The Earned Income Tax Credit (EITC) is a proven policy that helps workers who are not being paid enough to better afford their daily needs. In New Jersey, the over half million families that benefit from the federal credit are also able to get a state credit, receiving an important boost during tax time to the tune of $811 a year on average. Even that modest amount is crucial to help struggling working families in our high-cost state; and New Jersey should be commended for being a national leader for its state EITC contribution.

The Christie administration’s recent efforts to clamp down on “fraud” in the program, however, are leaving more and more people in limbo, preventing them from receiving their tax refund in a timely manner – refunds that many families rely heavily upon to take care of bills, repairs, and basic needs. And these delays couldn’t come at a worse time, as the Garden State continues to battle with stubbornly high poverty rates that endanger the health and prosperity of everyone,.

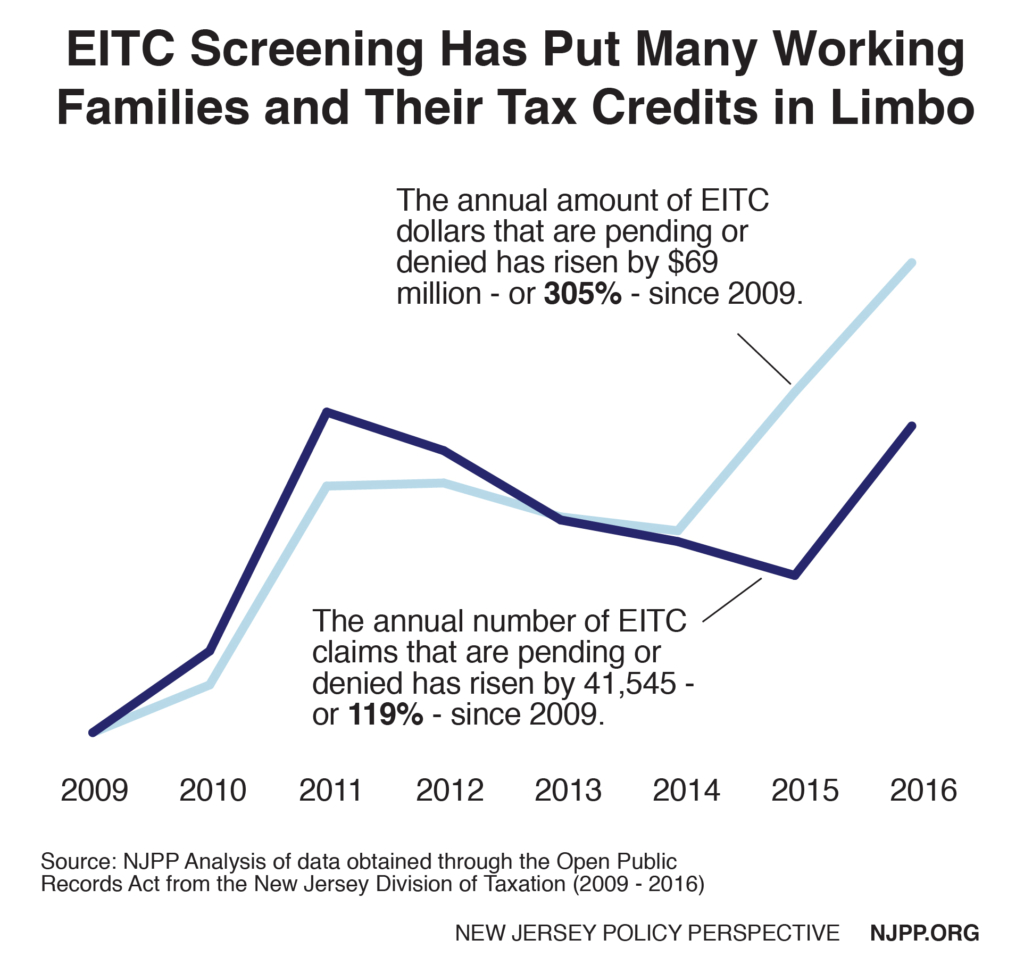

Since the state began its “enhanced screening” process in 2011, the tax refunds of hundreds of thousands of low-income working families have been significantly delayed or denied. In fact, this policy has caused the average number of taxpayers with pending or denied EITC claims to nearly double, rising to an average of 85,690 a year (2011-2016) from 44,232 (2009-2010) – and it’s caused the total average annual amount of EITC dollars pending or denied to increase by 147 percent, to about $65 million a year (2011-2016) from about $26 million a year (2009-2010).

In the meantime, real New Jerseyans are suffering as they go without vital refunds that they rely upon to afford important needs. The rate of true poverty – 200 percent of the federal poverty level, or about $48,700 for a family of four in 2016 – in New Jersey has remained stubbornly high for the past several years, measuring higher than 23 percent since 2010 and hitting 23.7 percent in 2016. As the state’s economy has slowly recovered from the Great Recession, too many working-class New Jerseyans are being left behind. Launching a punitive – and misguided – policy that prevents these families from receiving important tax refunds in the middle of a poverty crisis is severely harmful.

In the meantime, real New Jerseyans are suffering as they go without vital refunds that they rely upon to afford important needs. The rate of true poverty – 200 percent of the federal poverty level, or about $48,700 for a family of four in 2016 – in New Jersey has remained stubbornly high for the past several years, measuring higher than 23 percent since 2010 and hitting 23.7 percent in 2016. As the state’s economy has slowly recovered from the Great Recession, too many working-class New Jerseyans are being left behind. Launching a punitive – and misguided – policy that prevents these families from receiving important tax refunds in the middle of a poverty crisis is severely harmful.

State officials have justified this change by citing the error rate of the EITC – the IRS estimates between 22 and 26 percent of EITC filings contain errors – but there are better, less draconian ways to deal with this issue.

The IRS itself refers to this problem as an “improper payment rate” rather than “fraud,” because most filing errors are unintentional, not malicious. Enacting error-reduction proposals approved by the federal Treasury Department – such as simplifying the rules around who can apply and working with commercial providers to reduce errors in the returns they submit – would do more to reduce the numbers of false claims than targeting taxpayers. In short, the state should take every step possible to mitigate the error rate without putting low-income residents in limbo.

Over the course of the past several years, the Garden State has experienced worsening economic inequality, stubbornly high poverty, stagnant household income and frustratingly slow job growth when compared to our neighbors and the nation. To withhold over $90 million in total from the state’s most vulnerable families at such a time is seriously damaging. New Jerseyans deserve a government that can efficiently process tax returns so they can receive their refunds in a timely manner and address pressing economic issues in their lives. The state needs to determine and implement a plan that will end this situation before more vulnerable New Jerseyans are harmed even further.