“The only way to stem our tide of outmigration is to bring our economic policies in line with our direct regional competitors — Pennsylvania and New York.”

And so the latest wolf cry from business lobbyists about New Jersey’s supposed crisis of “outmigration” begins. The only problem: there is no “tide of outmigration” to Pennsylvania and New York. In fact, there is a very small ripple in the reverse direction.

On the whole, despite what anti-tax forces would have you believe, New Jersey’s population and total income are growing, not shrinking.

These recycled claims about state income losses and migration patterns are part of a long-term strategy to cut taxes for businesses and New Jersey’s wealthiest households. Not only are they misleading and inaccurate, they are an unnecessary distraction at a time when a clear-eyed and pragmatic approach to New Jersey’s financial and economic crises is needed more than ever.

It is disingenuous to assert that the tax policies of Pennsylvania and New York are challenging the state’s competitiveness and robbing New Jersey of people and dollars. Highlighting only those who leave makes it seem as though New Jersey is the ever-shrinking state – a falsehood that becomes clear when one sensibly includes those who move here.

In other words: context matters. A lot.

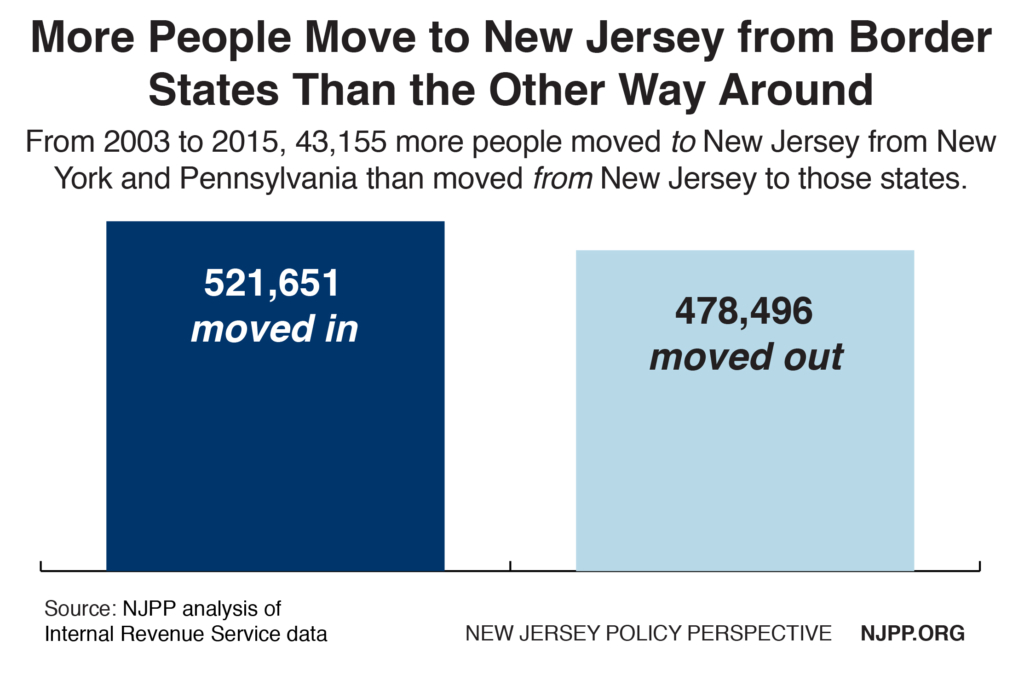

While it is true that New York and Pennsylvania continue to be the top two destination states for New Jerseyans moving away, it is also true that they are the top two origin states for people moving to New Jersey.

In fact, more people move to New Jersey from New York than from the other way around. And for every 10 Jerseyans who move to Pennsylvania, 8 Pennsylvanians move to New Jersey. There is nothing new about these patterns, and they are relatively constant through various tax and economic policy changes.

That is the nature of bordering states. People tend to come and go relatively frequently – and there is simply no evidence that New Jersey’s or our neighbors’ tax policies drive their relocation decisions.

It is also incorrect to imply that New Jersey’s state income plummets when people leave the state. In fact, this is a misrepresentation of IRS income data, as we pointed out last year.

Nonetheless, business lobbyist are back at it again – making the grossly misleading claim that New Jersey “lost” over $20 billion in adjusted gross income in the last decade. And once again they are doing so without putting that number into context. Shine a light on the whole $3 trillion enchilada and that “loss” ends up being less than 1 percent (.71 percent) of the state’s total household income generated during that time – a tiny sliver, at best.

But the bigger issue is that the IRS has explicitly cautioned against using adjusted gross income in this way – an inconvenient matter that business lobbyists would rather ignore just as they would rather ignore the fact that state-to-state moving patterns are about more than taxes.

This “exodus” storyline is being promoted as a canary in the coal mine, when, in reality, it is merely a distracting non-issue designed to scare the public and discourage legislators from enacting pragmatic tax policies.

Enough with the scare tactics. It’s time to get serious about rebuilding New Jersey’s prosperity.