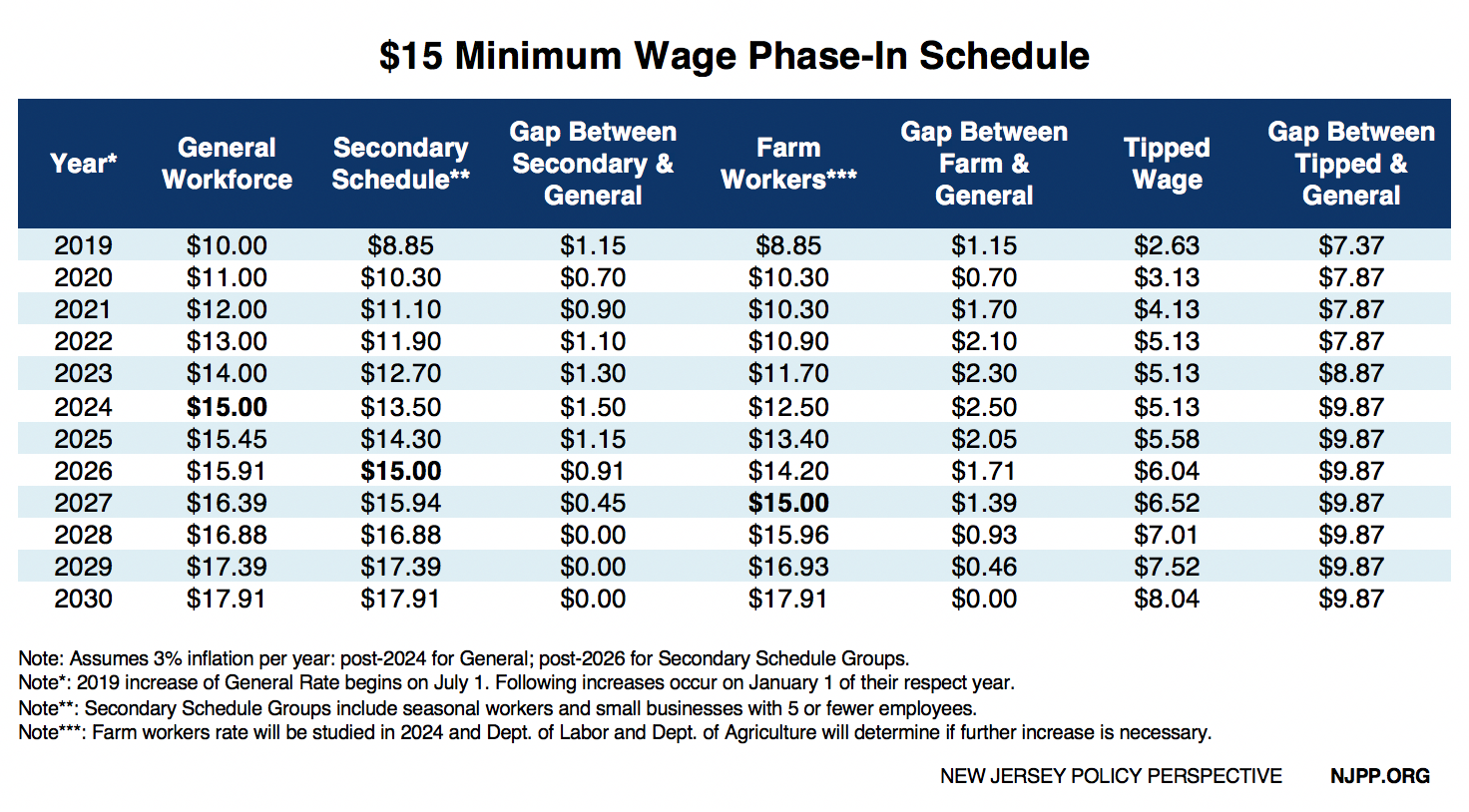

Earlier this month Governor Murphy and legislative leaders reached a deal to raise the state’s minimum wage to $15 by 2024, for most workers. Seasonal and small business employees will reach $15 by 2026, while farm workers will reach $15 by 2027, but only if the labor commissioner and secretary of agriculture sign off on it. The proposal is far from perfect — and unnecessarily complex as all work should be valued equally — but nonetheless it will have a tremendous positive impact for the Garden State’s low-paid workers and broader economy. Further, the minimum wage will remain indexed to inflation, and despite a slower phase-in for some, the legislation provides a pathway for all workers to reach the full minimum wage by 2030.

The Basics

NJPP has long-advocated for a $15 minimum wage for all workers to combat poverty and ensure all New Jerseyans can better support themselves and their families. The current minimum wage of $8.85 fails to reflect the state’s high cost of living and helps explain why four in ten New Jerseyans qualify as working poor, according to the United Way ALICE report. Raising the minimum wage to $15 an hour will boost the take home pay of nearly one million workers and inject billions of dollars into the state economy as families have more disposable income to spend in their local communities.

Assembly bill A15 is the current proposal to raise the minimum wage to $15 and is the culmination of a year-long deliberation between Governor Murphy, Senate President Sweeney, and Assembly Speaker Coughlin. The bill passed the Assembly Labor Committee on Thursday, January 24, and is being fast-tracked through the Legislature — the bill could pass both chambers and be signed by Governor Murphy by the end of the month.

The proposal makes new distinctions in New Jersey’s wage and hour law, so workers in certain sectors — in particular farmworkers, seasonal workers and employees at small businesses with five employees or less — will have to wait longer to reach a $15 minimum wage. Again, it is important to note that for these workers, the bill provides a pathway to parity, so all workers will have the same minimum wage from 2030 onward. This is critical because it prevents workers on the slower phase-in schedule from earning a sub-minimum wage in perpetuity. Instead, they will just be on a slower phase-in schedule but will eventually catch up to the full minimum wage and its yearly cost of living increases.

Unfortunately, this does not apply to tipped workers, as is detailed below, and further advocacy is necessary on behalf of both tipped and farm workers to ensure that the dignity of their work is fully valued and properly honored.

Phase-In Schedule (For Most Workers)

As specified in the bill, the current minimum wage of $8.85 will rise to $10.00 an hour on July 1, 2019, and to $11.00 an hour on January 1, 2020. From then on, the minimum wage will increase by $1.00 per hour every January 1st until it reaches $15.00 on January 1, 2024. Every year thereafter, the minimum wage will receive an inflationary bump, tied to the Consumer Price Index (CPI).

Secondary Schedule (Seasonal and Small Business Workers)

For seasonal workers, defined as “those who are employed by an employer that is a seasonal employer or non-profit or government entity, and not outside of the period of that year commencing on May 1 and ending September 30,” and employees at businesses of five workers or fewer, the minimum wage will rise at a slower rate and reach $15.00 an hour on January 1, 2026. The next two years will act as a catch up period, so that by January 1, 2028 these workers will earn the same minimum wage as everyone else, including cost of living increases. From 2028 onward, these workers will earn the full minimum wage and will be eligible for the same CPI increases as the general minimum wage.

Farm Workers

With regard to farm workers, the minimum wage for will increase to $12.50 an hour by January 1, 2024. At that juncture, a joint decision will be made by the state labor commissioner and secretary of agriculture on whether to recommend that the minimum wage for farm workers should continue to increase. If the two agree that the minimum wage should continue to increase, it will rise to $15.00 per hour by 2027, and will reach parity with all other workers by 2030 If the two parties cannot come to an agreement, a third member — as proposed by the governor and approved by the legislator — would break the tie and affirm the decision. If the state labor commissioner and secretary of agriculture make a recommendation to prevent further increases, the legislature would have to affirm that decision by passing a concurrent resolution.

While the different schedule for farm workers is less than ideal, it is important to note that absent both a recommendation not to continue on the specified path by the state labor commissioner and secretary of agriculture, and a concurrent resolution adopted by both houses of the legislature implementing the recommendation, the increases to $15 by 2027 remain in effect, as will further increases to catch up to the general minimum wage.

Tipped Workers

With regard to tipped workers, their minimum wage will increase to $5.13 per hour by 2022, where it will remain until 2024. Then, beginning in 2025, the wage will increase in concert with the general minimum wage, remaining $9.87 lower than the general minimum wage in perpetuity. NJPP has advocated for a full phase-out of the tipped wage as it improves the work experience for employees, guarantees a level of income that enables them to reliably budget for their lives, and very clearly makes a tip a tip again rather than being a critical portion of earnings that is necessary to afford the most basic of needs. We will continue to advocate for a full phase-out of the tipped wage, as is the law in seven other states, so that the labor of tipped workers is properly recognized and valued.