To read a PDF version of this policy brief, click here.

The COVID-19 pandemic hit New Jersey with a ferocious punch, leaving the state scrambling to contain the spread of the virus, save lives, and provide financial relief to the families and businesses who need it most. Depending on how quickly the state economy gets back on track and how much aid the federal government provides to offset New Jersey’s budget shortfall, many state programs and services are in serious danger of cuts or, worse, elimination. The economic fallout from COVID-19 is a stark reversal of the healthy state economy of the past two years that allowed New Jersey to expand investments in areas like pre-K education, free community college, transit infrastructure, the state’s reserves, and much more. Unfortunately, New Jersey’s recent deposits in its Rainy Day Fund will not be enough to weather this downturn; the state ran out of time, and now the departments tasked with running state government and responding to the COVID-19 crisis are facing an uncertain future, much like the rest of the economy.

Without proper funding, state government cannot fully serve the needs of the public, especially during a time of crisis when the demand for services is at an all-time high. Unfortunately, New Jersey lacks the reserves to help shore up these departments, as outlined in NJPP’s latest report. Making matters worse, tax revenue from income, sales, and corporate business taxes is collapsing at an unprecedented pace. Federal aid to help state budget shortfalls is essential to contain the damage, but it has yet to be considered in a serious way by Congress. If anything, the crisis has put a glaring spotlight on the damage done by a decade of government disinvestment. To ensure a strong and immediate recovery from the COVID-19 crisis, New Jersey cannot afford to repeat the mistakes of the past.

In response to the Great Recession, New Jersey lawmakers and Governor Christie made brutal cuts to state agencies and public programs, ultimately slowing the state’s recovery. Even before the COVID-19 pandemic hit, these cuts continued to hamper New Jersey’s ability to provide critical services that New Jersey families, communities, and the broader economy rely upon. Taken as a whole, staffing levels across all departments dropped by over 20 percent since the Great Recession in 2008. Today, funding for departments has yet to reach pre-recession levels and, for many, staffing is at a record-low for the past two decades.

Departments of Health and Human Services

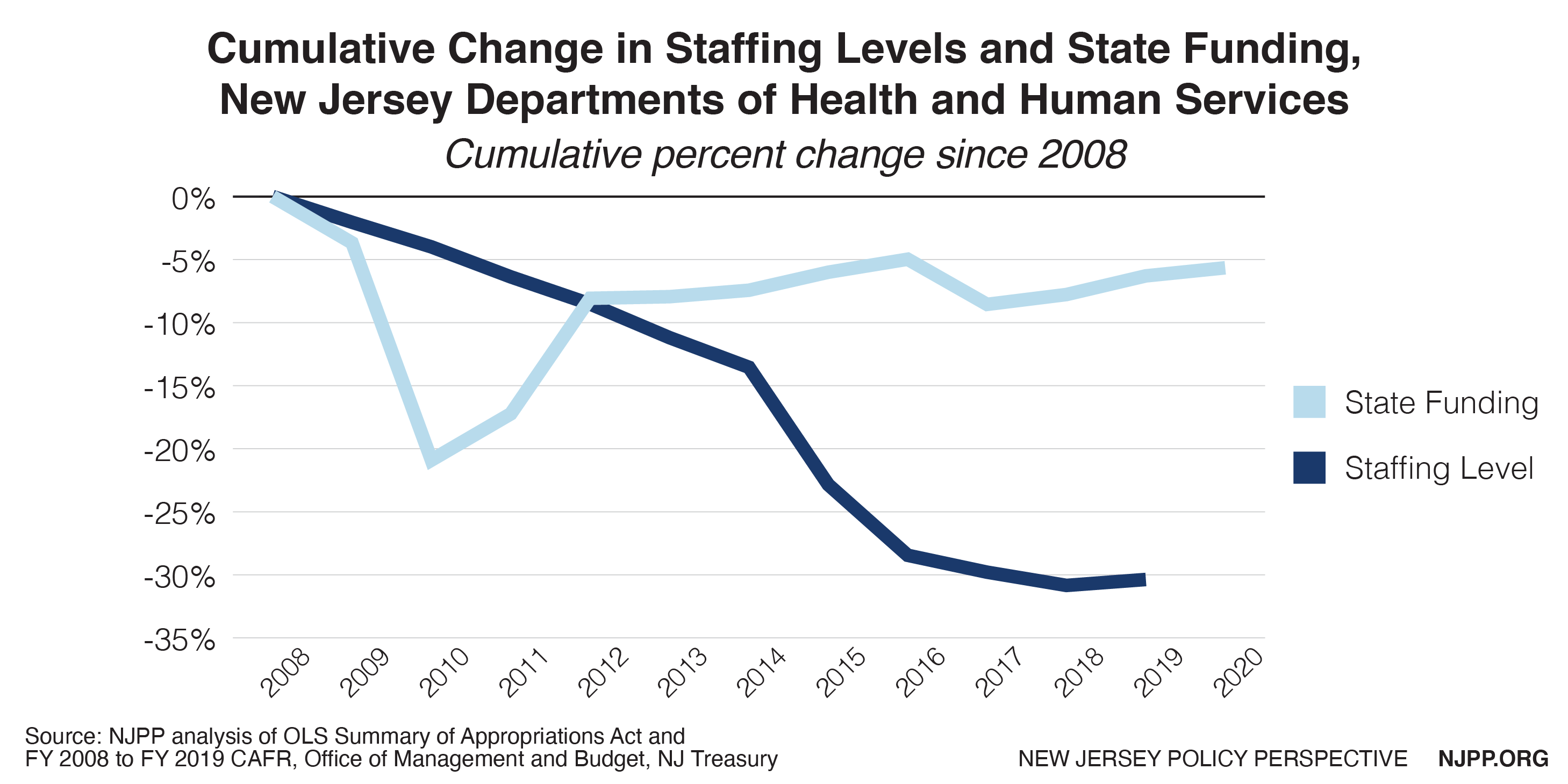

During normal times, and especially now in the middle of a global pandemic, the state departments of Health and Human Services ensure the safety and well-being of New Jersey’s most vulnerable populations, including the elderly, the disabled, those in addiction recovery, and children living in deep poverty. Taken together, the Department of Health (DOH) and the Department of Human Services (DHS) now function with less funding (6 percent) and about a third less staffing (30 percent) than they had at the onset of the Great Recession in 2008.

Without the necessary financial resources and workforce, it is near-impossible for the departments to promote public health. For example, the state is unable to ensure that community hospitals are in compliance with safety standards like adequate nursing staff levels, putting patients and their communities at risk. The lack of adequate resources and proper oversight has also plagued DOH’s medical examiner system, which The Star-Ledger described as a “national disgrace” in their 2017 Death and Dysfunction report. Despite a larger workload in recent years due to the overdose epidemic, the state medical examiner offices have 20 percent fewer employees than 10 years ago. Similarly, local health departments — the frontline of the state’s COVID-19 response — have been underfunded for decades, leaving them ill-equipped to handle the workload in response to the viral outbreak. Compared to other states, New Jersey fell to the bottom quarter for spending per person on local health departments at less than $30 per person. For reference, states like New York and Maryland invest at least $70 per person in local health departments.

Department of Labor and Workforce Development

Once shelter in place became the new norm, much of New Jersey’s economy ground to a halt, with record numbers of residents losing their jobs and closing their businesses. Since the COVID-19 pandemic hit, more than 718,000 New Jersey workers — representing more than 15 percent of the state’s workforce — have filed for unemployment benefits to make ends meet.

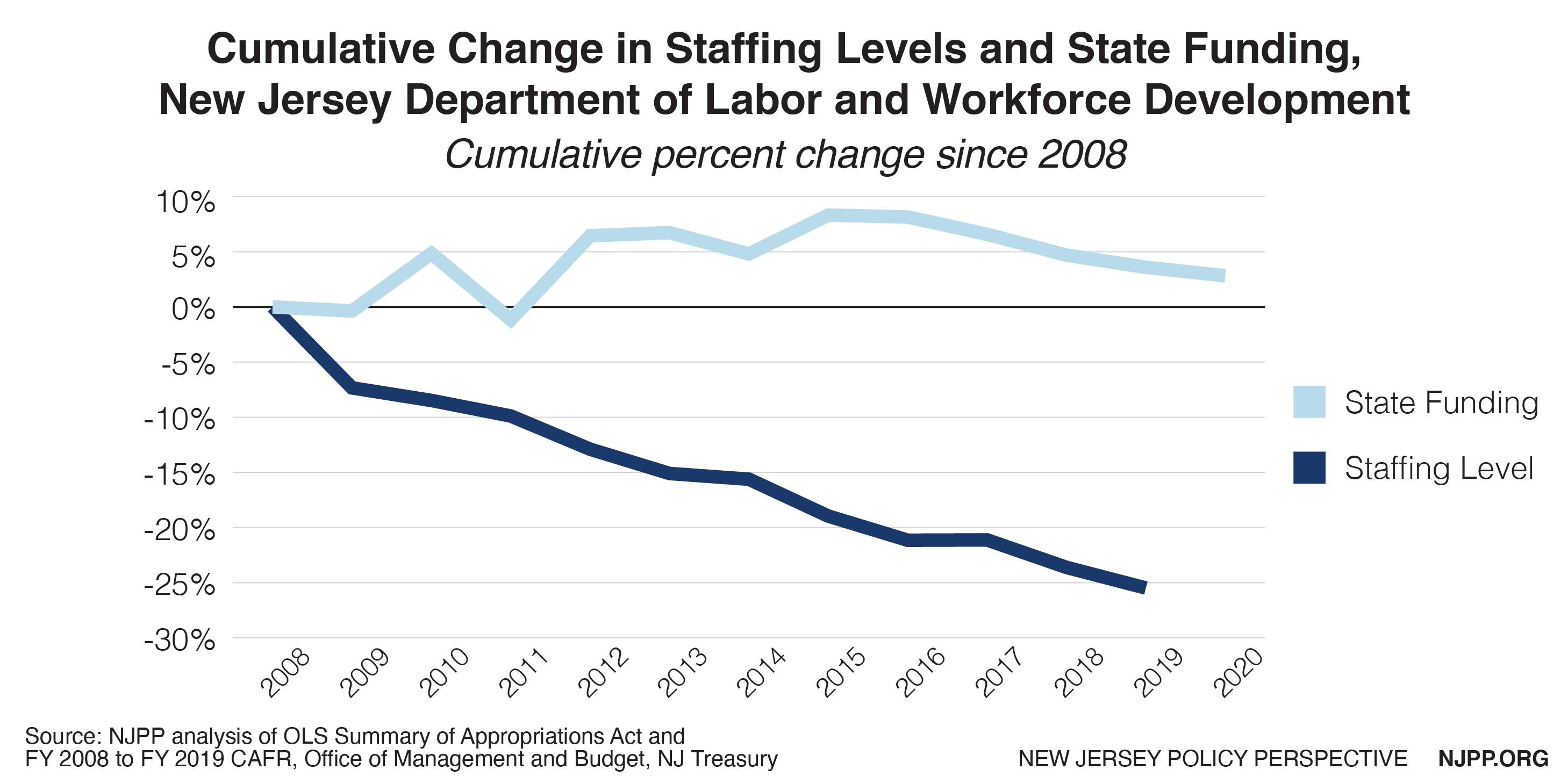

However, many of these workers are unable to file their claims, as the department lacks the necessary staff and resources to handle all of the applications. Inadequate staffing and out-of-date software have paralyzed the department to the point where Governor Murphy has called on retired employees to return to work and help with the backlog. While the state Department of Labor and Workforce Development’s funding has remained stable since the Great Recession, it is operating with far fewer employees now than it did over a decade ago; since 2008, the department has experienced a 25 percent cut in staffing levels. This significant drop flew largely under the radar until now as residents go weeks without receiving their unemployment benefits.

Department of Community Affairs

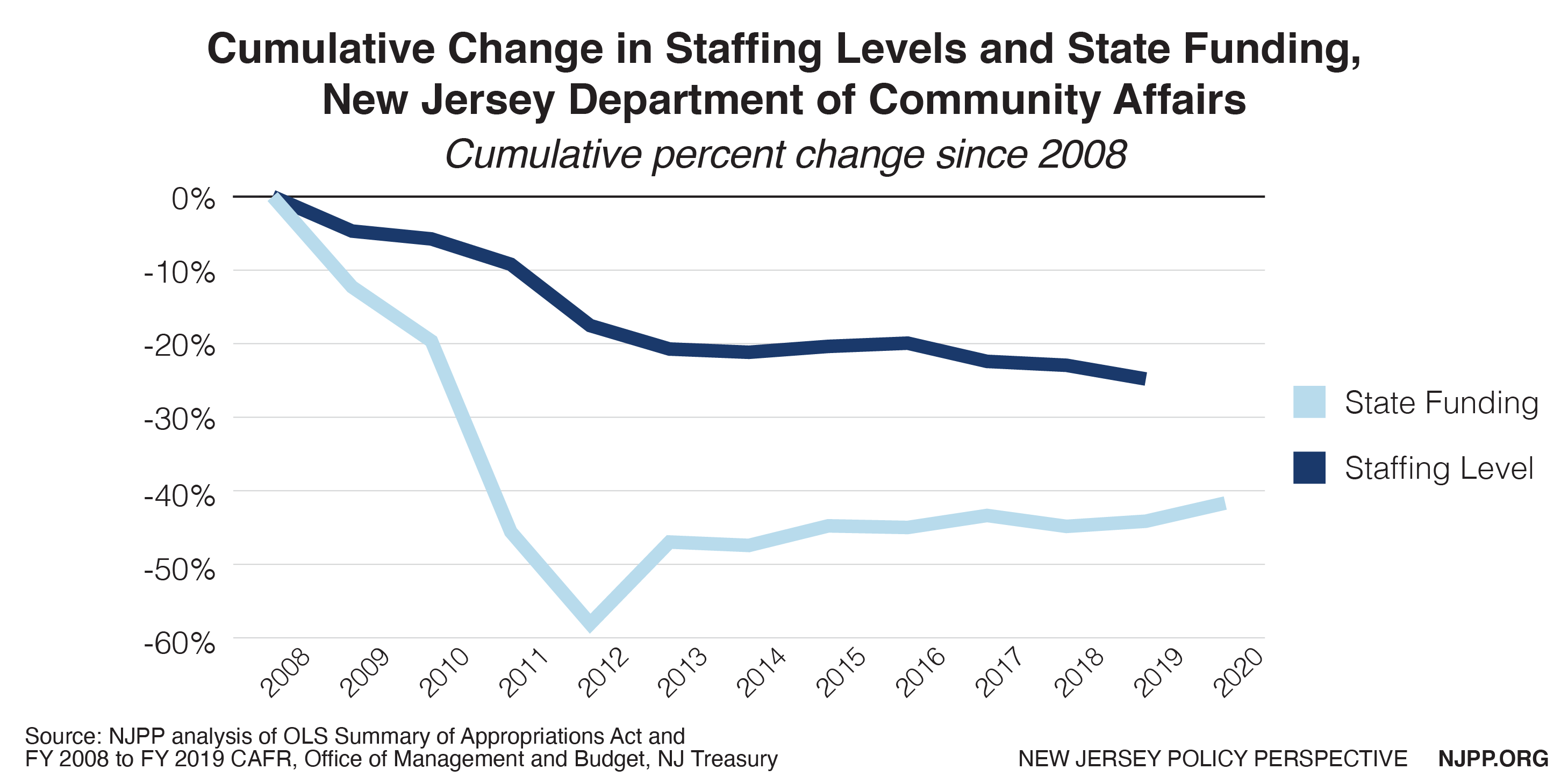

Far too many jobs in our economy do not pay enough or provide enough hours for families to meet their basic needs. As a result, thousands of New Jersey families struggle to afford necessities and rely on state assistance to help pay for their utilities and rent. The demand for these services was acute before the COVID-19 pandemic and even more so now as residents lose their jobs and struggle to pay their bills. But an inflation-adjusted 42 percent drop in funding since just before the Great Recession means less resources for the Department of Community Affairs to do its job and help those hit hardest by this crisis.

By providing low-income households much-needed energy assistance or affordable housing opportunities now, the state could play a vital role in helping the state economy recover more quickly — but only if it has adequate funding to do so. Even the Treasury Department has had to make do with almost half the funding it used to receive, undermining its ability to develop and enforce the tax laws that secure financial resources for all of these departments.

When in a Hole, Stop Digging it Deeper

When state government finds itself in a hole, as it does now in the COVID-19 crisis, cuts will only dig the hole deeper. Scaling back essential government services should not be an option, as the safety net programs administered by New Jersey’s departments and agencies will act as the foundation for the state’s ultimate recovery. To fund these investments and prevent cuts that would be devastating to families in every corner of the state, New Jersey must find new revenue as part of its response to COVID-19 and the resulting economic fallout. We suggest starting with targeted changes to the tax code, like making the income tax more progressive and extending the corporate business tax surcharge, to help fund New Jersey’s recovery.

Methodology

State funding figures are from the New Jersey Office of Legislative Services Summary of Appropriations Act and are inflation-adjusted to 2020 U.S. Dollars. Staffing level figures are for full-time employees, according to the New Jersey Department of the Treasury, Office of Management and Budget, Comprehensive Annual Financial Report (CAFR) for FY 2008 to FY 2019, and the Governor’s Budget Message for FY 2009 and FY 2021 . The staffing levels represent total staffing, including positions funded by the state and federal government. State funding and staffing level figures are combined for the Department of Health and Department of Human Services to account for offices and responsibilities that have been transferred from one department to the other over the time period reviewed in this analysis.

Departments of Health and Human Services

In FY 2008, combined state funding for the Department of Health and the Department of Human Services was $8.1 billion; in FY 2020, state funding was $7.6 billion. In FY 2008, total full-time staffing was 17,634; in FY 2019, total full-time staffing was 12,279. In FY 2008, 66 percent of full-time staff were funded by the state and 34 percent were funded by the federal government. In FY 2019, 32 percent of full-time staff were funded by the state and 68 percent were funded by the federal government.

Department of Labor

In FY 2008, state funding for the Department of Labor was $167 million; in FY 2020, state funding was $172 million. In FY 2008, total full-time staffing was 3,418; in FY 2019, total full-time staffing was 2,547. In FY 2008, 6 percent of full-time staff were funded by the state and 94 percent were funded by the federal government. In FY 2019, 6 percent of full-time staff were funded by the state and 94 percent were funded by the federal government.

Department of Community Affairs

In FY 2008, state funding for the Department of Community Affairs was $1.6 billion; in FY 2020, state funding was $923 million. In FY 2008, total full-time staffing was 1,129; in FY 2019, total full-time staffing was 849. In FY 2008, 15 percent of full-time staff were funded by the state and 85 percent were funded by the federal government. In FY 2019, 10 percent of full-time staff were funded by the state and 90 percent were funded by the federal government.