To read a PDF version of this report, click here.

New Jersey’s fiscal year 2019 budget, the first of Governor Murphy’s administration, signaled a much-needed reversal after nearly a decade of austere fiscal policy. After years of neglect, assets critical to New Jersey’s economic success, like K-12 schools, public transit, and county colleges all received modest increases in state funding. However, this year’s budget falls short in one key area that has plagued the state and its finances for three decades: there are simply not enough stable, long-term sources of new revenue to sustain these increased investments. Failing to implement adequate revenue streams is a missed opportunity that will make it more difficult for the state to meet its current and future obligations, including public employee pensions, corporate tax subsidy payouts, and payments to bondholders and debt service. This year’s budget could have – and should have – marked a new era for New Jersey’s finances, but it ended up kicking the proverbial can even farther down State Street and makes next year’s budget an even more dramatic test.

There’s one glaring difference between this year and next: in 2018, the elected officials participating in the budget process did not have to worry about a June primary or November general election. In 2019, every member of the General Assembly wanting to remain will be focused on re-election and less interested in making tough decisions to fund important investments. Instead, they’ll likely hope that the temporary hike in corporate tax rates (the most unpredictable and variable of the major taxes), accompanied by new taxes on ridesharing services, e-cigarettes, and what appears to be a surprisingly low tax rate on the proposed legalization of marijuana, will be adequate to meet New Jersey’s neglected needs. Revenue collections for the FY 2019 budget were above target in September, but lawmakers should not assume or rely upon such robust returns in the future.

Now that the dust has settled on New Jersey’s FY 2019 budget debate, one thing is certain: there is a lot more cleaning up to do. Though this year’s budget is the largest dollar amount ever, it is still a budget stretched thin. Many departments are making do with yet another year of flat funding and, even with the slightly increased budget surplus, New Jersey is still in no position to withstand another recession or extreme weather event like Hurricane Sandy. The state cannot afford to build another budget based on political convenience. There is simply too much at stake.

First the good news.

New Jersey’s FY 2019 budget is the most progressive document to come out of the state house in a decade. Despite significant compromises on funding sources, most of the policy initiatives championed by Governor Murphy during his gubernatorial campaign remain intact, and many of the progressive priorities of the legislature received support.

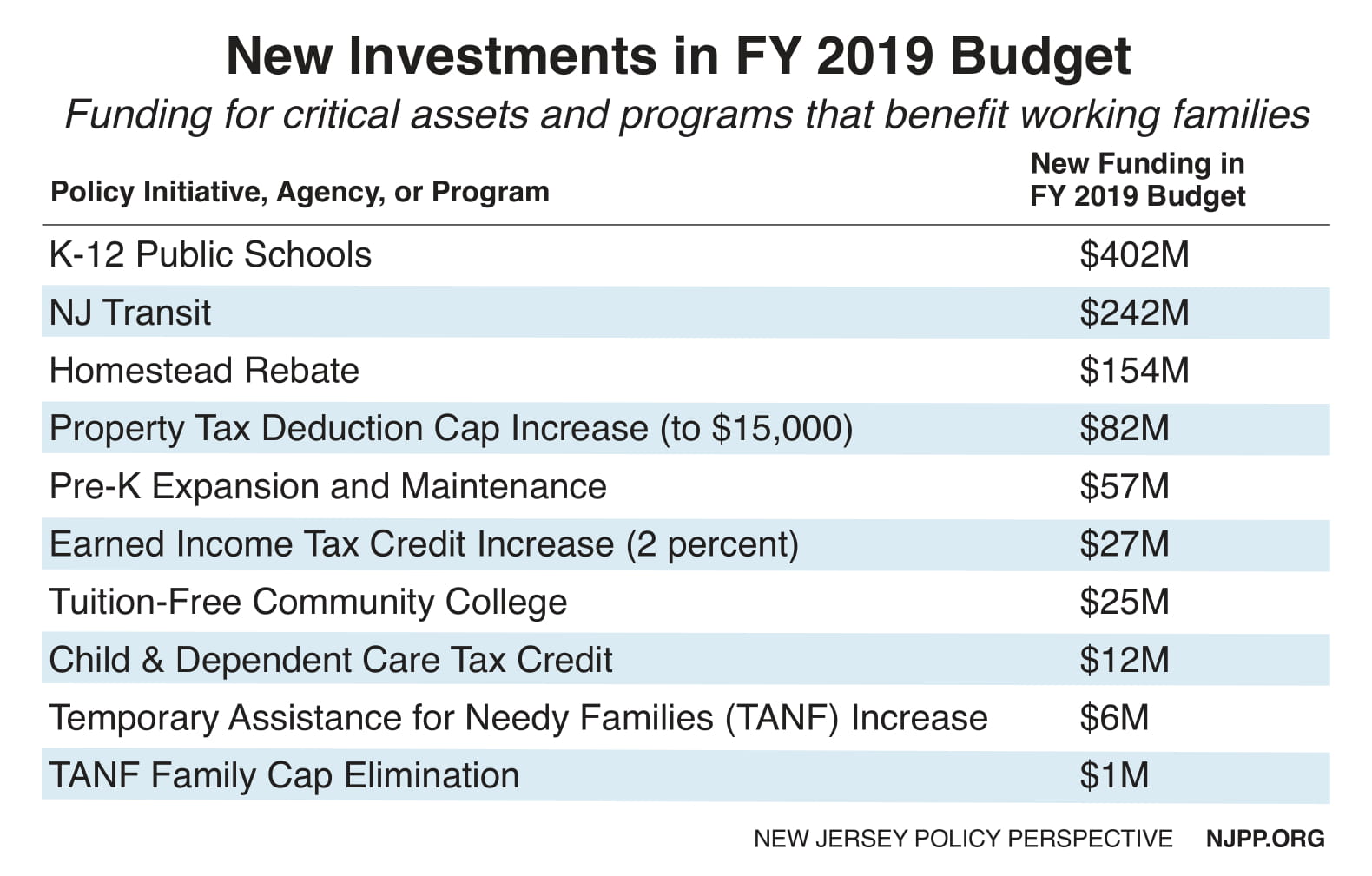

These top priorities include overdue investments into state assets that are proven to help economies grow. After years of financial neglect and passing operating costs onto commuters, New Jersey Transit got a boost of $242 million earmarked to improve services and the reputation of the state-run transportation network. New Jersey’s K-12 public schools received a $402 million increase in funding, and a noticeable overhaul of the school funding formula will help update how districts receive state assistance in response to changing demographics. By shifting additional funds to historically under-funded districts, New Jersey can support one of its most important assets – and the state’s children – in a more equitable way.

This year’s budget also acknowledges the importance of investing in New Jersey families by embracing progressive policies that lift up young children, young adults and working parents struggling to make ends meet. It includes an overdue expansion of pre-K education with an $57 million investment to enhance preschool programs for more than 4,000 3- and 4-year olds in qualifying districts.

For those entering college, there’s $27 million for a new tuition-free community college program, removing barriers to higher education for students in low-income households. Additionally, over 500,000 low-income workers will see the first of three annual increases in their Earned Income Tax Credit (EITC), one of the best policy tools for lifting families out of poverty. And approximately 70,000 New Jersey families who make below $60,000 are now eligible for a new tax credit to help offset the cost of child and dependent care, an enormous expense for working parents.

For those families who are struggling the most acutely, New Jersey has finally increased funding for its cash assistance program for the first time in 31 years. The program also dropped the punitive family cap provision, an outdated deterrent that only served to punish Temporary Assistance for Needy Families (TANF) recipients for having children while receiving cash assistance.

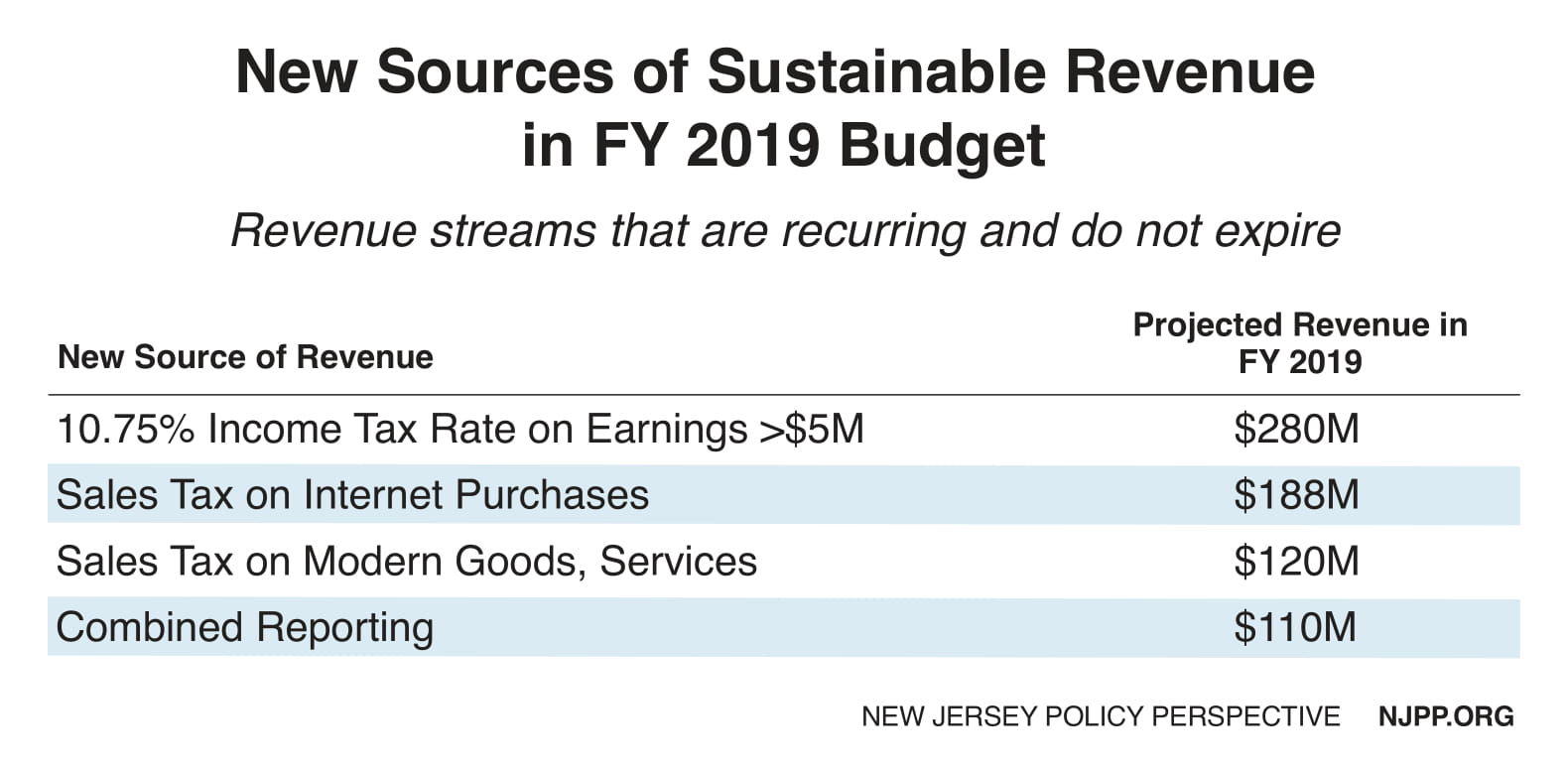

These investments were made possible with over $1.5 billion in additional revenue from a variety of new sources, including: a new 10.75 percent tax on multimillionaire income over $5 million (raising $280 million), a temporary corporate tax surcharge averaging 2 percent over the next four years ($425 million), expanding the sales tax to include internet purchases ($188 million), and a one-time general tax amnesty initiative ($200 million). A variety of new revenue streams, including new taxes on e-cigarettes, short-term housing rentals, and ride-sharing services, were also included in the budget, raising an additional $120 million. And a new rule that closes corporate tax loopholes will boost corporate business tax revenue by at least $110 million.

On the surface, these new revenue sources are an essential ingredient of Governor Murphy’s progressive vision. For example, in an era of runaway income inequality a new tax bracket on New Jersey’s earners with $5 million and more in annual income is long overdue. With $280 million more in income tax revenue, the state can provide a slight increase to its property tax relief programs which suffered in recent years from repeated cuts and delayed payments. Closing loopholes that multi-state corporations use to avoid taxation evens the playing field for all businesses operating in New Jersey. And a last-minute U.S. Supreme Court decision finally opens the door to taxing internet purchases made by New Jersey shoppers in other states, further modernizing the tax code. But because this funding package was built on a foundation of political horse-trading and compromise, it simply doesn’t have the durability and strength to help the state rebuild its key assets and invest in long-term initiatives.

Here’s why.

First, the new revenue sources lack the kind of long-term sustainability that New Jersey needs to face its neglected, underfunded obligations while also investing in assets and programs that support economic growth. To move away from instability and meaningfully combat inequality, New Jersey must think beyond temporary taxation and one-shot gimmicks.

Take, for example, the new income tax bracket of 10.75 percent on household earnings over $5 million. This new tax is much narrower in scope than the original proposal, which would have applied to households earning over $1 million and would have raised $765 million a year. The final policy spared approximately 31,000 wealthy households from a state income tax increase, even though these same households were just gifted unexpected federal tax breaks from Republicans in Congress on top of making outsized income gains since the end of the Great Recession.

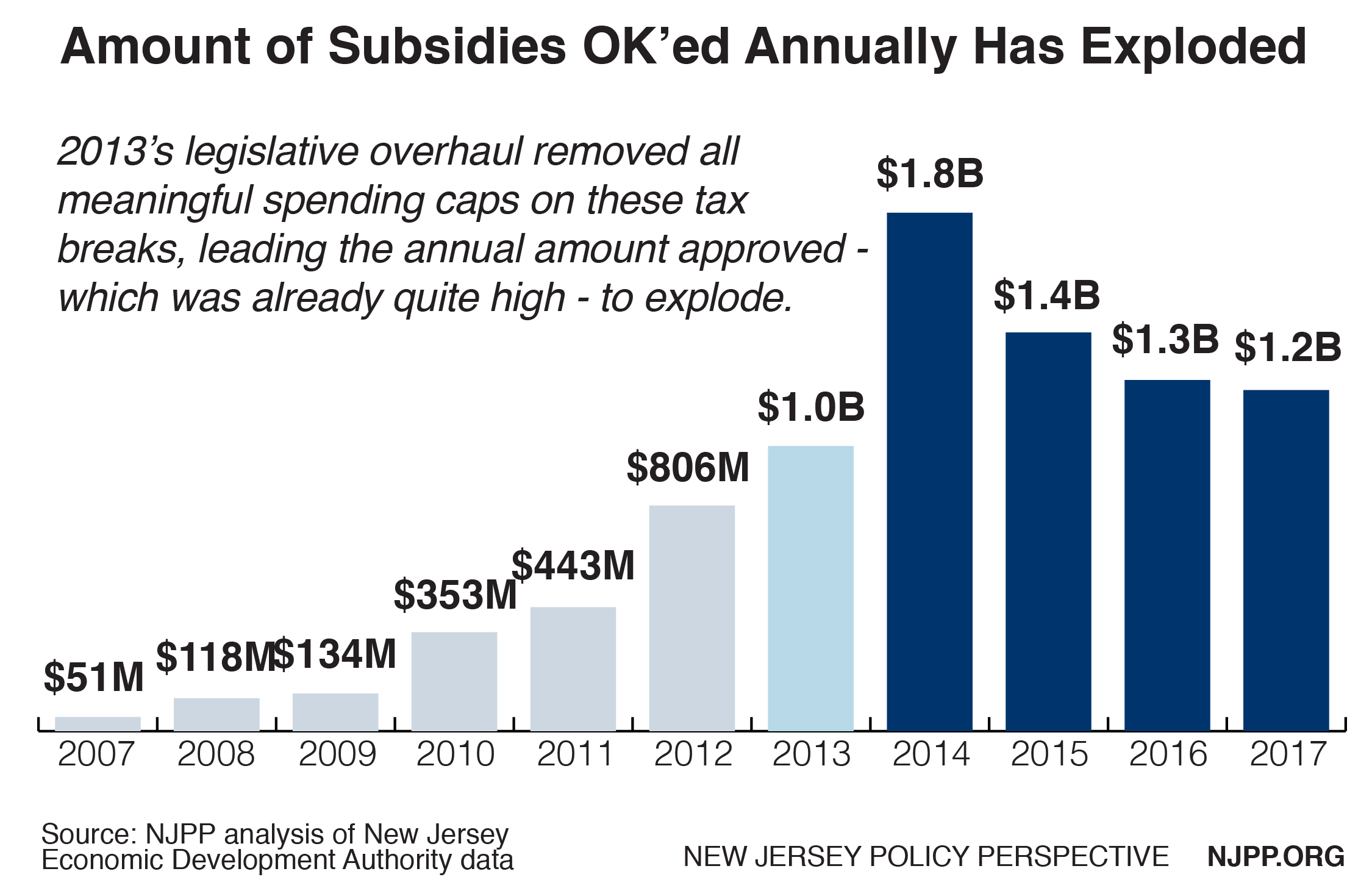

The budget claims to address the generous federal tax breaks given to large corporations with an average two percentage point corporate business tax surcharge at the state level. The new tax is expected to raise $425 million the first year, improving the state’s ability to adequately fund the kinds of things that all businesses operating in the Garden State depend on: an educated workforce, public safety, and reliable transportation networks. But the tax policy has one fatal flaw – the surcharge expires in 4 years, opening the state to another large budget hole at precisely the moment New Jersey will begin paying off its flamboyant corporate tax subsidy program to the tune of $1 billion a year.

The rest of the budget’s new revenue sources consist of one-offs like the tax amnesty initiative and a mixed bag of smaller “sin” taxes on e-cigarettes, recreational marijuana and sports betting. These sources may bring in millions but, in the grand scheme of things, they are barely noticeable given New Jersey’s financial woes.

Major tax policy decisions made over the course of three decades contributed to this situation. To regain the stature of a state committed to paying for its obligations and fostering a fair and prosperous economic future, New Jersey must embrace meaningful and bold tax reform beyond short-term housing rentals and online sports betting.

Missed opportunities.

New Jersey could easily begin steering the ship back to safer waters by modernizing the state sales tax, a critical source for funding higher education, health care, public safety and other important public services that a thriving state economy requires. The state needs to both broaden the tax base to include more services, especially those used by higher income households, and return the sales tax rate to 7 percent. That gimmicky reduction passed in 2016 put an undetectable amount of extra cash into the pockets of most New Jersey working families. In exchange, it left an enormous hole in the state’s budget. The cost of the cut is about $600 million a year and is expected to reach $735 million by 2026.

For decades, New Jersey helped to close the wealth gap by levying both an estate tax and an inheritance tax and investing the resulting revenue in important assets like NJ Transit, public colleges and health care initiatives that benefit everyone. Unfortunately, state legislators agreed to phase out New Jersey’s estate tax as part of the 2016 gas tax deal. That change, which affected just 4 percent of estates, now costs New Jersey about $500 million a year, handicapping the state’s ability to make crucial investments while further enriching the heirs of New Jersey’s wealthiest families. Eliminating this tax gave estates that are valued at more than $5 million an average tax break of $1.1 million. Then, just one year later, the GOP tax plan lifted the threshold of the federal estate tax from $11 million to $22 million. Decades of uneven income and wealth growth have put the wealthiest residents miles ahead of everyone else. Now the tax code has only made it worse.

By restoring the estate tax with a higher threshold, New Jersey could regain the lion’s share of estate tax revenue it has collected while ensuring that the wealthiest heirs pay their fair share at the state level. For example, reinstating the tax on estates worth more than $1 million would recoup 93 percent of the tax revenue. However, if New Jersey is to depend on the inheritance tax as its only source of taxation of inherited wealth, then policymakers should make it fairer and more adequate by expanding the types of heirs required to pay the tax and ensuring that only New Jersey’s wealthiest heirs pay the tax. Creating an exemption up to $1 million would keep this tax fair and help guard against the deepening trend of concentrated wealth.

Policymakers ought to level the playing field and allow small businesses a better chance of competing with larger companies while raising the revenue necessary to help the entire economy thrive – not just the shareholder set. And federal changes that have drastically cut corporate taxes mean that New Jersey needs to do even more to ensure that all businesses have a fair shot while preventing larger corporations from gaming the system. New Jersey lawmakers should get creative while at the same time taking a defensive stance against tax breaks that hurt the state’s ability to provide public services and make investments that actually help the economy grow.

First, rein in corporate subsidy programs. In the aftermath of the GOP tax law, New Jersey must seriously consider the repeal or reform of the 2011 business tax breaks, like restoring the minimum tax on large pass-through entities to offset the new federal tax credit. Finally, policymakers ought to enact a financial transaction tax. Taking these bold actions could raise over $300 million a year in new corporate business revenue, while relieving long-term budget pressures that will plague New Jersey for years to come if not addressed.

Strategically protecting and investing in assets is what drove New Jersey’s thriving economy for decades. But since the early 1990’s, that enterprising and stable environment has eroded as political leaders of both parties neglected to maintain those assets through fair and equitable taxation. Obviously one budget won’t fix this trend, but New Jersey’s economic and financial freefall can’t begin its reversal with a year-to-year band-aid approach either. It’s time to restore equity to the state’s tax code while raising the resources needed to invest in assets and opportunities that drive economic growth for all of New Jersey’s families and businesses.