Welcome to NJPP’s State of the State 2019: Rapid Reaction, your source for commentary and data analysis on Governor Murphy’s address. The transcript below was taken from a conversation in NJPP’s conference room and has been lightly edited.

Lou (Louis Di Paolo, Communications Director): In his first State of the State address, Governor Phil Murphy highlighted major initiatives signed into law over the last year and doubled down on his vision for a “stronger and fairer” New Jersey. From implementing paid sick days for over a million workers to providing equal access to financial aid for undocumented students, the governor outlined major policy victories in what he called a “productive year” with the Legislature.

He also spent a big portion of his speech on New Jersey’s economic subsidy programs. He opened by saying he was delivering a totally different speech from the one he planned on giving after reading the State Comptroller’s audit of the EDA. Did either of you expect the EDA audit to dominate the beginning of the governor’s speech?

Sheila (Sheila Reynertson, Senior Policy Analyst): No, but the timing was perfect. He took full advantage of the EDA audit to call out the state’s out of control tax subsidy programs. This line stood out to me:

This is about wasted money, phantom jobs, squandered opportunities, and misplaced priorities. This is about a failed status quo and a broken system.

It’s time to fix it and, together, we can. #StateoftheStateNJ

— Governor Phil Murphy (@GovMurphy) January 15, 2019

I see no lies here. New Jersey’s tax incentive programs operated without stringent oversight and left NJ taxpayers on the hook for $11 billion at a time they are constantly being told that there is not enough revenue to invest in higher education, mass transit and clean energy. I love that he put taxpayers front and center and called for putting caps on the amount of money the EDA gives out every year.

Brandon (Brandon McKoy, Director of Government Affairs): I definitely wasn’t expecting him to start out so strong on this issue out of the gate, but I’m glad he did. Getting right on subsidies is central to improving the state’s fiscal health, and it’s definitely something that the ratings agencies would like to see. For too many years New Jersey has been really irresponsible with these programs, and like Sheila says, voters are tired of hearing that we have tons of money available for already-wealthy and well-connected corporations but not enough to improve our schools or make major investments in NJ Transit. So thumbs up from me on the Gov talking about this issue so much today, it’s really important and he made that abundantly clear.

Lou: Fortunately, the state’s subsidy programs sunset at the end of the current fiscal year. Given the governor’s remarks, what do you think the future holds for the EDA? And what reforms have to happen to prevent another $11 billion from going out the door without proper oversight?

Sheila: Spending caps! This alone will be a great victory for accountability and oversight. I appreciated that the Governor’s remark about how there is a place for tax incentives to encourage businesses to invest in New Jersey, but in no way should they be the only strategy. I would have loved for him to connect more dots between the over-reliance on the tax incentives and the deep disinvestments to the proven tools that can help build a stronger economy: education, infrastructure and workforce development. Regardless, the reforms he highlighted are exactly the kind of fixes needed to rein in the program.

Brandon: I have nothing to add here. She covered it.

Lou: That’s why Sheila makes the big bucks. But let’s focus on those who aren’t. This is the first time I can remember a sitting governor mention poverty in their State of the State address. What are your thoughts, Brandon? And where do we go from here?

Brandon: Looks like someone read my twitter feed! Yeah, after the speech ended I just thought for a moment about how many times the governor actually *said* the word “poverty” and was kind of taken aback by it, but in a good way.

Also, for the record, @GovMurphy spoke extensively about #poverty in NJ, particularly when compared to his predecessor. That’s really refreshing to see because at the end of the day poverty is the biggest threat to so many of our shared goals. Good speech. #NJSOTS19

— Brandon J. McKoy (@Brandon_McKoy) January 15, 2019

It might sound silly, but I can’t tell you how many economic outlook presentation or fiscal analysis meetings I’ve been in where poverty isn’t mentioned even once. Considering how central poverty is to our economic fortunes and opportunities, it really is a huge oversight. So it was honestly refreshing to see the governor not only mention poverty as a challenge, but highlight it as something he wants to aggressively tackle and mitigate. There’s a lot of people who suffer from poverty in New Jersey — a lot more than most realize — so having the top elected official of the state understand that is a great thing to see.

Sheila: I agree! He also lifted up those who work full time or who work at multiple jobs just to make ends meet in New Jersey. “The working poor of New Jersey are no longer invisible. We see them.” That’s a game changer in a state that ignored TANF recipients for 31 years, in a state in need of a more realistic path toward a $15 minimum wage.

Lou: I’m not sure if you two caught this, but the Governor’s line on passing a $15 minimum wage bill received the biggest applause. I’m not sure if that’s because everyone in the room was clapping (I doubt that) or the advocates sitting in the gallery were making a lot of noise. Either way, there were reports that the Governor and legislative leaders were close to a deal on the minimum wage last month, but things have simmered since. NJPP has said many times that raising the minimum wage will boost the take home pay of over one million workers, but that assumes everyone is included. How bad are the carve outs proposed in Speaker Coughlin’s bill? And do you think the governor’s address got him any closer to a clean bill, without exemptions?

Brandon: I honestly don’t know if the remarks in this speech have helped improve the odds of a clean bill, but the fortunes of a clean bill really shouldn’t rely on the governor’s remarks in his State of the State, especially considering the legislature passed a clean bill on its own just a few years back. The carve outs in the Speaker’s bill are bad enough that most advocates, when they saw it, dismissed the proposal out of hand. The general wage gets to $15 by 2024, which is okay, but the carve outs are too broad and too slow. The bill carves out youth workers, seasonal workers, farm workers and small business workers at firms with 10 employees or less — and it doesn’t bring them to $15 until 2029, which is 10 years from now. That’s just way too long. It creates a permanent subclass of workers, doubling down on some of worst mistakes in US labor history, and fails to take the goal of tackling poverty seriously.

“This bill gives the Legislature the ability to pretend as if it is concerned about this issue, but it delays any meaningful action. You’re either for the $15 minimum wage — or you’re not.” #RaiseTheWage #FightFor15 https://t.co/OiXVHIckYY

— Brandon J. McKoy (@Brandon_McKoy) December 8, 2018

There’s also the problem of what it does for tipped workers. It increases the tipped wage from $2.13 to $5.13, but the gap between the tipped wage grows from $6.72 to $9.87. One of the things we’ve urged lawmakers to do is, at the very least, not increase the gap between the tipped wage and minimum wage. It creates all sorts of problems, invites greater instances of wage theft, and exacerbates income inequality. So the tipped wage piece of this bill is something we’re really going to have to improve. And, again, this could all be avoided if the legislature just introduced and passed the same clean bill that it did in 2016, the one that Governor Christie vetoed. Governor Murphy has said he would sign that bill, so it is really frustrating to see such good legislation get watered down so drastically. It’s really hurting our workers, businesses and the broader economy.

Sheila: What Brandon said. But wasn’t the biggest applause line the restored funding from Planned Parenthood and New Jersey having the nation’s strongest equal-pay law, Lou? Hooray for treating women like people!! Lol.

Lou: Treating women like people — what a radical concept! But let’s pivot to what wasn’t included in the speech. Rapid response: were you surprised by any policy areas that weren’t included in the governor’s remarks?

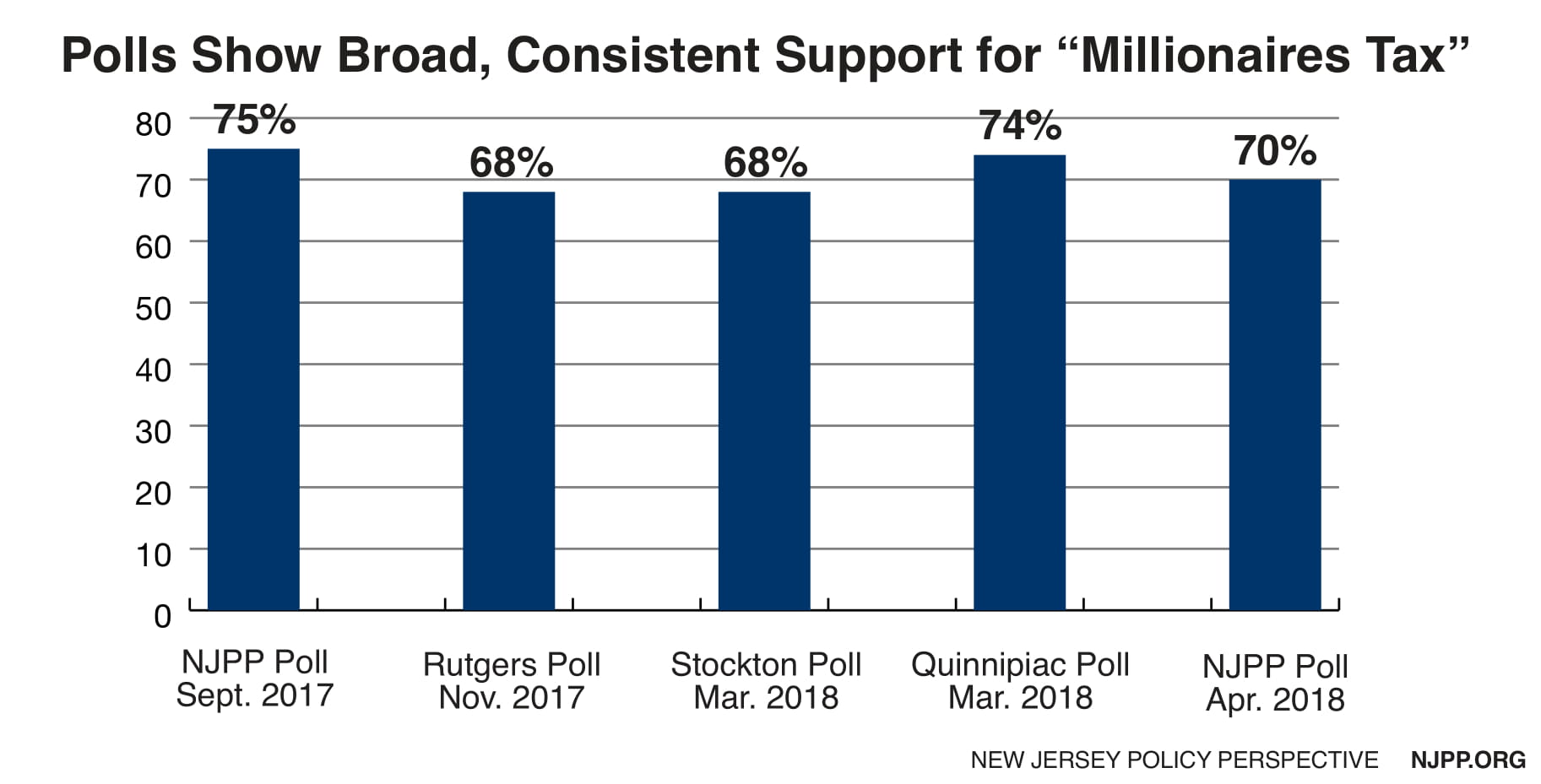

Brandon: Didn’t hear a *whole* lot about reforms to the tax code or implementation of progressive tax policies like a true millionaire’s tax or the estate tax, but I guess those things are mostly saved for the budget address so it’s ultimately not too surprising.

Sheila: Codifying Roe v Wade and removing remaining barriers to contraception and abortion for uninsured and underinsured in the Trump/Kavanaugh era, expanding health care coverage for children regardless of immigration status, innovative ways to help low- to middle-income families with child care costs. Real talk about New Jersey’s empty rainy day fund putting the state in a precarious position should we be hit by another recession or superstorm.

Brandon: Sheila is better at rapid response than I am. Didn’t hear much about working family tax credits either.

Lou: I’ll answer my own question. I was a little surprised we didn’t hear anything about a public bank. But we all knew that would be a heavy lift. But to wrap this up, I have two closing questions. 1) What policies are you most excited for in 2019? And 2) I had fun with this, so can we do another rapid reaction blog post for the budget address?

Brandon: I’m excited for getting some really good policies implemented, especially minimum wage. There’s a lot of energy out there right now for strong, progressive policies and I think a lot of New Jerseyans want and expect to see their elected officials working towards these goals on their behalf. I hope 2019 will be a good year for getting some things in place that we’ve been working on for a long time.

And progressive taxes. Definitely progressive taxes. Bring back the estate tax, reform the inheritance tax, restore the sales tax to 7 percent, and put in a *real* millionaire’s tax!

Lou: That’s an ambitious tax agenda. But a true millionaires tax is really, really popular among likely voters, so who knows?

Either way, my fingers are crossed. Sheila?

Sheila: Getting paid family leave reforms across the finish line will be a huge moment. The program is underused by workers and many of the fixes will hopefully make an impact. And yes(!!!) to progressive taxation — it’s time to course correct previous mistakes and create a tax code that reflects reality. Take a true millionaire’s tax — it is long overdue in a state where the top earners have made the most income gains since the end of the last recession. Finally, I would love to see New Jersey take the lead on expanding health care regardless of immigration status. I could keep going….but it’s time to clock out.

Brandon: The next time we do this I expect to see more gifs.

Sheila: And Gritty memes.

Lou: Good point, Sheila. I bet more people will read this if we can tease that there’s a Gritty meme buried in here. BOOM!