To read a PDF version of this report, click here.

The Earned Income Tax Credit – or EITC – is a critical tool that improves the lives of working families across New Jersey and the entire country. But it falls short in boosting incomes for low-wage working adults who aren’t raising children, because they are largely excluded from the credit. As a result, working adults without children are the lone group of Americans that the federal tax code taxes into – or deeper into – poverty.

Expanding the EITC for low-income workers without dependent children would raise their incomes and help offset the impact of other taxes they pay.[1] And in a high-cost state like New Jersey, which leads the nation in the share of 18 to 34 year olds living at home,[2] this EITC expansion would help promote greater economic mobility for young workers, which in turn would help boost the economy.

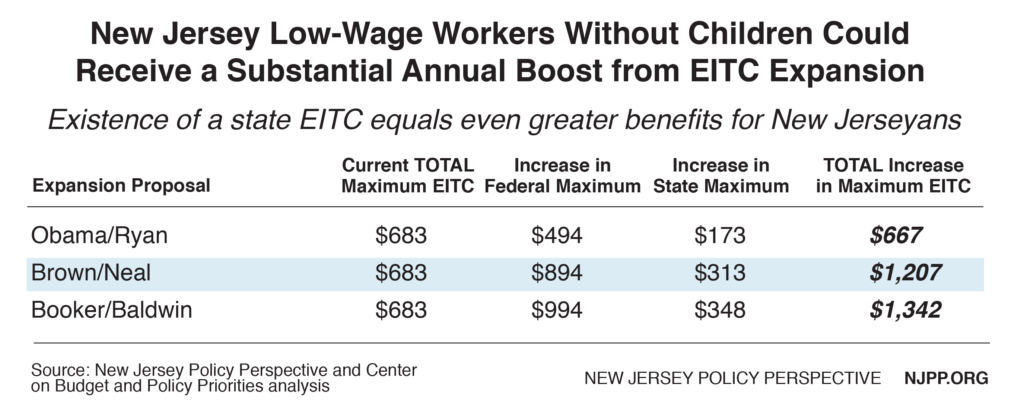

Thankfully, national leaders from both political parties agree that these workers shouldn’t be taxed into economic hardship, and they have plans to address it. President Obama and House Speaker Paul Ryan have put forth nearly identical proposals that would start a course correction by lowering the eligibility age for childless workers’ EITC to 21 from 25, and raising the maximum federal credit to roughly $1,000 from $506. This plan would help approximately 343,000 New Jersey workers, including 101,000 workers between the ages of 21 and 24 who would be eligible for the credit for the first time.[3]

Thankfully, national leaders from both political parties agree that these workers shouldn’t be taxed into economic hardship, and they have plans to address it. President Obama and House Speaker Paul Ryan have put forth nearly identical proposals that would start a course correction by lowering the eligibility age for childless workers’ EITC to 21 from 25, and raising the maximum federal credit to roughly $1,000 from $506. This plan would help approximately 343,000 New Jersey workers, including 101,000 workers between the ages of 21 and 24 who would be eligible for the credit for the first time.[3]

A separate plan proposed by Senate Finance Committee member Sherrod Brown and House Ways and Means Committee member Richard Neal is even more robust and would expand the credit for 425,000 New Jersey workers, including 122,000 workers between the ages of 21 and 24 who would be eligible for the credit for the first time. Under this plan, the age for eligibility would be lowered to 21 and the maximum credit would be raised to about $1,400.

More recently, Senators Cory Booker and Tammy Baldwin introduced their own plan that it is the most ambitious of the bunch. Just like the others, this plan would lower the age for eligibility to 21, but it would increase the maximum credit to a little over $1,500 as well as widen the income range at which workers are eligible to receive the maximum credit. Additionally, this plan would mirror the Obama proposal by extending eligibility to workers aged 65-66. Under this plan, 504,000 New Jersey workers would be helped, including at least 122,000 workers between the ages of 21 and 24 who would be eligible for the credit for the first time.[4]

Starting in tax year 2016, a qualifying New Jersey worker without children can receive up to $506 for the federal EITC and up to $177 for the New Jersey EITC.[5] The existence of a strong state EITC that piggybacks off the federal credit ensures that low-wage working New Jerseyans would receive an additional bang for the buck with any federal expansion.

The benefits of extending the EITC to childless workers go beyond helping low-income individuals and families afford more of their day-to-day needs. Decades of research on the EITC has shown improvements in health outcomes and increased employment for EITC recipients, and recent studies indicate that this expansion for workers not raising children could reduce crime and increase public safety.[6]

Just as research by the federal government projects that increasing the minimum wage to $12 by 2020 would reduce crime by 3 to 5 percent and yield national public savings of $8 billion to $17 billion,[7] recent studies have shown that extending the EITC to workers without dependent children would have similar effects. Implementing this policy would boost incomes for workers with criminal records as they take steps to re-enter the workforce, helping them get on their feet and reducing the likelihood that they will commit further crimes. Expanding the EITC could create an estimated national societal benefit of $1.7 billion to $3.3 billion by decreasing criminal offenses 0.5 percent to 1 percent each year, according to the Center for American Progress.[8]

Extending the EITC to younger workers with no children would have a particularly significant impact today. Across the nation, fewer young adults are even entering the labor force; labor-force participation among childless young adults with a high school education or less has plummeted by 12.5 percent in less than two decades – currently 3 of every 10 of these young adults aren’t in the labor force.[9]

And in New Jersey, nearly half of young adults between 18 and 34 years old live at home with their parents – more than in any other state – thanks to few job opportunities, low wages and the high cost of housing in the Garden State.[10]

Expanding the EITC would go a long way to helping more young adults enter the workforce, and – particularly when combined with other smart policies like raising the minimum wage – would help make work pay and encourage more young New Jerseyans to fully participate in the state’s economy.

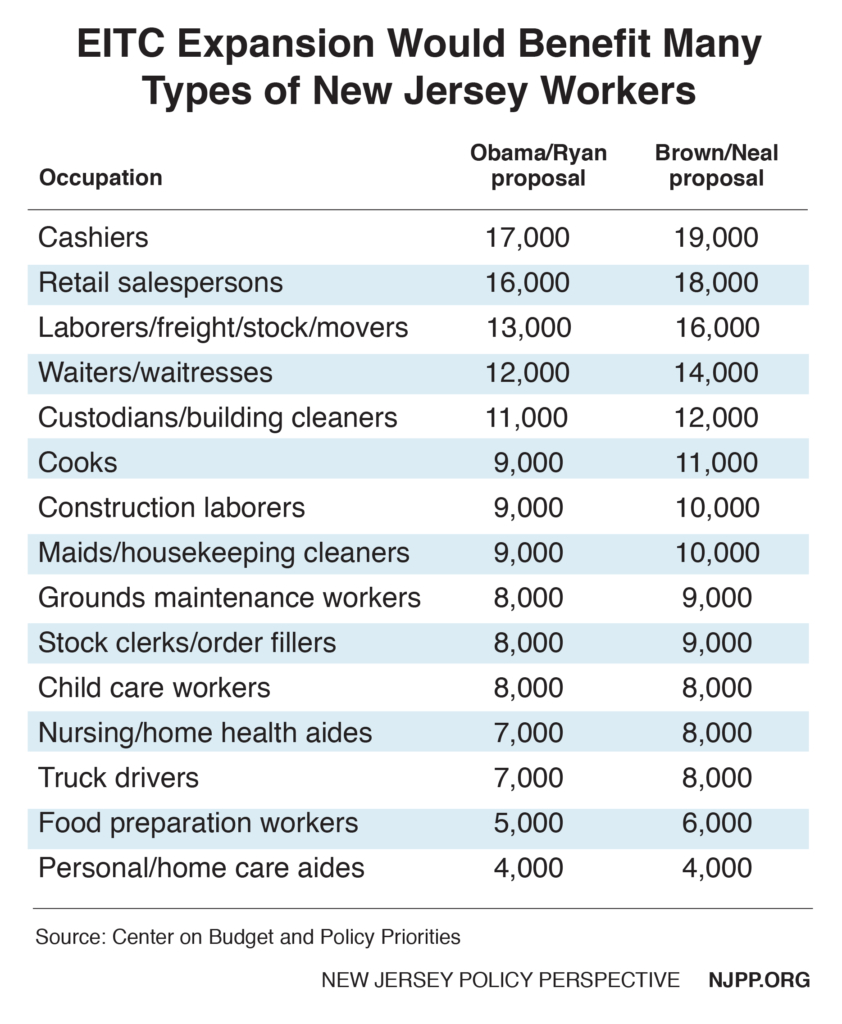

A Diverse Group of Workers Would Benefit from EITC Expansion

Proposals to extend the EITC to childless workers would reward the hard work of a broad swath of people in every state – young and older, male and female, and across all races – who do important low-paid jobs in hospitals, schools, office buildings, and construction sites. (See Appendix for full breakdown by occupation.)

In New Jersey alone, thousands of workers across different ethnic groups and vocations would benefit from an EITC expansion to childless workers.

In New Jersey alone, thousands of workers across different ethnic groups and vocations would benefit from an EITC expansion to childless workers.

Looking at the most modest expansion plan, the Obama/Ryan plan, at least 101,000 New Jerseyans between 21 and 24 years old would be helped. At least 57,000 African Americans, 113,000 Latinos, 145,000 Whites (Non-Hispanic), and 25,000 Asians of all ages would be helped. Additionally, at least 9,000 veterans and active duty military members would be helped by the Obama/Ryan EITC expansion. (Detailed demographic and occupational breakdowns are not currently available for the Booker/Baldwin proposal.)

If Congress Fails to Act, New Jersey Should Step Up

While the cleanest path forward to expand the EITC to these workers without children is at the federal level, if Congress fails to act, New Jersey should follow the lead of other states and consider implementing the EITC expansion at the state level.

In 2014, Washington, D.C. expanded its EITC for childless workers from those who make under $14,000 to those who make under $23,000. It also increased the maximum credit from about $200 to about $500.[11] In May of this year, the Minnesota legislature passed a bill that would have lowered the age of eligibility for childless workers from 25 to 21 and increased the size of the credit.[12] Earlier this year, both houses of the Maryland legislature were poised to pass bills that would have expanded the EITC, but ultimately failed to do so. The bills would have expanded Maryland’s eligible EITC from childless workers who make $11,000 or less to those who work full-time and earn $18,720 or less per year, and they would have also increased the amount of credit received.[13]

Whether it occurs at the federal or state level, expanding the EITC for younger workers without children would be a significant boost for hundreds of thousands of New Jerseyans, and the benefits would be felt for years to come.

Appendix: Number of Workers Helped, Selected Occupations

Endnotes

[1] Center on Budget and Policy Priorities, Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty, April 2016.

[2] New Jersey Policy Perspective, New Jersey’s Sluggish Recovery Hurting Working Families, September 2016.

[3] The Obama proposal would also extend eligibility to workers age 65-66, while the Ryan proposal would not.

[4] Ibid. 1

[5] The state Earned Income Tax Credit will rise to 35 percent under A-12, which was signed into law by Governor Christie on October 14, 2016.

[6] Ibid. 1

[7] White House Council of Economic Advisers, Economic Perspectives on Incarceration and the Criminal Justice System, April 2016.

[8] Center for American Progress, EITC Expansion for Childless Workers Would Save Billions – and Take a Bite Out of Crime, August 2016.

[9] Ibid. 1, Figure 4

[10] Ibid. 2

[11] DC Fiscal Policy Institute, District of Columbia’s Earned Income Tax Credit, August 2014.

[12] Minnesota Budget Project, 2016 Tax Bill Provisions Focus on Working Minnesotans, May 2016.

[13] Tax Justice Blog, Income Tax Cuts, Including Expanded EITC, Fail to Make It Across Finish Line in Maryland, April 2016.