicago-edu.proxy.libraries.rutgers.edu/doi/full/10.1086/649831

[15] Brand, J., Friscia, E., Lleras, A., Patel, A., Robinson, Y., Williams, R. (2018). Millennials In New Jersey: Migratory Patterns and Public Opinion. https://www.njpp.org/wp-content/uploads/2018/09/Embargoed-NJPP-Practicum-Millennial-MIgration.pdf

[16] ITEP (2019). Understanding Five Major Federal Tax Credit Proposals. Retrieved from https://itep.org/wp-content/uploads/052219-Understanding-Five-Major-Federal-Tax-Credit-Proposals_ITEP.pdf

[17] Marr, Chuck et al. (2019). Working Families Tax Relief Act Would Raise Incomes of 46 Million Households, Reduce Child Poverty. https://www.cbpp.org/sites/default/files/atoms/files/4-10-19tax.pdf

[18] Ibid.

[19] S.4 – LIFT (Livable Incomes for Families Today) the Middle Class Act. https://www.congress.gov/bill/116th-congress/senate-bill/4/text?q=%7B%22search%22%3A%5B%22lift+the+middle+class+act%22%5D%7D&r=1&s=3

[20] H.R.1431 – Cost-of-Living Refund Act of 2019 https://www.congress.gov/bill/116th-congress/house-bill/1431/text; S.527 – Cost-of-Living Refund Act of 2019 https://www.congress.gov/bill/116th-congress/senate-bill/527

[21] ITEP (2019). Cost-of-Living Refund Act. https://itep.org/cost-of-living-refund-act/; Tax Policy Institute (2019). Analyst of the Cost-of-Living Refund Act of 2019. https://taxfoundation.org/cost-of-living-refund-act-2019-analysis/

[22] ITEP (2019). Working Families Tax Relief Act. https://itep.org/working-families-tax-relief-act/

[23] Ibid.

[24] Urban Institute (2019). State Earned Income Tax Credits. https://www.urban.org/policy-centers/cross-center-initiatives/state-and-local-finance-initiative/state-and-local-backgrounders/state-earned-income-tax-credits

[25] Muhammad, Daniel (2019). The 2015 Expansion of the District of Columbia Earned Income Tax Credit for Childless Workers. https://cfo.dc.gov/sites/default/files/dc/sites/ocfo/publication/attachments/DC%20Childless%20EITC%20020619.pdf

[26] Ibid 12.

[27] Center on Budget and Policy Priorities (2019). States Can Adopt or Expand Earned Income Tax Credits to Build a Stronger Future Economy. https://www.cbpp.org/research/state-budget-and-tax/states-can-adopt-or-expand-earned-income-tax-credits-to-build-a#_ftn6

[28] Maryland Center on Economic Policy (2018). 2018 Legislation Largely Improved Maryland’s Tax Code. https://www.mdeconomy.org/2018-legislation-largely-improved-marylands-tax-code/

[29] Tax Credits for Workers and Their Families (2018). Maryland Expands EITC to Younger Workers. http://www.taxcreditsforworkersandfamilies.org/news/maryland-expands-eitc-to-younger-workers/

[30] Center for Budget and Policy Priorities (2019). States Can Adopt or Expand Earned Income Tax Credits to Build a Stronger Future Economy. https://www.cbpp.org/research/state-budget-and-tax/states-can-adopt-or-expand-earned-income-tax-credits-to-build-a

[31] New Jersey Department of the Treasury. Tax Expenditure Reports (Fiscal Years 2012-2015). https://www.state.nj.us/treasury/taxation/taxexpenditurereport.shtml

[32] NJ Division of Taxation. New Gross Income Tax Legislation Makes Changes for Tax Year 2018 (P.L. 2018, c.45)”. https://www.state.nj.us/treasury/taxation/grossincometax.shtml

[33] Center of Budget and Policy Priorities (2019).). How the Federal Tax Code Can Better Advance Racial Equity. https://www.cbpp.org/research/federal-tax/how-the-federal-tax-code-can-better-advance-racial-equity

[34] ITEP Microsimulation Tax Model Overview (2019). https://itep.org/itep-tax-model-simple/

[35] Arteta, G., Daly, R., Howes, A., Idowu, F., Rosenbaum, W., Sekuler, C. (2019). Closing the Gap: Expanding the Earned Income Tax Credit. https://bloustein.rutgers.edu/wp-content/uploads/2019/10/2019-Closing-the-Gap.pdf

[36] Steven Ruggles, Sarah Flood, Ronald Goeken, Josiah Grover, Erin Meyer, Jose Pacas, and Matthew Sobek. IPUMS USA: Version 9.0 [dataset]. Minneapolis, MN: IPUMS, 2019. https://doi.org/10.18128/D010.V9.0

[37] U.S. Census Bureau. American Community Survey Response Rates: New Jersey. https://www.census.gov/acs/www/methodology/sample-size-and-data-quality/response-rates/index.php