FOR IMMEDIATE RELEASE: February 24, 2016

Contact: Jon Whiten (NJPP), 609.393.1145 ext. 15 & whiten@njpp.org or Kelly Davis (ITEP), 262.472.0578 & kelly@itep.org

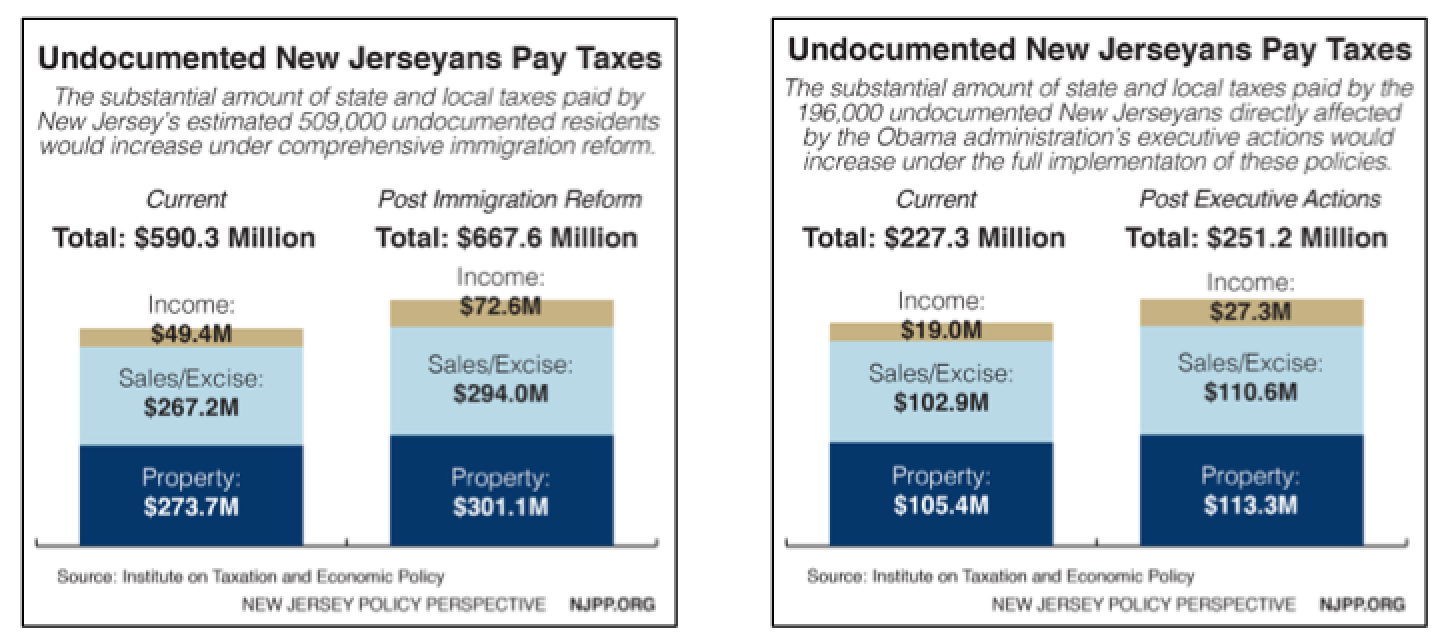

Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $590 million in New Jersey, according to a new study released today by the Institute on Taxation and Economic Policy (ITEP). The study, Undocumented Immigrants’ State and Local Tax Contributions, also estimates that New Jersey stands to gain $24 million in increased revenue under full implementation of the administration’s 2012 and 2014 executive actions and by more than $77 million under comprehensive immigration reform.

“New Jersey is home to a diverse immigrant community, and it’s not surprising that our undocumented neighbors contribute so much in state and local taxes. In fact, the $590 million they pay each year is the fifth highest in the country,” said Erika Nava, Policy Analyst at New Jersey Policy Perspective. “This report is essential in busting the myth that undocumented New Jerseyans don’t pay taxes or contribute to the state’s economy. In fact, just like the rest of us they pay quite a lot already – and would pay more under common-sense reforms.”

With the lack of comprehensive immigration reform at the federal level, states have taken matters into their own hands by advancing pragmatic policies that help both documented and undocumented immigrants. New Jersey has taken some initial steps, but could do much more, including allowing immigrants to drive legally and ensuring that undocumented students who want to attend public colleges and universities have access to state financial aid. As this study shows, undocumented immigrants are already contributing greatly to New Jersey’s economy; allowing them to drive legally or attend college would boost these contributions.

The report found that undocumented New Jerseyans contribute $274 million in property taxes, $49 million in personal income taxes and $267 million in sales and excise taxes to New Jersey and local governments. These tax contributions would be larger if all undocumented immigrants were granted legal status under a comprehensive immigration reform and if President Obama’s 2014 executive action were upheld.

“Regardless of the politically contentious nature of immigration reform, the data show undocumented immigrants greatly contribute to our nation’s economy, not just in labor but also with tax dollars,” said Meg Wiehe, ITEP State Tax Policy Director. “With immigration policy playing a key role in state and national debates and President Obama’s 2014 executive action facing review by the Supreme Court accurate information about the tax contributions of undocumented immigrants is needed now more than ever.”

To view the full report or to find state-specific data, go to www.itep.org/immigration