To read a PDF version of this report, click here.

Strengthening New Jersey’s ability to compete in the 21st century economy requires updates to a sales tax code that was designed and implemented before the rise of online shopping and a service-oriented economy.

New Jersey can modernize its sales tax and raise revenue required to invest in public services by:

- Broadening the tax base to include more services

- Adopting a remote sales tax law

- Closing the online hotel tax loophole

- Repealing the yacht sales tax

- Last but not least, returning the tax rate to 7 percent

Like nearly all other states, New Jersey levies a sales tax on consumers purchasing goods and services at the retail level. The sales tax brings in more than $9 billion a year, making up a little over 25 percent of state revenues, making it a critical source for funding higher education, health care, public safety and other important public services required for a thriving state economy. About 20 percent of New Jersey’s sales tax revenue comes from non-residents.

Like nearly all other states, New Jersey levies a sales tax on consumers purchasing goods and services at the retail level. The sales tax brings in more than $9 billion a year, making up a little over 25 percent of state revenues, making it a critical source for funding higher education, health care, public safety and other important public services required for a thriving state economy. About 20 percent of New Jersey’s sales tax revenue comes from non-residents.

Examples of taxable items in New Jersey include cars, furniture and meals in restaurants. Taxable services include snow removal and lawn maintenance, auto repair and cable and internet services. Exempt from the sales tax are goods and services like groceries, clothing, certain professional services and real estate sales. Although New Jersey does not allow local governments to levy general sales taxes, there are a few exceptions in place to mostly help tourism thrive in a handful of shore towns and support economic development in Atlantic City.

The general sales tax is added as a percentage of the purchase price.[1] Sellers add the tax to the purchase price, collect the tax from the buyer at the time of sale and then periodically submit the revenue to the state treasury. The current rate is 6.625 percent, the fifth highest among states that levy a sales tax (California has the highest state-level rate, at 7.25 percent). But because other states permit municipalities to levy a local sales tax, New Jersey’s rate is actually lower than that of nearby metro areas. New York City’s combined sales tax rate, for example, is 8.875 percent. Philadelphia’s combined rate is 8 percent.

Because so many everyday items are taxed, just about everyone in the state pays the sales tax. But the sales tax is regressive, meaning that low-income shoppers spend a larger share of their income on the sales tax then everyone else. The bottom 20 percent of New Jersey families pay 5.5 percent of their average annual incomes to sales and excise taxes (this includes fuel taxes, which aren’t directly addressed in this report), while middle-income families pay 3.2 percent and the wealthiest 1 percent of families pay just 0.7 percent. However, keeping grocery items and clothing tax-free does help make New Jersey’s sales tax less regressive than other states’ sales taxes. In fact, the gap between the average share of income paid to sales and excise taxes by the bottom 20 percent of families and the top 1 percent in New Jersey is the 10th smallest of all states.

On the whole, the sales tax has been a reliable source of revenue for New Jersey, making up over 25 percent of New Jersey’s revenues in nearly every year since 2000 (with the exception of 2005 and 2006). But the 2016 cut to the sales tax will put a dent in collections. Lawmakers ought to reform New Jersey’s sales tax with three priorities in mind: modernizing it, making it fairer and ensuring it raises adequate revenue to spur public investments.

Broaden the Sales Tax to Include More Services

The nature of New Jersey’s economy has changed dramatically since the sales tax was first introduced in 1966. At that time, industries producing goods accounted for more than a third of the national gross domestic product (GDP). By 2016, the manufacturing sector was down to 18 percent of the economy, according to the federal Bureau of Economic Analysis. Meanwhile, the services industry grew from half of GDP to more than two-thirds during that same 50-year period.

Things like cell phones, internet, cable TV, health clubs, tanning salons and lawn maintenance are common services people pay for today that were not as widespread a few decades ago. As services become an ever-more important fixture of the state economy, policymakers ought to be taxing more of them.

The services subject to New Jersey’s sales tax were last updated in 2006. These changes a dozen years ago led to the taxation of services like computer software, floor covering installation, delivery charges, some landscaping services, storage units, health club memberships, tanning salons, massage services and tattoo parlors. At the time, the state estimated the sales tax reform would generate over $400 million in new annual revenue.[2] In its first year, it did just that, bringing in $427 million, a 5 percent increase in sales receipts.

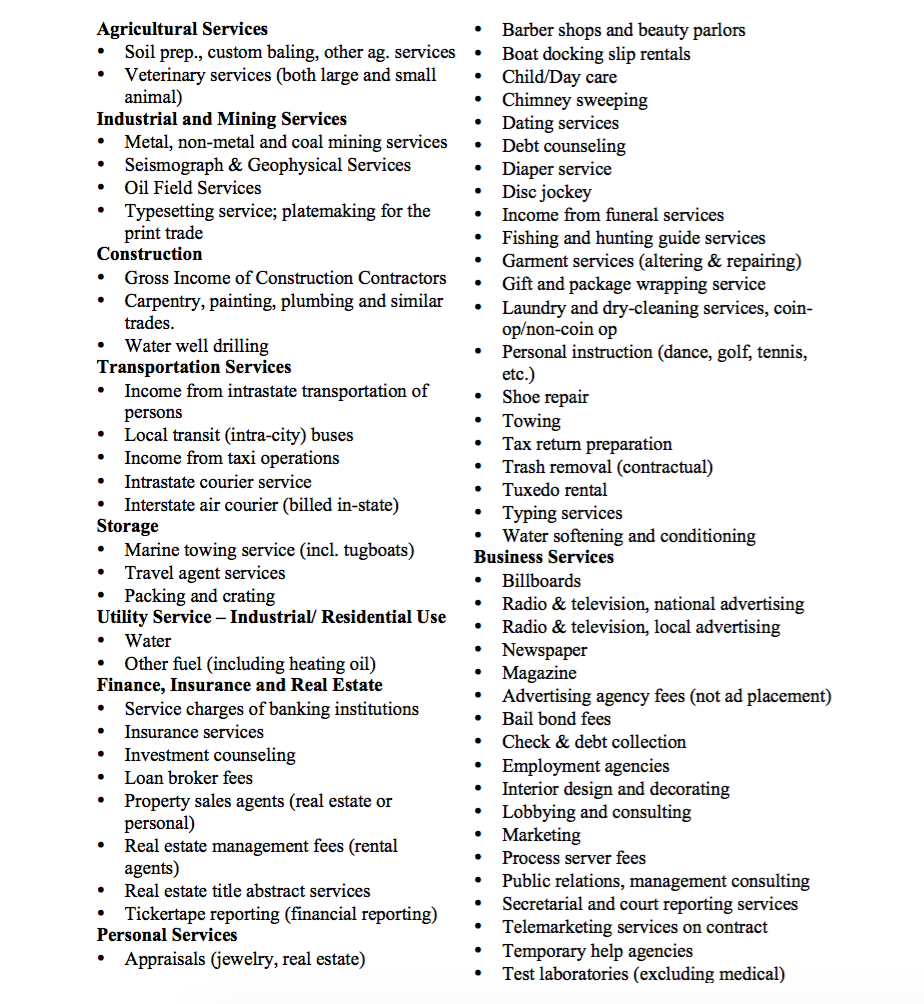

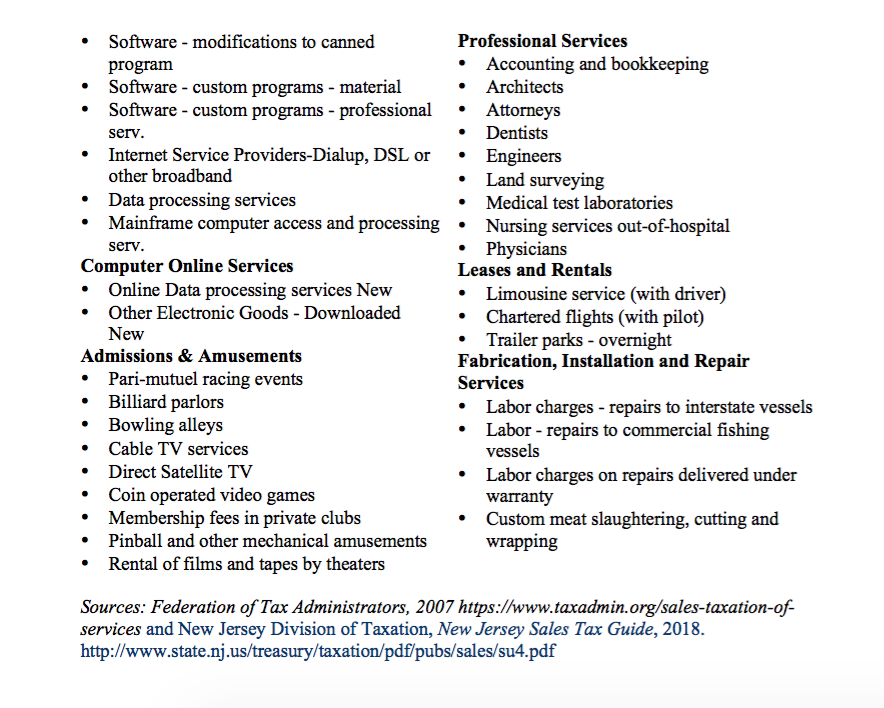

As services become an even larger part of household spending, New Jersey’s sales tax must adjust and adapt. The taxation of services also allows state policymakers to fold them into the sales tax code with a focus on high-end services to make the tax code fairer. These include professional services like accounting and bookkeeping and those provided by architects, attorneys and engineers as well as services that are predominantly utilized by upper-income households like investment counseling, interior decorating, private club membership fees, chartered flights, horse training and dry-cleaning services. (See Appendix for an expanded list of exempt services.) In addition, policymakers need to reverse course on legislation passed last year that dropped the sales tax on limousine services.

Levying sales taxes on more services would make New Jersey’s tax systems not only fairer but would help to create a more stable tax base over the long term and may help reduce the year-to-year volatility of sales tax collections. Finally, expanding the sales tax to include more services could generate a substantial amount of revenue to help the state maintain funding of important investments like higher education, public safety, mass transit and other vital services.

Adopt a Remote Sales Tax Law

In 2012 New Jersey negotiated an agreement with Amazon to force the online retail giant to collect sales tax from Garden State consumers. It was an important step, but more action on remote sales to New Jersey shoppers is needed.

Federal law prevents states from collecting sales tax from out-of-state retailers that don’t have a physical presence in the state. Nonetheless, online and catalog shoppers that live in states that charge a sales tax are still legally obligated to pay the tax on purchases directly to the state government. Most people, of course, are not aware of this obligation and many of those who are, willfully ignore the law. This lack of compliance, while common, undermines states’ ability to collect sales tax on internet, catalog and other remote sales and puts local businesses owners who must charge sales tax on every purchase at a severe disadvantage. Without the authority to require out-of-state sellers to collect and submit sales taxes, states have lost more than $10 billion in lost annual revenue to online shopping alone.[3]

A federal solution to this problem would be ideal, but without a federal fix there is one avenue that could empower New Jersey to collect sales tax on remote sales and protect local businesses from unfair competition. An innovative disclosure law enacted in Colorado in 2016 requires remote retailers to remind customers that they likely owe sales tax on their purchases.[4] It also requires remote retailers to report some purchaser information to the state which it can use to seek payment of unpaid taxes on “big-ticket” items.[5]

Specifically, the law requires that out-of-state sellers notify their customers on the online “shopping cart” summary page that they may owe sales tax on what they bought. The seller then must mail a statement to their customers each year with a summary of the dollar amounts and nature of their purchases made the previous year and a reminder of their sales tax obligations. Finally, a document listing each customer’s total annual dollar amount of purchases must be provided by the remote seller to the state revenue department. This notification allows the state to selectively collect owed sales tax from customers who made large online purchases.

A more comprehensive and efficient solution to taxing remote purchases would be federal legislation authorizing states to require all remote sellers to charge sales tax in exchange for a simplified sales tax code. But until that happens, New Jersey should do what it can to ensure that its online shoppers are paying their fair share of sales tax, giving small in-state businesses a level playing field and providing the revenue needed to fund vital services and invest in things like education, infrastructure and health care.

Close the Online Travel Loophole and Tax Airbnb Bookings

Right now online travel companies like Expedia, Orbitz and Priceline can avoid collecting all the applicable sales tax on hotel room bookings even though New Jersey collects the tax when travel agents or travelers themselves book the same room. This loophole is not uncommon and costs states between $275 million and $400 million in combined annual revenue.[6]

Here is how the loophole works: online travel companies do collect taxes on applicable sales and lodging taxes but only on the wholesale room rate they pay hotels for the right to rent the rooms, not the higher retail room rate they actually charge renters. They argue that this practice fulfills their tax collecting obligation. However, state routinely tax the full retail price charged to customers for other types of sales found on online travel websites.

To ensure that the full retail room charge is taxed when the room is booked online, New Jersey needs to modernize its law which was written before the advent of the online booking industry. Closing this loophole could generate between $8 million and $12 million more in annual sales tax revenue based on 2010 data.[7]

Similarly, short-term rental marketplaces like Airbnb should also be collecting sales tax. In 2016, over 6,000 New Jersey homeowners rented out rooms or homes on Airbnb to over a quarter of a million people, generating $50 million in income. Last year the legislature passed a bill to include a sales tax plus an occupancy tax to these informal online bookings. Despite support from the business community and Airbnb itself, Gov. Christie vetoed the bill. It was estimated that the bill would generate more than $6 million in sales tax revenue and help to level the playing field for New Jersey’s lodging industry.

Reverse the Tax Break for Yacht and Boat Buyers

In 2016, New Jersey cut the sales tax on boats and other vessels sold in the state in half and capped the sales tax on boats at $20,000 – meaning that buyers of the most expensive boats are receiving even larger tax breaks. For example, an 80-foot yacht in the $5 million range used to be subject to a $350,000 sales tax. That same luxury boat is now subject to just $20,000 in sales tax – a 94 percent tax cut. The special and unnecessary exemption for boaters is estimated to cost the state between $8 million and $15 million in annual revenue.[8]

At a time when the state has not increased funding for TANF for over 30 years, it certainly sends the wrong message to provide such tax breaks for those who need it the least. This 2015 sales tax cut should be reversed.

Return the Sales Tax Rate to 7 Percent

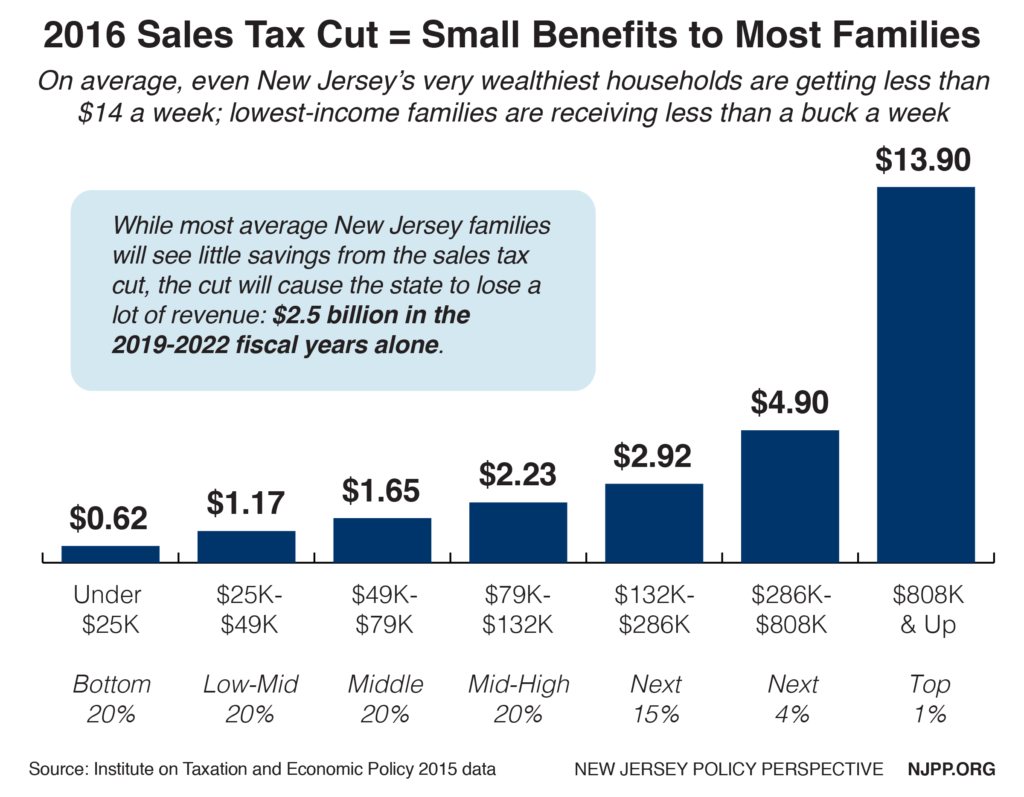

Last but not least, lawmakers need to reverse the gimmicky 2016 reduction in the sales tax rate, which has put very little extra cash in the pockets of most New Jersey working families but has blown a large hole in the state’s budget.

Under the tax cut, which was part of a larger deal to secure long-overdue transportation infrastructure funding, New Jersey’s sales tax dropped from 7 percent to 6.625 percent, where it stands today. The cost of this cut is about $600 million a year and growing (by 2026, for example, it’s expected to be $735 million).[9]

That kind of revenue loss is a huge blow to the state, but because the cost is spread across so many purchases and so many families, it barely registers in the pocketbooks of everyday New Jerseyans. Even the wealthiest 1 percent of families only save an average of $14 a week, while those in the bottom 20 percent earning less than $25,000 will see savings of less than a buck a week. New Jerseyans in the middle 20 percent (household incomes between $49,000 and $79,000) get an average tax cut of $1.65 a week.[10]

Appendix: Services Exempt from New Jersey Sales Tax

Endnotes

[1] New Jersey also levies an excise tax on specific items, including gasoline, alcohol and tobacco.

[2] Center on Budget and Policy Priorities, Expanding Sales Taxation of Services: Options and Issues, July 2009. https://www.cbpp.org/sites/default/files/atoms/files/8-10-09sfp.pdf

[3] Bruce, Fox and Luna in Center on Budget and Policy Priorities, States Should Adopt a Version of Colorado’s Remote Sales Tax Law, August 2017. https://www.cbpp.org/sites/default/files/atoms/files/8-3-17sfp.pdf

[4] Center on Budget and Policy Priorities, States Should Adopt a Version of Colorado’s Remote Sales Tax Law, August 2017. https://www.cbpp.org/sites/default/files/atoms/files/8-3-17sfp.pdf

[5] Only seven states (Alabama, Kentucky, Louisiana, Oklahoma, South Dakota, Vermont and Washington) have enacted some type of sales tax notification and reporting law. However, most are inferior to Colorado’s law and none are as comprehensive as the Multistate Tax Commission’s draft model law.

[6] Center on Budget and Policy Priorities, State and Local Governments Should Close Online Hotel Tax Loophole and Collect Taxes Owed, April 2011. https://www.cbpp.org/sites/default/files/atoms/files/4-12-11sfp.pdf

[7] Ibid at 7.

[8] Legislative Fiscal Note: http://www.njleg.state.nj.us/2014/Bills/S3000/2784_E1.PDF

[9] Legislative Fiscal Note: http://www.njleg.state.nj.us/2016/Bills/A0500/12_E3.PDF

[10] Analysis using Institute on Taxation and Economic Policy microsimulation, using 2016 incomes. The analysis is targeted to tax impacts for New Jersey residents only using an estimate that non-residents pay 20 percent of New Jersey sales taxes.